Alibaba (NYSE: BABA) stock price has been struggling to sustain upside momentum over the last twelve months. Investors concerns over U.S. China trade war restricted its share price in the range of $129.77 – $195.72. The shares are currently trading around $172.

Market pundits expect its share to hit $200 mark again this year. Alibaba stock previously traded above $200 level in mid-2018.

Jefferies analyst Thomas Chong believes Alibaba stock has the potential to trade above $210.

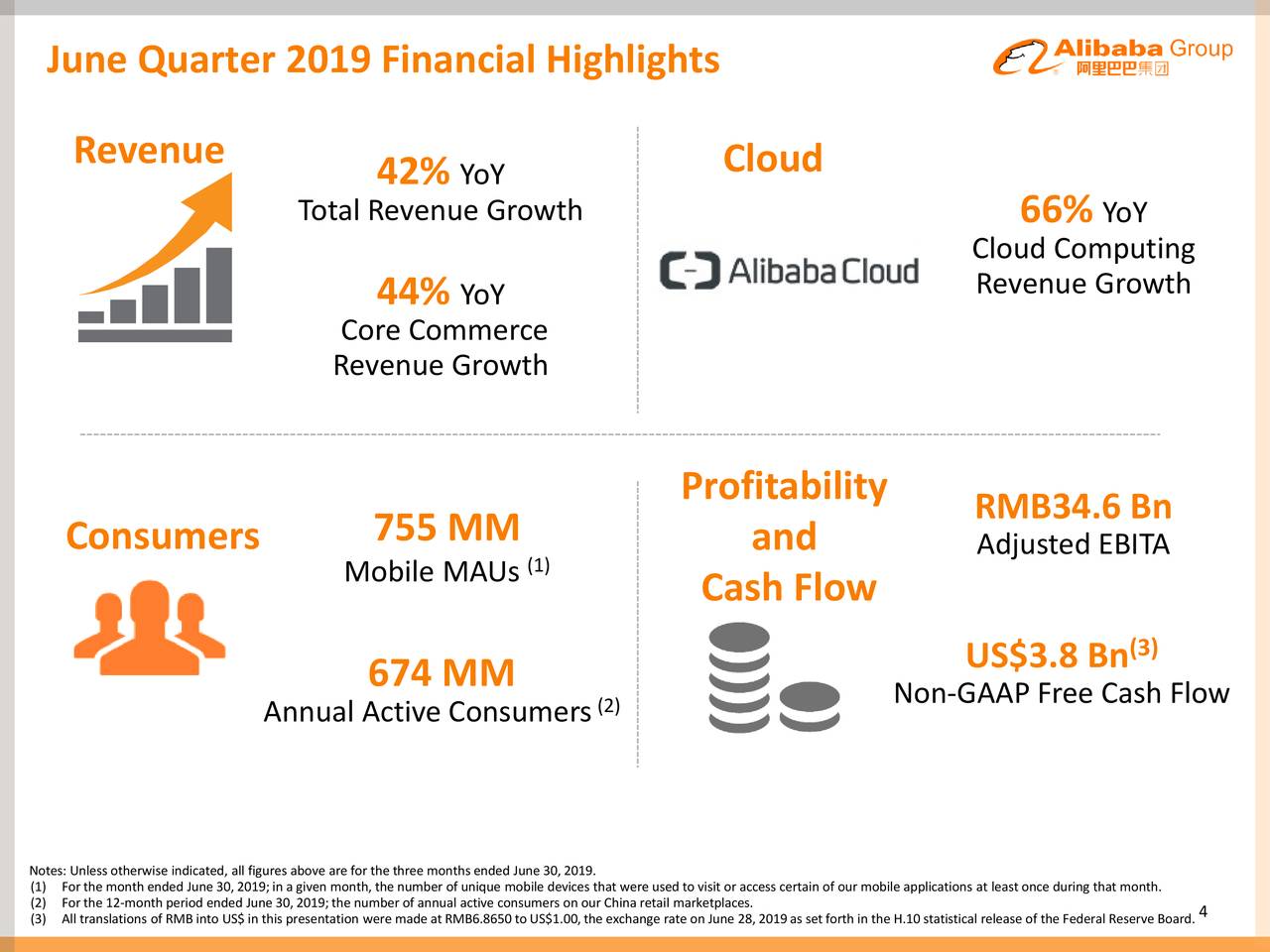

The firm’s confidence in its price performance is due to the better-than-expected total revenue growth and cloud-computing revenue. Baba’s cloud-computing revenue rose 66% Y/Y in the second quarter, driven by increasing average revenue per paying user and the number of paying customers.

The company’s revenue jumped 42% year over year in the second quarter. Its China retail marketplaces annual active consumers increased by 20 million to 674 million. Mobile MAUs on its China retail marketplaces hit 755 million, up 34 million over the same period last year.

