PayPal (NYSE: PYPL) stock remains the best performers over the last twelve months. Its share price is currently hovering close to the highest level of $121. Although the share price rallied more than 29 per cent in the past year, the market analysts are anticipating further upside in the coming days. They believe the muted investor’s reaction to financial results is offering a buying opportunity for new investors.

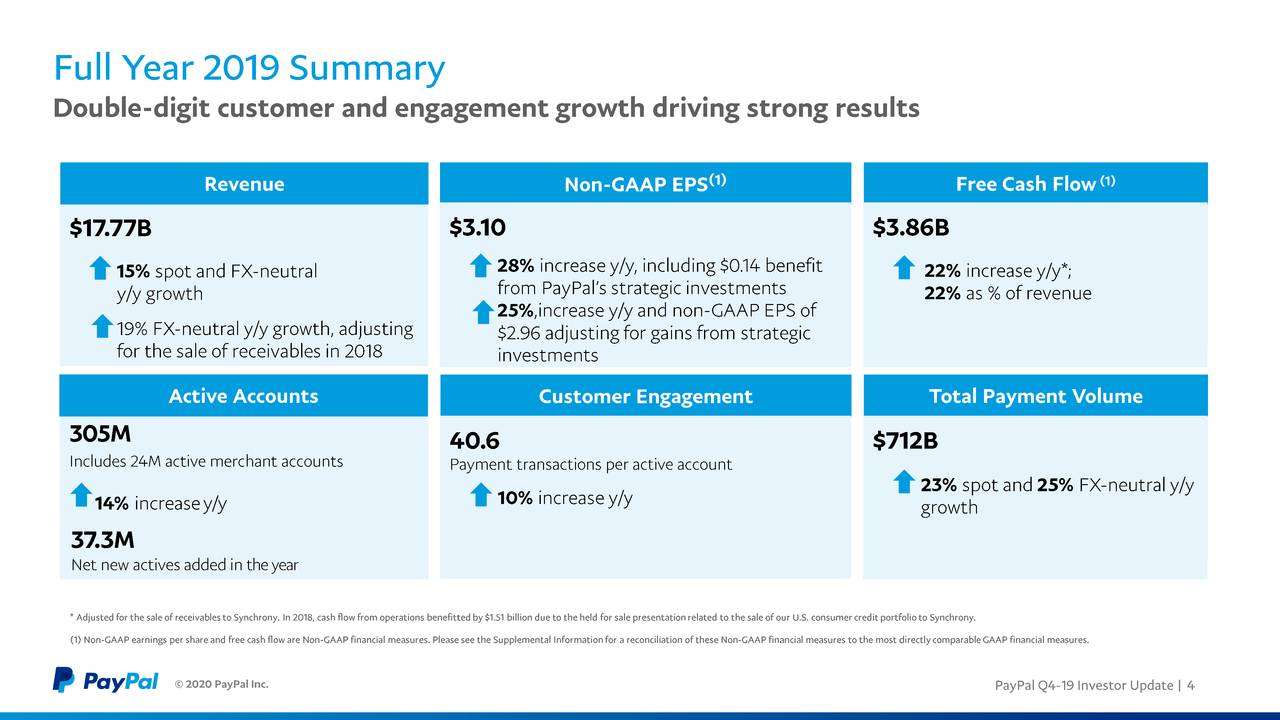

PayPal reported several new financial records in the final quarter and fiscal 2019. Its revenue and earnings grew at a double-digit rate. The company anticipates similar growth for fiscal 2020 despite increasing market competition.

Guggenheim is Seeing a Buying Opportunity in PayPal Stock

Guggenheim looks optimistic over the future fundamentals of PayPal. The firm is showing confidence in its expansion in China. The latest Honey acquisition is adding to the firm’s confidence. Its analyst Jeff Cantwell provided a Buy rating, saying the muted stock reaction to the fourth-quarter beat creates an opportunity for investors.

The company had topped fourth-quarter revenue and earnings estimates by $20ml and $0.03 per share. “Transformative purchase of Honey is a significant positive and expects long-term tailwind with expansion into China. PayPal’s risk profile now looks favorable, valuation looks reasonable, and we expect further price appreciation from here,” Jeff Cantwell.

Fourth Quarter Results and 2020 Outlook Impressed Analysts

The company generated fourth-quarter revenue of $4.96bn, up 17 per cent from the year-ago period. The full-year revenue grew 15 per cent to $17.77bn. Its fourth-quarter operating income enlarged 34 per cent year over year while full-year operating earnings grew 24 per cent from the past year period.

“PayPal delivered strong results in 2019, achieving many records including revenue, net income, and operating margin performance. We added 37.3 million net new active accounts, bringing total active accounts to 305 million, up 14% year over year,” said Dan Schulman, President of PayPal.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account