Alibaba (NYSE: BABA) stock price is well set to extend a bullish trend, according to market pundits. The stock price rose close to 40% year to date from its 52-weeks low of $130 a share.

Despite trade war headwinds, the company has been enhancing investor’s confidence through its robust financial numbers and investment strategies. Alibaba stock price is currently trading close to $180. Fortunately, the market pundits expect the acceleration of the bullish trend.

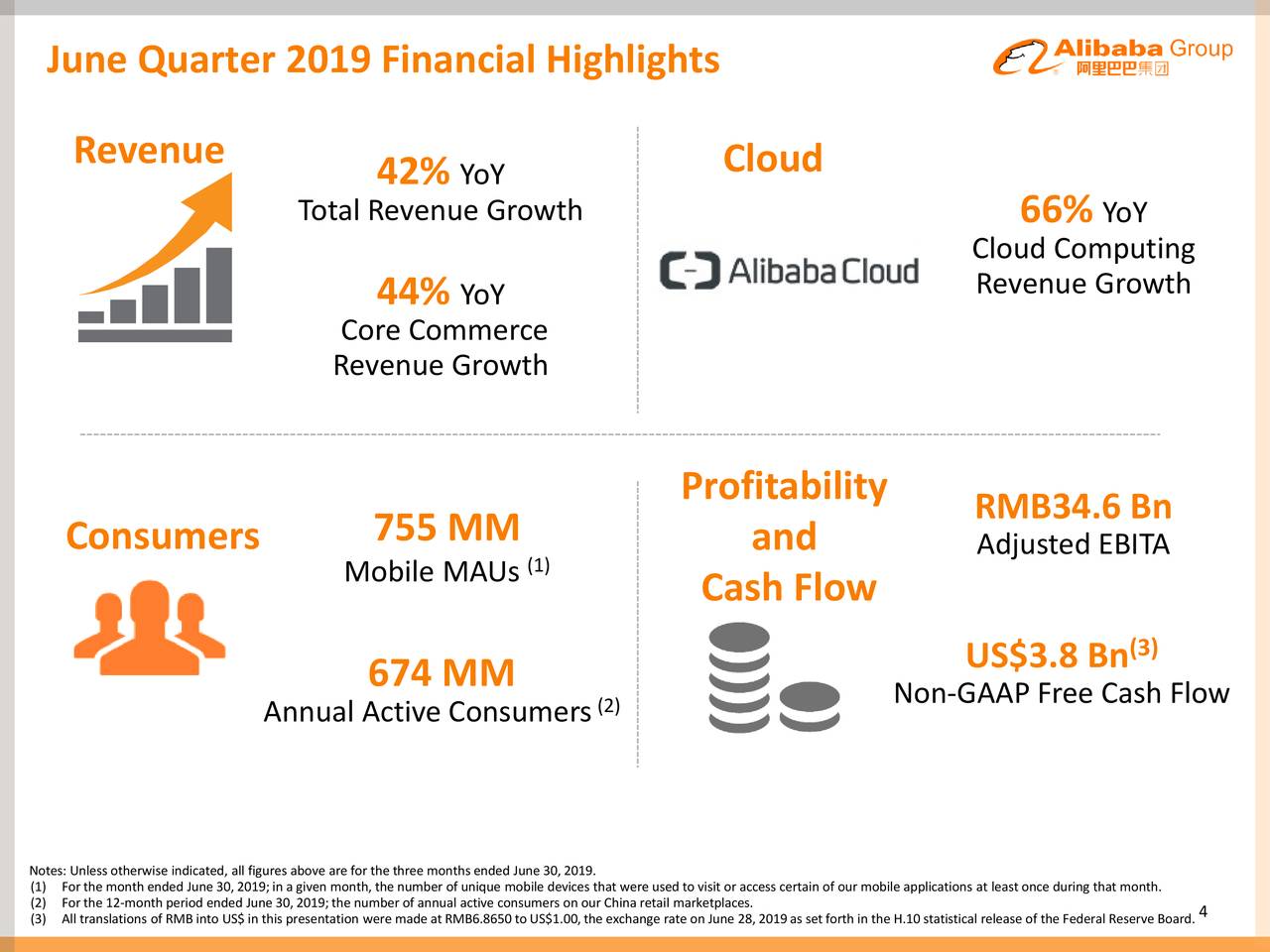

For instance, Jefferies analyst Thomas Chong has set a price target of $216 – with a buy rating. The analyst praises revenue growth from cloud computing segment. Its cloud-computing revenue grew 66% year over year in the latest quarter. The revenue growth is driven by an increase in average revenue per paying user.

Baird’s analyst Colin Sebastian provided an Outperform rating – with a price target of $195. The analyst is optimistic about future fundamentals.

Colin Sebastian said, “the earnings results showed cheering signs of growth from lower-tier cities along with impressive operating leverage.” The analyst sees prospects for Alibaba stock price appreciation amid the high revenue growth and margins.

