AMD (NASDAQ: AMD) stock price soared to the highest level this year after reporting stronger than expected performance from its new product line. The shares are trading around $37 at present, up close to 90% year to date. The robust share price momentum is also supported by improving market outlook.

The market analysts have raised their targets for AMD stock price despite higher valuation. The shares are currently trading at 55 times to earnings compared to the industry average of 20 times.

Market Pundits are Presenting a Bull Case for AMD Stock Price

Although the share price and valuations doubled since the start of this year, market analysts are seeing the acceleration of the bullish trend.

Rosenblatt has set a Buy rating for AMD with a price target of $52. The firm says, “AMD reported clean “meet and meet” earnings results for Q3 and Q4.” Rosenblatt believes that the company is well set to continue the momentum in the coming quarters. The firm is showing confidence in broad-based desktop and server deployments, a new game console cycle and continuing notebook traction.

New Product Line Is Likely to Boost Financial Numbers

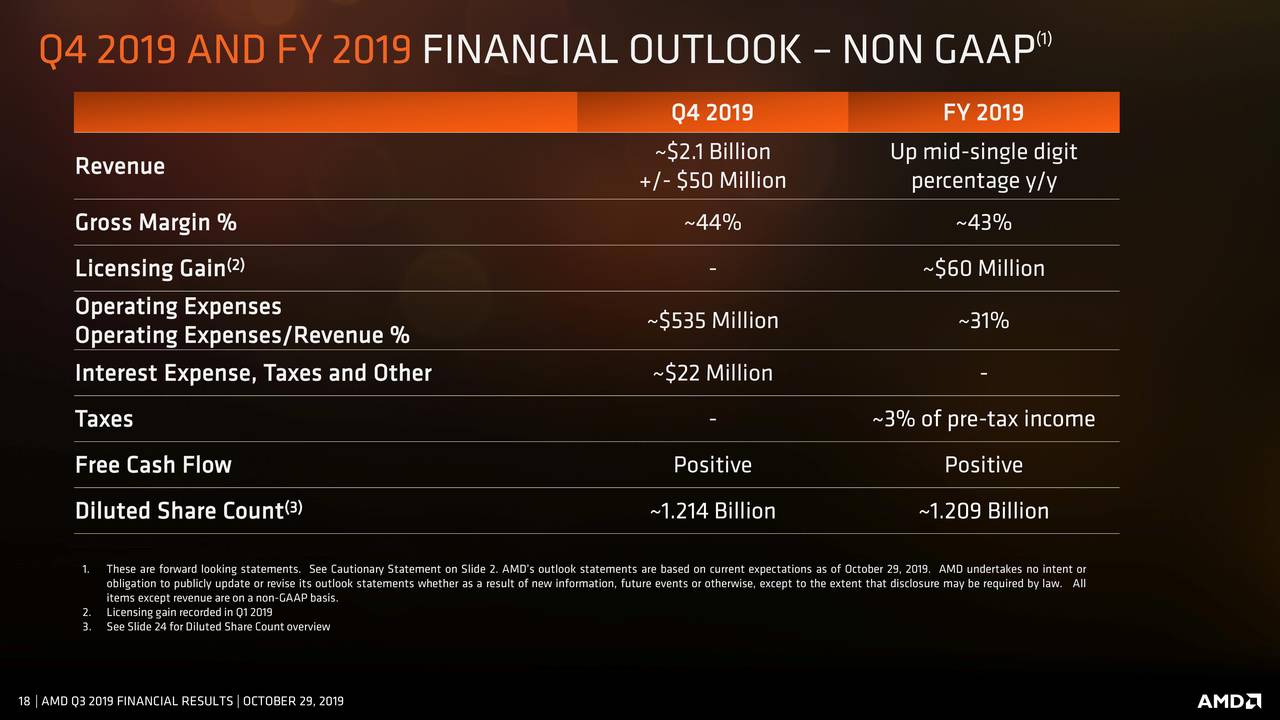

The company has generated 9% year over year revenue growth in the third quarter. The revenue is up 18% from the previous quarter. The revenue growth is supported by 7nm Ryzen, Radeon and EPYC processor sales. Q3 was the best quarter in terms of revenue growth since 2005.

AMD’s margins and net income also experienced a substantial boost, thanks to 7nm Ryzen, Radeon and EPYC processors. It reported the highest third-quarter gross margin since 2012. Its net earnings per share of $0.18 increased from last quarter earnings of $0.13 per share.

The company looks optimistic about future trends. The CEO said, “We have the strongest product portfolio in our history, significant customer momentum and a leadership product roadmap for 2020 and beyond.”

AMD expects fourth-quarter revenue to increase 49% year over year and 17% from the previous quarter. Therefore, robust revenue growth is likely to back the bullish trend for AMD stock price.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account