Adobe (NASDAQ: ADBE) stock price has generated substantial returns for investors in the past few years. It’s stock price rose 179% in the past three years; the stock is up 300% in the last five years. The significant growth in its share price is due to investor’s confidence in its technological improvements and financial numbers.

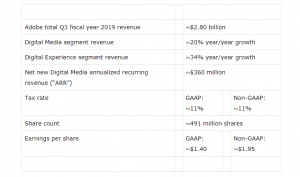

Adobe stock price is currently trading close to $280 – down slightly from 52-weeks high of $313 a share. Its shares are likely to extend the upside momentum in the coming days. This is because of high double-digit growth in financial numbers. The company has generated record revenue and earnings for the second quarter.

“Adobe delivered another record quarter in Q2,” said John Murphy, executive vice president, and CFO, Adobe. “Highlights include 25 percent year-over-year revenue growth, strong net new Digital Media ARR and operating cash flow of $1.11 billion.”

The company has generated record revenue of $2.74 billion in Q2, thanks to digital media revenue – which jumped 22% year-over-year.

On top, its cash generation has been adding to its investment potential. It has generated more than $1 billion in operating cash flows in the latest quarter. It does not offer any dividends to investors. This means the company is free to invest the entire cash flow in growth opportunities. It has repurchased 2.5 million shares in Q2. Share buybacks always provide positive support to share price performance.

The company expects similar growth in the following quarters. It expects Q3 revenue growth in the range of 24% from the past year period.

Shantanu Narayen, president, and CEO, Adobe said, “With an innovative technology platform, exciting product roadmap and a strong ecosystem of partners, we are well-positioned for the second half of FY19 and beyond.”

On the whole, Adobe stock price is likely to receive strong backing from financial numbers along with aggressive business growth strategies. Share buybacks and cash generation potential would help in enhancing investors confidence.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account