Adobe (NASDAQ: ADBE) stock price generated substantial gains for investors in the last month. The upside momentum is backed by the trader’s sentiments regarding improving fundamentals. ADBE shares are currently trading around $300, up close to 32% year to date.

Analysts are expecting Adobe share price to extend the momentum in the coming months. Several catalysts are supporting Adobe stock price at present.

The expectations for double-digit growth in free cash flows are among the biggest catalyst. Adobe does not offer dividends. Therefore, it has the potential to invest the entire free cash flow in growth opportunities.

Analysts Raised Adobe Stock Price Target

Several key firms have lifted ADBE shares target following strong third-quarter results. For instance, Jefferies has set a Buy rating with the price target of $340 to $350. The firm says there are numerous opportunities ahead with plenty of room for product innovations.

Citi raised Adobe’s price target to $321 from $313, citing a more optimistic outlook than previous expectations. Cowen believes ADBE has bullish long-term growth potential despite macroeconomic headwinds.

On the other hand, some market pundits are seeing the huge share price upside as a selling opportunity for value investors. They argue it’s a perfect time to capitalize on gains. This is because they expect a more challenging economic environment to shrink multiples across SaaS.

Strong Financial Numbers Enhances Bullish Sentiments for ADBE Shares

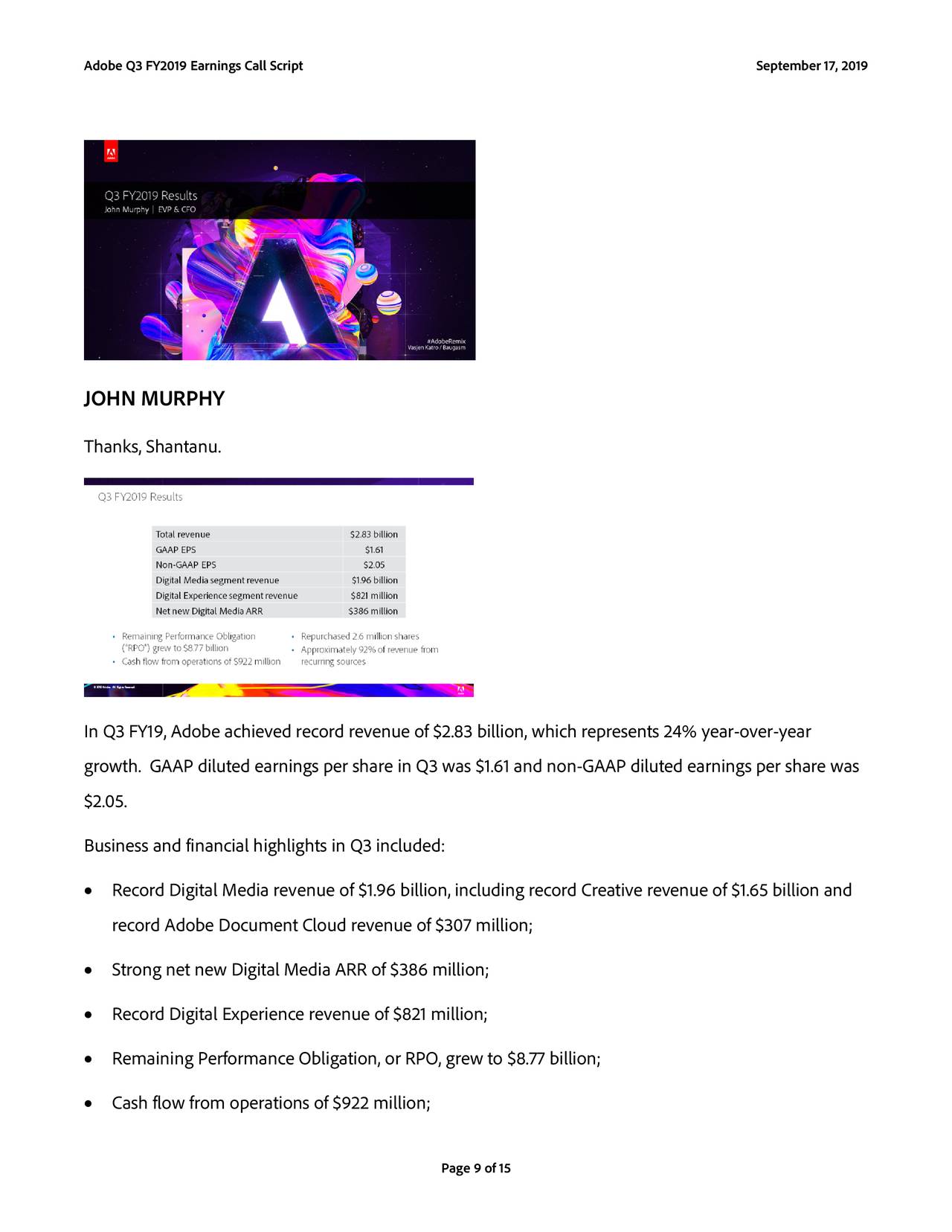

Adobe has generated record quarterly revenue of $2.83 billion in Q3 2019. This represents an increase of 24% from the past year period. The revenue growth is driven by the Digital Media segment – which grew 22% from the same period last year.

Moreover, the company has presented stronger than expected growth for fiscal 2020. Adobe forecasts 2020 revenue in the range of $13.15B compared to estimate for $13.14B. , The earnings per share is anticipated around $9.75, up from the estimate of $9.69. Overall, future fundamentals are supporting Adobe stock price upside momentum despite economic concerns.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account