AMD (NYSE: AMD) stock price extended the upside trend after topping fourth-quarter estimates. In addition, the California-based semiconductor firm expects high double-digit revenue growth for 2020. Its new product line is likely to add to revenue growth this year.

AMD stock price is currently trading around $50. However, the stock price is likely to move higher, according to market analysts. The analysts are showing confidence in Ryzen and EPYC processors’ sales growth. In addition, AMD’s strategy of offering solid cash returns could also contribute to the share price momentum.

Record Q4 and 2019 Revenue Enhanced Bullish Sentiments

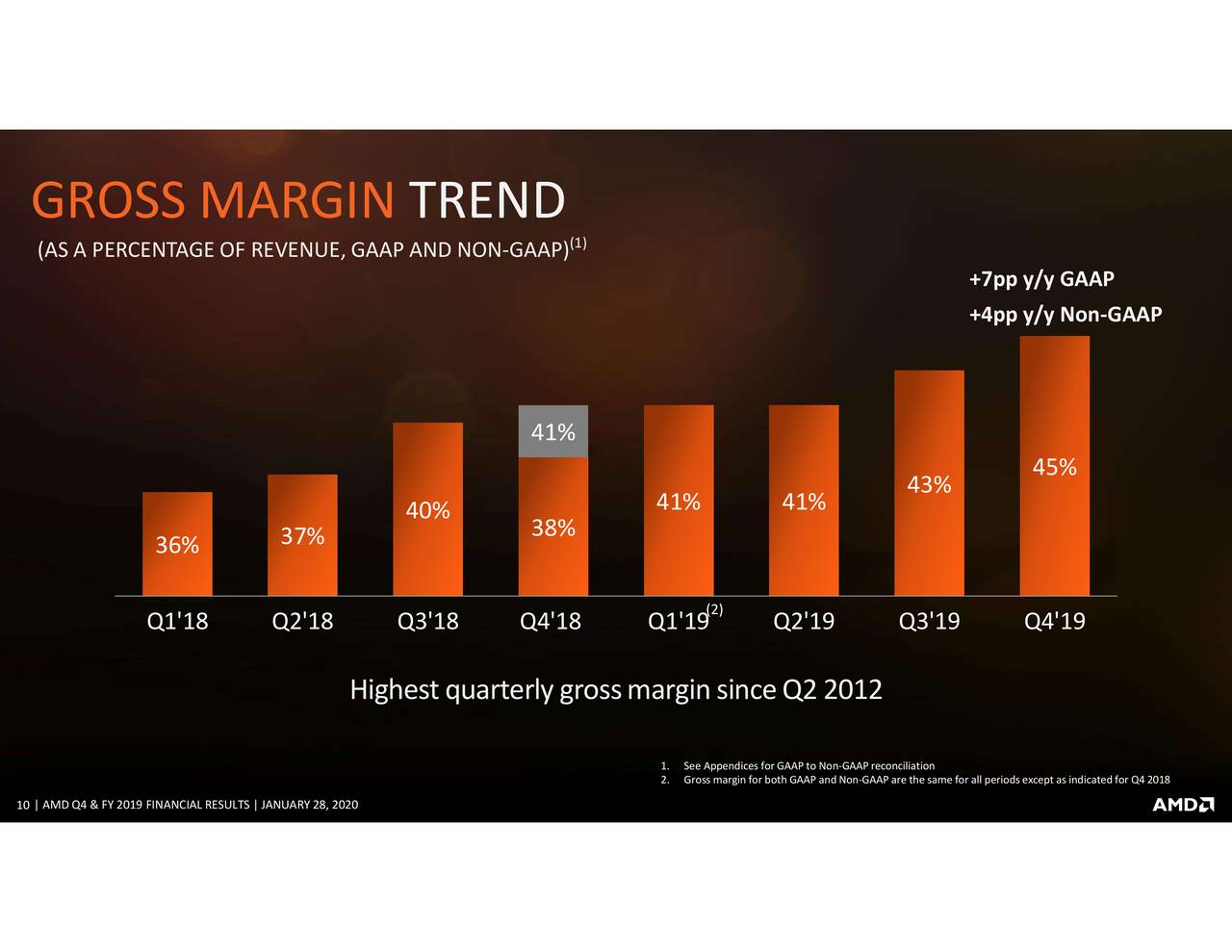

AMD topped fourth-quarter revenue and earnings estimates by $20 million and $0.01 per share, respectively. Its Q4 revenue of $2.13 billion grew 50% from the year-ago period. The full-year revenue also stood at a record level of $6.73 billion, representing a growth of 4% from last year. The company claims that the new product line is also adding to margins and profits. Its fourth-quarter earnings per share stood at $0.15, up from $0.04 a year ago and $0.11 in the prior quarter.

