Find more information about how to buy and trade stocks in our stock trading guide here.

American Airlines (NASDAQ: AAL) stock price lost close to half of its value during the latest selloff but the majority of market analysts and bargain hunters are suggesting capitalizing on attractive buying opportunities in the U.S. airline stocks.

Warren Buffet, the well-known value investors and bargain hunter, added 976,000 Delta Air Lines (NYSE: DAL) shares in February for roughly $45.3 million. The investment indicates Buffet’s strategy of buying fundamentally strong companies on short-term headwinds.

Delta Air Lines stock is currently hovering around the lowest level since 2016. It provides scheduled air transportation for passengers in the United States and internationally. Its fleet includes 1,000 aircraft. The company had generated fiscal 2019 pre-tax income of $6.2b.

Warren Buffet is not alone in showing confidence in attractive valuations of airline stocks. “If coronavirus concerns fade in the coming weeks and the U.S. is able to avoid recession, this scenario could see a recovery in ex-Asia demand, which could lead airline stock prices and earnings streams to stabilize,” Citigroup analyst Stephen Trent said. The analyst provided buy ratings for Delta, United Airlines (NYSE: UAL), American Airlines and Spirit Airlines (NYSE: SAVE).

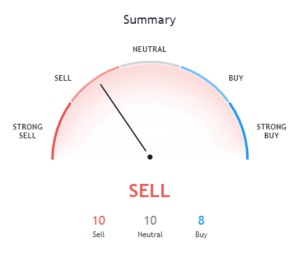

American Airlines stock price is currently trading around $17, down significantly from a 52-weeks high of %35 a share. Its stock is trading around only 4.5 times to earnings and 0.17 times to sales ratio compared to the industry average of 22 and 2.30 times, respectively. The short-term moving averages and oscillators data from tradingview.com, however, indicates strong selling in the short-term.

National Economic Council director Larry Kudlow recently indicated that the U.S. government is planning to offer support to certain industries including airlines. The potential fiscal stimulus for the airline industry could also help in driving share prices higher.

American Airlines declined 10 per cent of its international capacity for its summer peak schedule along with cutting 7.5 per cent of April domestic capacity. International capacity cuts are only due to coronavirus related problems in the Asia Pacific.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account