Activist shareholders increasingly focused on the removal or replacement of top executives at European companies in the second quarter. There has been a prominent demand against boards or management teams since the onset of the coronavirus pandemic, according to a report from Lazard.

There has been an increase in the demand for removal or replacement of top executives at European companies since the onset of the coronavirus pandemic, according to the report.

Lazard head of European shareholder advisory, Rich Thomas, told CNBC’s “Squawk Box Europe” on Tuesday that leadership is “never more important” for activist investors than in times of crisis.

“That is why we are seeing leadership of companies firmly in the crosshairs of many activist shareholders and activist campaigns,” said Thomas, adding that the coronavirus crisis has taken away some of the traditional tools available to shareholder activists.

“During the Covid crisis, activist shareholders were less interested in cost reductions, job cuts and return on capital. When the question has been about leadership, and how the board and management is steering the company through this crisis, they have been more receptive,” Thomas added.

The volume of activist shareholders campaigning worldwide dropped sharply in March and April, during the peak of the crisis, but May saw a slight resurgence with 16 campaigns and $3.3bn of cash deployed.

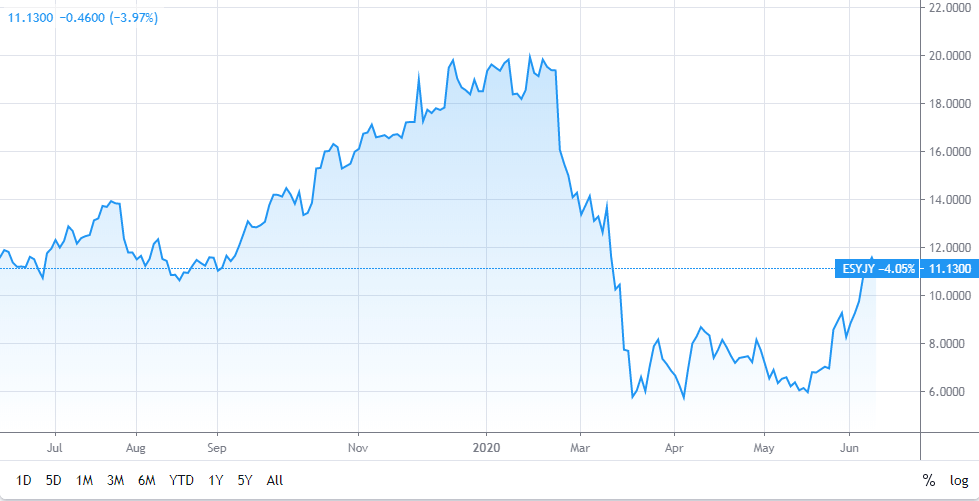

Only 16 campaigns were observed in May after a campaign by TCI (The Children’s Investment Fund) to remove Wirecard chief executive Markus Braun when a critical audit failed to answer questions about accounting practices. Earlier, activist shareholders and easyJet billionaire founder Stelios Haji-Ioannou (pictured) in April attempted to oust the airline’s chief executive and chairman over a £4.5bn Airbus order it “simply cannot afford”.

After the airline’s largest shareholder forced a crunch vote in a failed attempt to remove chief executive Johan Lundgren, chairman John Barton, chief financial officer Andrew Findlay and non-executive director Andreas Bierwirth, EasyJet said it was unable to cancel the Airbus contract by reason of force majeure. Since then, shares of the air carrier have risen by around 65% to $11.13.

In March, Hugo Boss announced that its chief executive Mark Langer will leave the managing Board following pressure from activist shareholder Bluebell Capital. Its stock climbed on Friday after the fashion retailer confirmed ongoing talks with former Tommy Hilfiger chief executive Daniel Grieder to take the top job.

If you are interested in buying stocks of companies, we have a list of the best stock brokers you can invest with.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account