“We had a strong quarter to start our fiscal year, with revenue growing 42% and adjusted EBITDA growing 34% year-over-year,” said Maggie Wu, Chief Financial Officer of Alibaba Group. “We are pleased to see sustained user engagement and consumer spending across our platforms. We continue to invest for long-term growth while at the same time gaining cost efficiencies in our investment areas.”

Diluted earnings per share stood at $1.17 in Q2, an increase of 56% year-over-year. Higher revenue and earnings are adding to its cash generation potential.

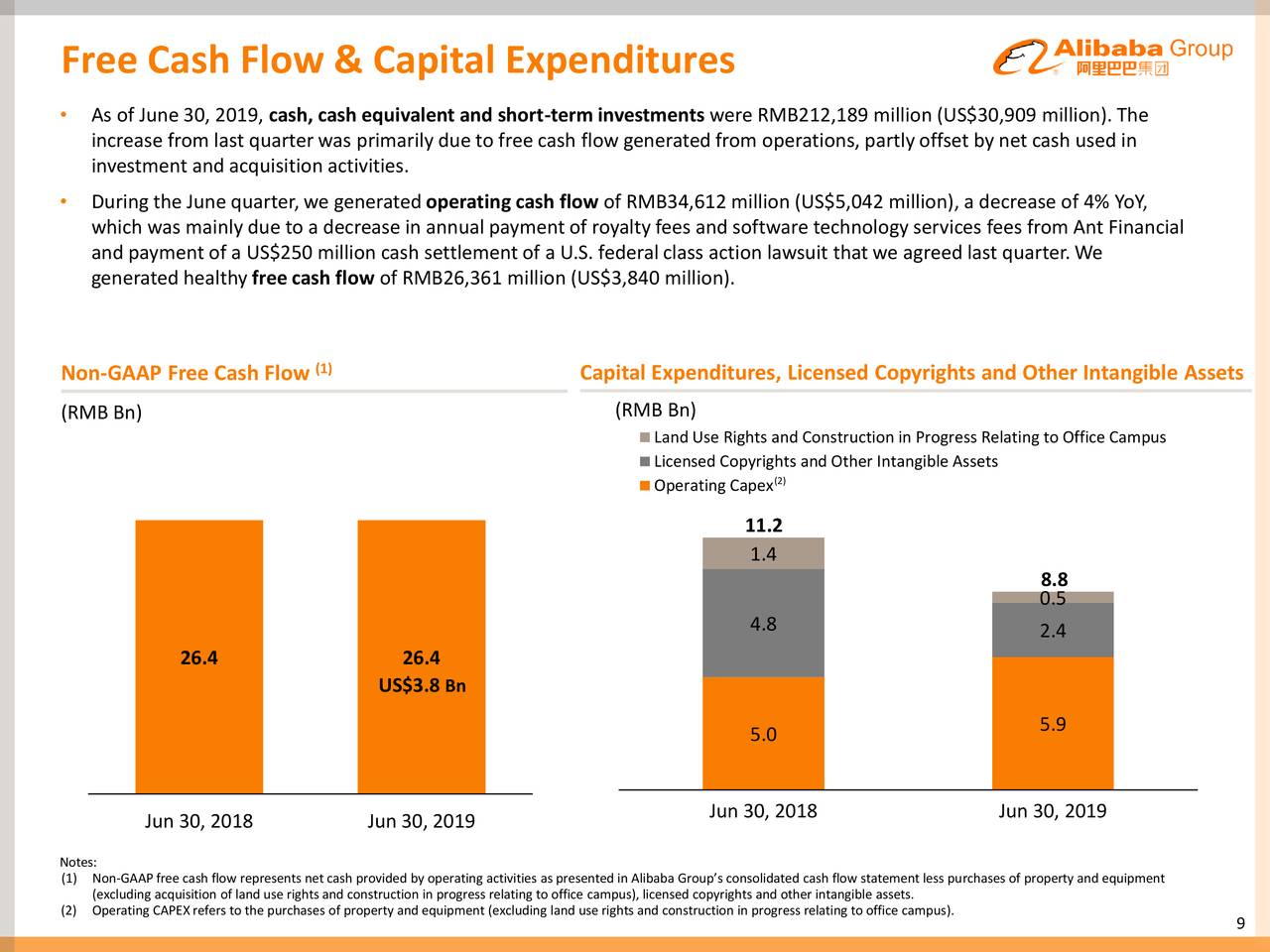

The company has generated operating cash flow of $5,042 million while free cash flows were standing close to $3,840 million.

Alibaba does not offer dividends to investors. Therefore, they are free to use these cash flows for investment in growth opportunities. The company plans to buy back $6 billion of outstanding shares in the following two years. Overall, the high double-digit growth in financial numbers is likely to add to share price momentum.

Click here to learn more about stock brokers and stock trading.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account