“2019 marked a significant milestone in our multi-year journey as we successfully launched and ramped the strongest product portfolio in our 50-year history,” said Dr. Lisa Su, AMD president, and CEO. “We delivered significant margin expansion and increased profitability as we gained market share with our Ryzen and EPYC processors.”

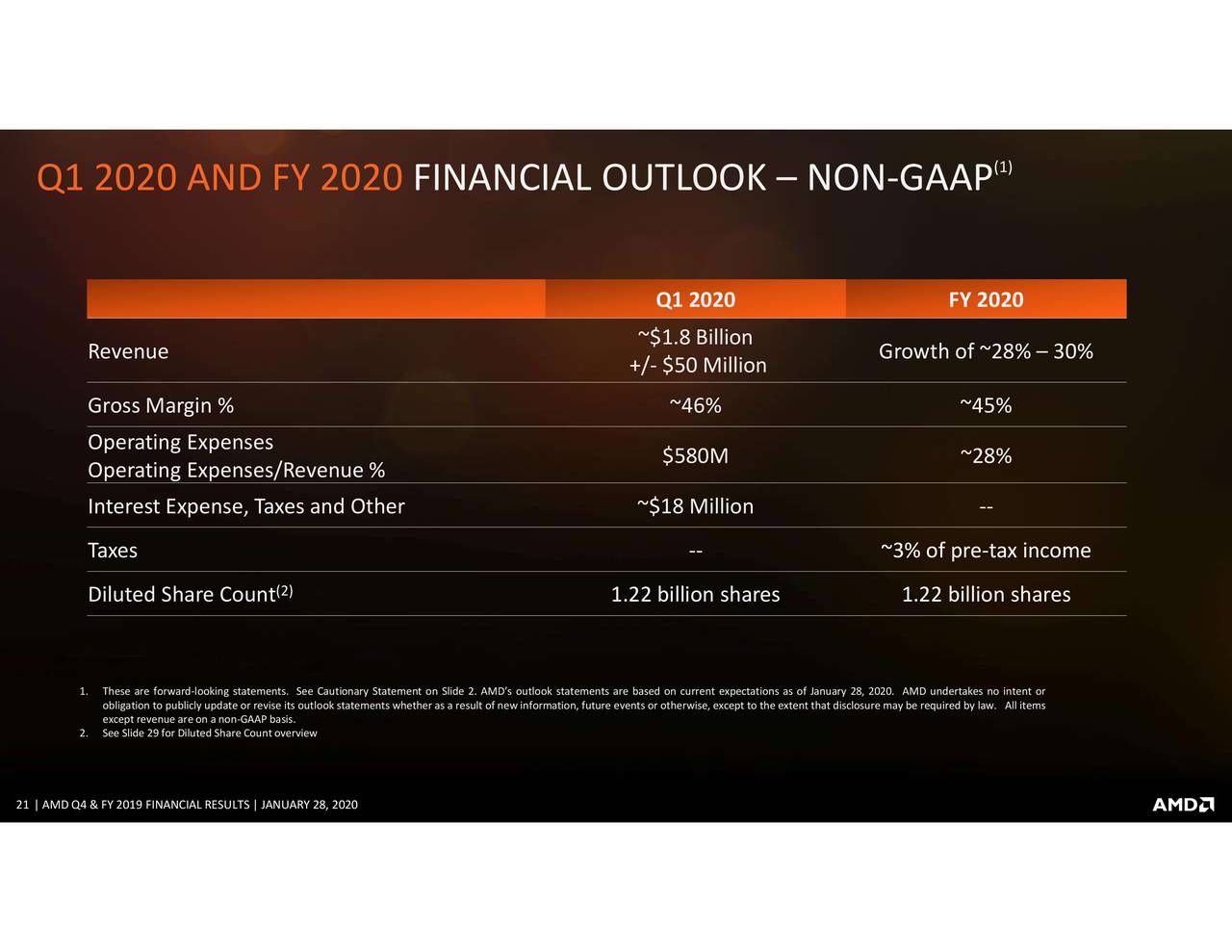

Outlook Indicates High Double-Digit Growth

AMD expects to accelerate financial growth into the following quarters. It forecasts first-quarter revenue to increase by 42% from the past year period. The full-year revenue is likely to hit a new record level; AMD anticipates 30% revenue growth for the full year compared to 2019. Ryzen, EPYC, and Radeon sales are likely to drive revenue growth in the following quarters. AMD is also likely to make a double-digit dividend increase in 2020 due to robust financial growth. The huge gap in free cash flows and dividend payments offer room for more dividend increases.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account