Alcoa (NYSE: AA) stock price lost more than half of its value in the past two years due to industry-related headwinds. AA share price extended the selloff in 2020 amid expectations for increasing aluminum supplies. Lower than expected results for fiscal 2019 is adding to bearish sentiments. The company missed revenue and earnings expectations for the fourth quarter by a wide margin.

Alcoa stock plummeted 30% in the last twelve months. AA share price is currently trading around $17. The sentiments are turning bearish due to prospects for a surplus in aluminum markets. The overcapacity from China is likely to impact global supply and demand dynamics in 2020.

Aluminum Surplus Could Negatively Impact Alcoa Stock

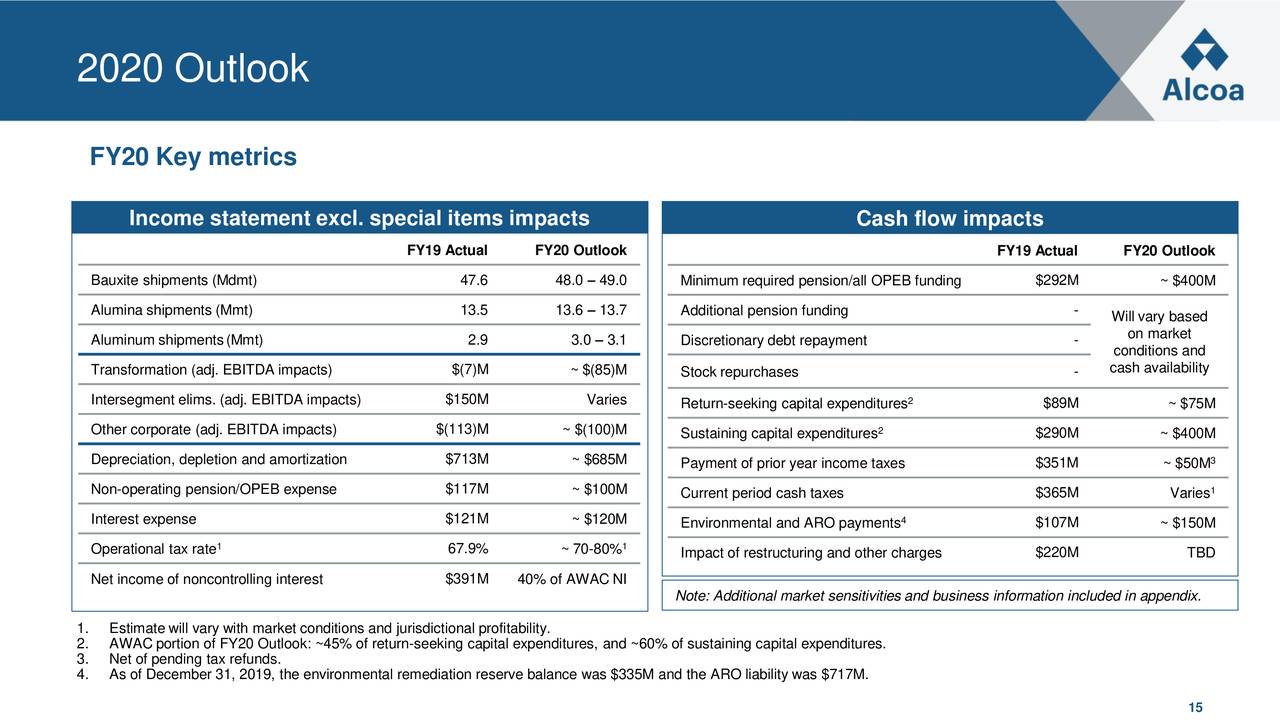

Alcoa share price extended the declining trend after predictions for supply-related headwinds. The company expects global aluminum supply to exceed the demand by 1M metric tons this year. This is up from a deficit of 900K-1.1M tons last year. Meanwhile, the worldwide demand is likely to increase by 1.4%-2.4%, which is less than the growth in supply.

