Amazon (NASDAQ: AMZN) stock price soared to the highest level in history following bullish business reports in the past few weeks. Morgan Stanley group of analysts led by Michael Wilson added Amazon to its “fresh money buys” list. The firm is optimistic about future fundamentals and business growth trends.

Amazon stock soared close to 14 per cent in the last month to the record level of $2180. AMZN share price grew 31% in the last twelve months. The share price rally has pushed its valuation above the $1tl level, making it the world’s fourth-largest company. Morgan Stanley and other firms are presenting a bright outlook for AMZN share price.

Morgan Stanley Suggests to Buy Amazon Stock

Morgan Stanley analysts provided a price target of $2400 for Amazon share price. They highlighted several catalysts for share price upside momentum. “Amazon stock is likely to keep climbing, fueled by investments in Amazon’s one-day shipping that are accelerating share gains even faster than expected,” Morgan Stanley analysts say.

Morgan Stanley analysts believe the company’s strategy of investing in high margin areas has been boosting margins and earnings. The analysts say the underperformance in fiscal 2019 is mostly blamed on profitability. Amazon shares grew only 23 per cent in 2019 compared to the S&P 500 gain of 31 per cent. “With that concern now fading for Amazon specifically, we think the catch up may have just begun,” Morgan Stanley analysts said.

Fourth Quarter Results Added to Sentiments

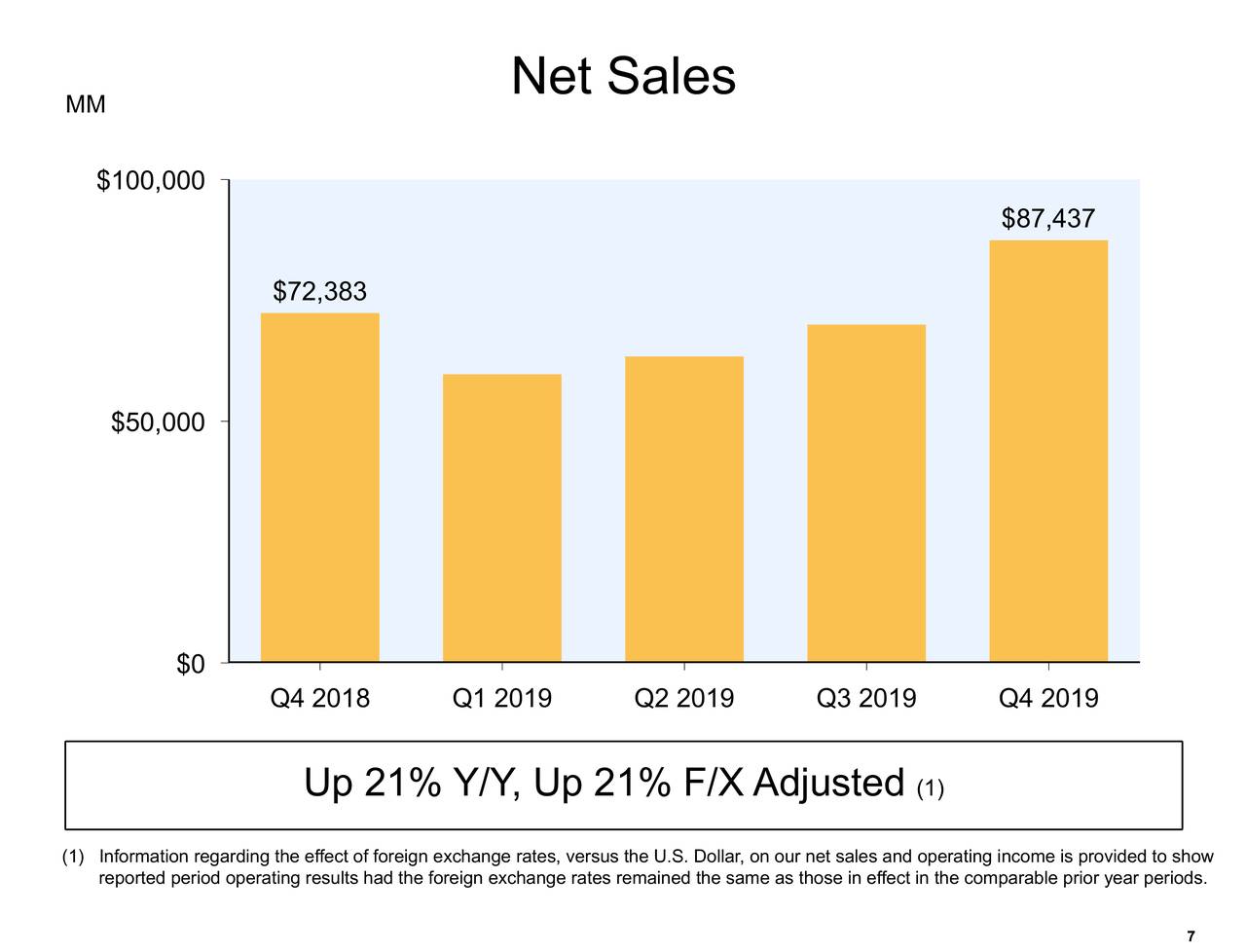

Amazon’s share price also received support from the fourth-quarter beat and a robust year over year growth in financial numbers. Its fourth-quarter revenue of $87.44bn topped estimates by $1.34bn; the revenue increased 20.80 per cent from the past year period. The company expects first-quarter revenue in the range of $73bn compared to the consensus of $71bn. The company had generated operating cash flow growth of 25 per cent in fiscal 2019. It expects high double-digit earnings and cash flow growth in fiscal 2020.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account