Alibaba (NYSE: BABA) stock price remains steady after posting record Singles’ Day sales of $38 billion. Despite record sales, the sales growth remains weakest since it started this event in 2009. The annual shopping festival sales growth stood around 26% this year.

The deceleration in sales growth is due to the slowing e-commerce industry in China. Last year, it had generated 27% sales growth on the Singles’ Day event. Alibaba stock price is currently trading around $186, down slightly from 52-weeks high of $195. Market analysts are expecting BABA shares to hit $200 mark in the coming days.

The Deceleration is Not Drastic

Fortunately, market analysts believe the decline is not drastic; the investors are currently focusing on the record number of $38 billion. This is the biggest one-day event in the world. The Black Friday clocked close to $25 billion in sales. Meanwhile, Cyber Monday reported almost $8 billion.

Almost 84 brands including Apple, Fast Retailing’s Uniqlo and L’Oreal have made more than 100 million yuan in sales in the first hour alone.

The majority of merchants used live streaming in its Tmall marketplace to sell products. “Nearly all our brands have opted for live streaming promotions sometime this year,” says Josh Gardner, who helps overseas companies sell products on Tmall.

Baird has set Baba stock price target at $200 despite concerns over slowing sales. Baird analyst Colin Sebastian said, “the magnitude of the slowdown appears less drastic than last year and that delivery levels had a healthy growth.”

Future Fundamentals are Strong for Alibaba Stock Price

Alibaba shares are likely to receive support from record Singles’ Day sales. This event sale of $38 billion is likely to help it in generating larger than expected growth in third-quarter revenue this year.

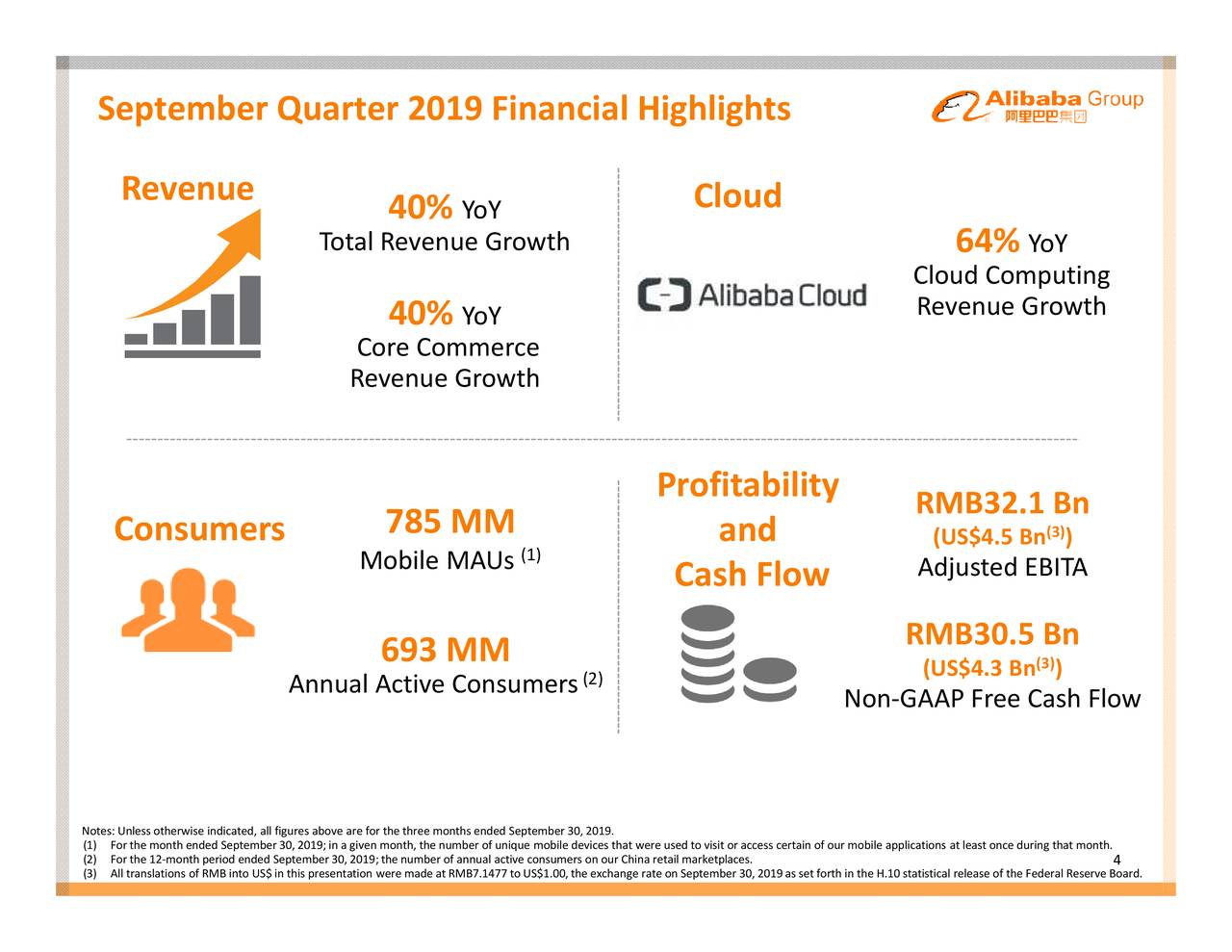

Baba has generated 40% year over year revenue growth in the latest quarter. The market analysts are also expecting its revenue growth to receive support from the acceleration in cloud revenue.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account