“China overcapacity remains a problem for the aluminum market with no change on the horizon,” Jefferies analysts wrote. “While Alcoa is taking actions to cut costs and drive productivity, weak aluminum market fundamentals and a lack of free cash flow are concerns.”

Financials Could Further Decline in 2020

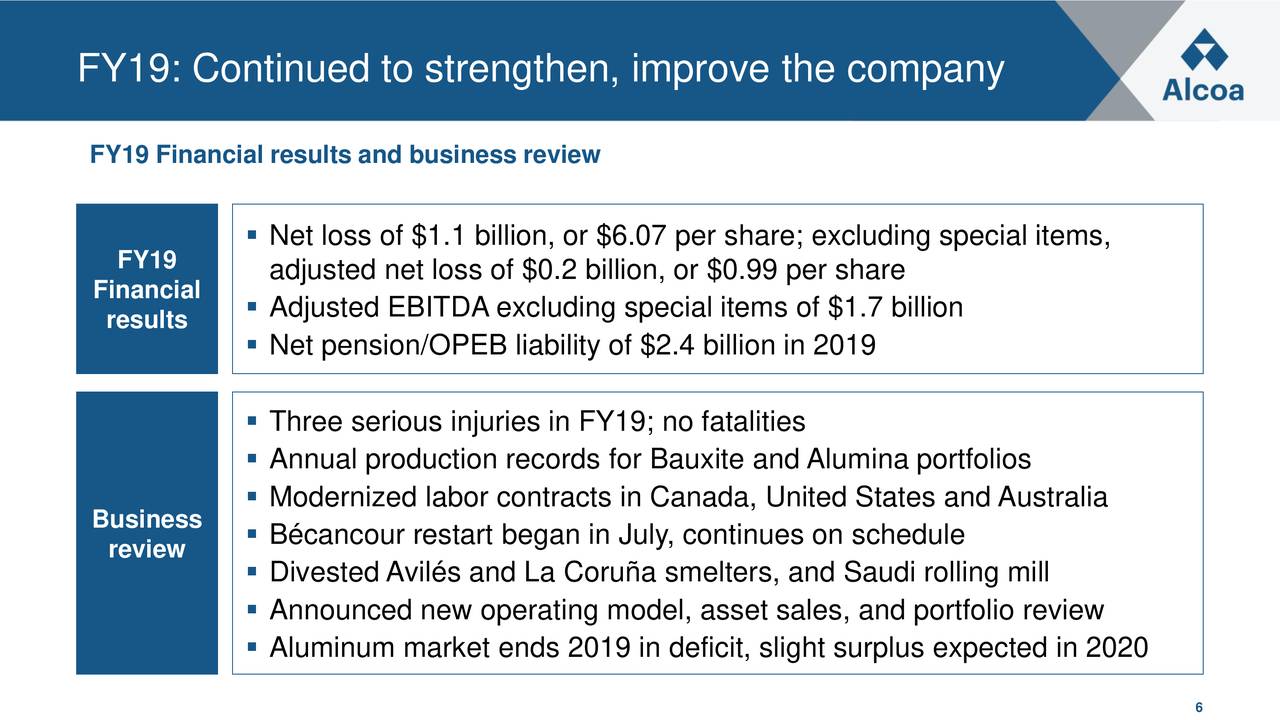

The company generated a huge year over year decline in financial numbers last year. Its fourth-quarter revenue of $2.4 billion declined 27% from the year-ago period. It reported an adjusted loss of $0.31 per share in Q4 compared to a profit of $0.71 per share a year ago. The company also reported a big loss for fiscal 2019.

Moreover, it expects a tough time for the aluminum industry. Alcoa anticipates lower results for the bauxite segment because of sluggish pricing and lower volumes along. The company guides flat performances for its alumina and aluminum segments. Overall, Alcoa stock price is likely to remain under pressure in the coming months.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account