AMD (NASDAQ: AMD) stock stood among the winners of fiscal 2019. In addition, market analysts are anticipating a significant upside in 2020. Investors and traders are showing confidence in their new product line and revenue growth potential. The improving market fundamentals are also enhancing investor’s sentiments in AMD share price upside.

AMD stock rose 136% in fiscal 2019 on the back of prospects for a new product line. The company’s strategy of investing in organic and inorganic growth opportunities is working. This is evident from the financial performance in the latest quarter and a robust outlook for the following periods.

Analysts are Boosting AMD Stock Price Targets

The majority of market analysts have raised the AMD stock price target amid improving prospects for 2020. Nomura is among the bulls. The firm increased the stock price target to $58 with a Buy rating from an earlier target of $40.

Its analyst David Wong anticipates AMD’s strong competitive position in 2020. The analyst expects growth from new products along with increased ASPs, revenue growth, and operating leverage.

On the other hand, Rosenblatt appears more bullish about the future. The firm provides a Buy rating with a price target of $65. Its analyst Hans Mosesmann said, “The 2019 rally will continue into 2020 with “limited competitive threats are slowing the momentum train.”

Financial Trends are Strong

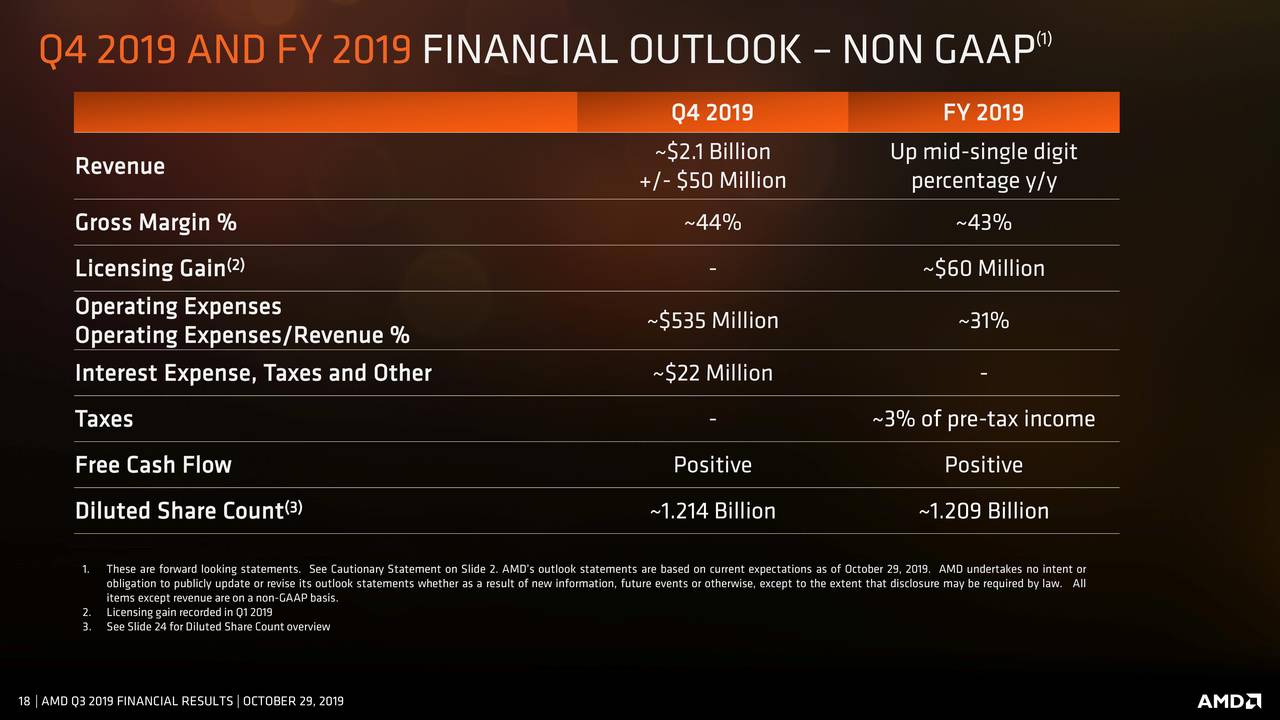

The company generated 9% revenue growth in the latest quarter while its gross margin expanded 3 percent points year over year. The revenue growth is driven by its three new products.

Its 7nm Ryzen, Radeon and EPYC processor sales are likely to increase at a massive pace in the following quarters. The company expects its final quarter sales to increase by 48% from the past year quarter. The earnings are expected to grow at a similar pace.

The market fundamentals are also supporting AMD’s stock price upside momentum. Semiconductor companies started experiencing positive demand amid declining inventories and a trade agreement with China.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account