AMD (NASDAQ: AMD) shares have been extending the upside momentum since the beginning of 2019. The semiconductor company is likely to accelerate growth in 2020, according to market analysts. The investors’ confidence in its new product line is adding to investor’s sentiments.

The sales of 7nm Ryzen, Radeon and EPYC processor are expected to boost its financial numbers in 2020. The latest financial numbers are showing the growth trends; the company has generated the best third-quarter revenue since 2005. The market analysts have increased the price target for AMD stock amid solid growth prospects.

Analysts See Upside for AMD Shares

The market pundits are showing confidence in the new product line and broader market trends. Baird raised the price target to $40, citing double-digit revenue growth in 2020. Baird analyst Tristan Gerra expects AMD to expand its market share in data center markets in addition to growth in the GPU businesses.

On the other hand, Wedbush analyst Matt Bryson lifted the price target to $51.50 from the previous target of $39. Matt Bryson says the new product line setup allows AMD to charge a premium, which lifts shares, revenue per part, and margin.

The potential launch of a 64-core part for its Threadripper platform is among the catalysts for AMD shares in 2020.

Financial Numbers are Supporting Upside Trend

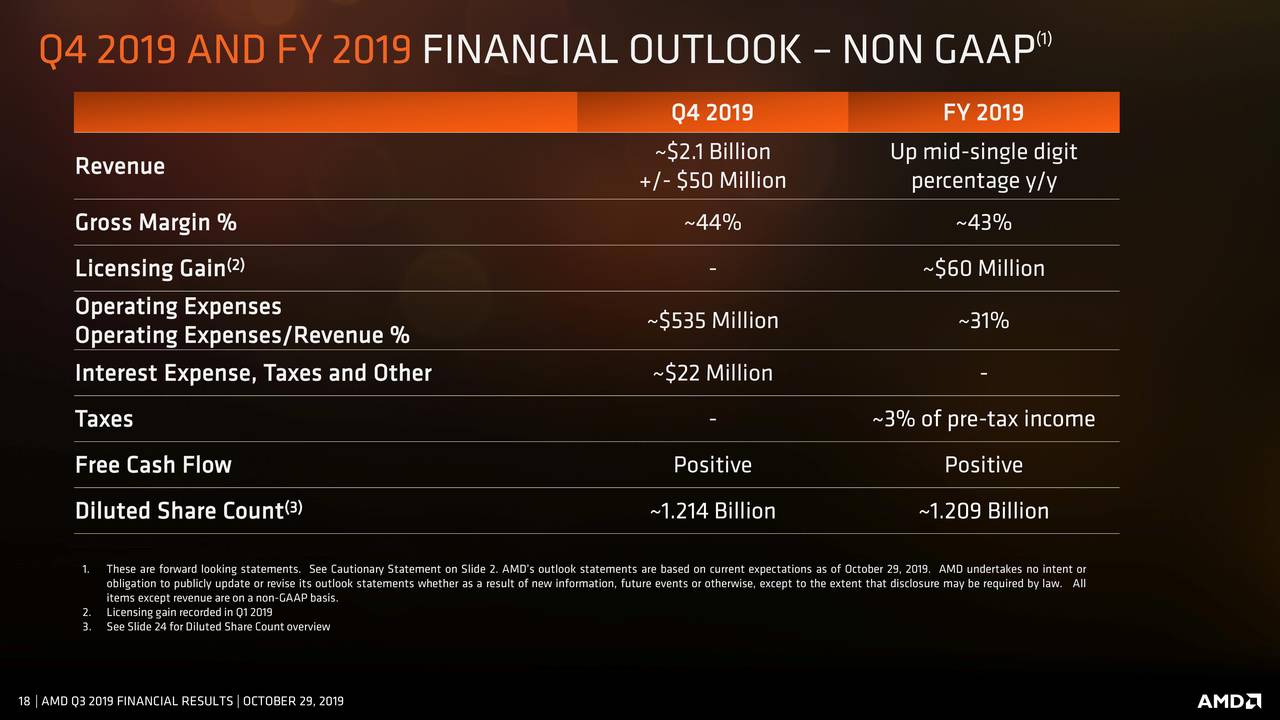

The company has generated robust growth in the third quarter. Its Q3 revenue of $1.8 billion increased 9% year-over-year and 18% quarter-over-quarter. In addition, its gross margin also grew 3 percentage points compared to the previous quarter. The financial growth is driven by the first full quarter of 7nm Ryzen, Radeon and EPYC processor sales.

The company expects further growth in the final quarter and fiscal 2020. It anticipated fourth-quarter revenue in the range of $2.1 billion. This represents almost 48% year-over-year and 17% increase from the previous quarter. Overall, future prospects appear bright for AMD shares.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account