The company has generated 42% revenue growth in the latest quarter. Its user base grew to 674 million annual active consumers. This represents a growth of 20% from the year-ago period. Moreover, it has the capacity to turn significant revenue growth into big profits. Its adjusted EBITDA rose 34% year-over-year in the latest quarter.

Daniel Zhang, Chief Executive Officer of Alibaba Group said, “We will continue to expand our customer base, increase operating efficiency and deliver robust growth.”

The company has been aggressively looking for new revenue growth drivers. Consequently, Alibaba has recently announced to buy Koala for $2 billion from Chinese gaming company NetEase.

In addition, Alibaba is also looking to invest $700M in Netease’s music streaming arm.

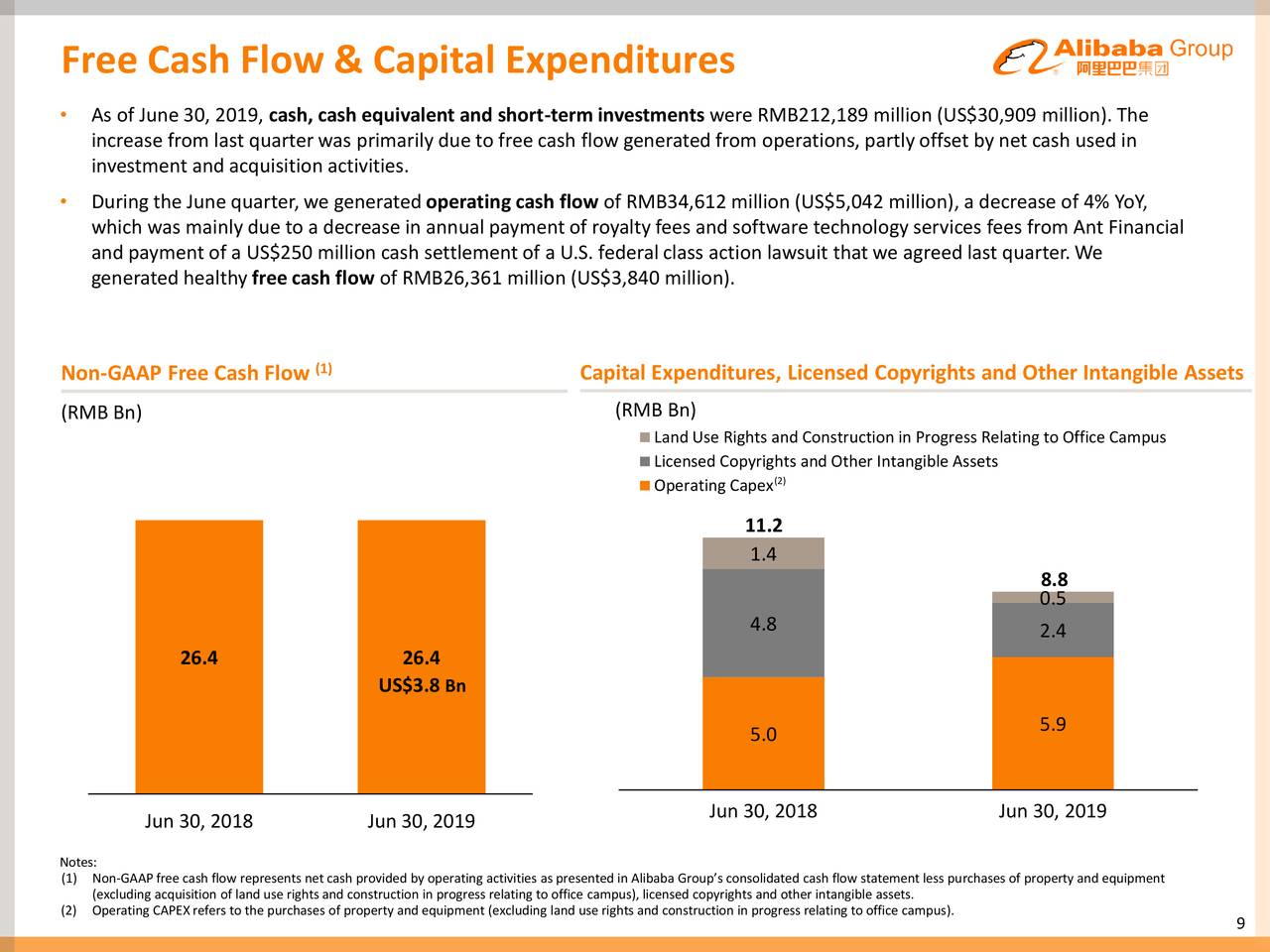

Its cash flows are offering a room for investment in organic and non-organic growth opportunities. The company has generated $5 billion in operating cash flows while its free cash flows were standing close to $3.8 billion.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account