Several economists predict that the United States might face a recession within the next two years. A recession is a period of falling economic activity spread across the economy, lasting more than a few months. The last recorded recession was in 2008 and 2009, leaving behind enormous effects.

When a recession hits, almost no company is spared, leaving investors to be interested in recession-proof stocks that can be bought through the verified stock brokers. It is worth noting that since recessions can negatively affect stock prices, the outcome does not last forever. At the same time, the gain on your purchased stocks is unlimited, but all your losses are capped. The long term trends will be in favor of investors.

Here are the six recession-proof stocks that could perform well in case of an economic meltdown.

McDonald’s Corp Stock (NYSE: MCD)

McDonald’s Corp (NYSE: MCD) is an American fast-food giant with branches in different countries across the globe. During the last recession, McDonald’s is among companies that performed well after gaining a staggering 8.5% even after paying dividends. During the tough period, McDonald performed well something tied to its underlying business. Revenues grew by 3.2 percent, and operating income rose by 17 percent.

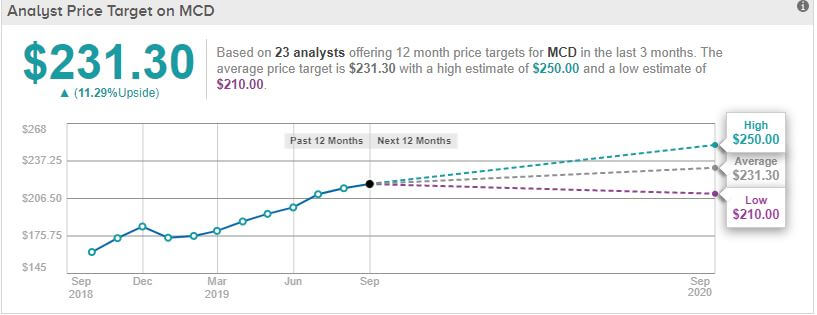

In the first quarter of 2019, MCD’s stock hit new heights by breaking out of the $200 mark. The company’s shares had stagnated for six weeks fluctuating between 194 and 199. Now trading at above $200, MCD’s stocks are on a new upward trend. Analysts estimate that within the next 12 months, MCD stocks can hit a high of $250.00 and a low of $210.00.

MCD remains bulletproof in the case of another economic meltdown. 2019 has seen McDonald’s “valuations test new highs with consistent results, outshining other global franchisees. MCD’s same-restaurant sales grew by 6.5%, beating the 5% consensus estimate in the latest growth report. Domestically, sales growth has been impressive, same as international counterparts. In 2019, International same-store sales grew by 5.4%.

MCD has witnessed a revamped Dollar Menu, which has directly contributed to higher spending per customer domestically. The increasing sales can also be linked to MCD’s efforts to renovate 12,000 stores in the U.S. by the fourth quarter of 2019.

For potential investors, it is worth noting that MCD is a master of dividends with 42 years of consecutive dividend growth. At the moment, investors receive an annual payout of $4.64 on a 2.13% dividend yield. Recently, MCD increased its quarterly dividend by 15% to $1.16 per share, suitable for a 2.2% yield.

McDonald’s is also looking for partnerships to position itself in the market ahead of competitors. The fast-food chain has partnered with Uber Eats to serve restaurants. Currently, delivery is available in over 15,000 McDonald’s locations. In most cases, delivery is boosting customer satisfaction scores.

Medtronic Plc Stock (NYSE: MDT)

With headquarters in the Republic of Ireland, Medtronic (NYSE: MDT) is the largest medical device company that generates the majority of its sales and profits from the U.S. healthcare system. For its U.S. operations, Medtronic has executive headquarters in Minnesota.

The company has been posting impressive results over the last few years. Such performance should give investors a good reason to put their money into the company without concerns. During the previous two years, Medtronic’s share value has grown by around 20%. The growth is directly linked to an increase in its revenues, margin expansion, price to earnings multiple growths, and lower share count.

Medtronic is known to be an adaptable firm due to its ability to incorporate changes in various global government health policies. The company has a smart focus on growing into emerging markets leading to double-digit sales growth in those rapidly rising healthcare markets. Over the long term, management is focusing on increasing sales growth in China, Latin America, and India. Generally, Medtronic has plenty of opportunities to grow, especially on the international scale.

That adaptability has enabled Medtronic to deliver 40 consecutive years of fast dividend growth. Analysts offering 12-month price forecasts for Medtronic have a median target of 118.00, with a high projection of 133.00 and a low estimate of 100.00. The median estimate represents a +9.04% increase from the last price of 108.22.

Medtronic boosts of a strong product portfolio comprising pacemakers, heart valves, stents, insulin pumps, and neurovascular products, among others. Furthermore, it has made acquisitions that are bound to increase its revenue. Recently, Medtronic acquired Mazor Robotics for $1.6 billion, a deal aimed to strengthen the Spine Surgery business. Historically, Medtronic has held a 50% share in its core heart devices.

For enhanced future growth, Medtronic has restructuring initiative dubbed Enterprise Excellence plan, which aims at $3 billion of annual growth run-rate savings by 2022. The program has been designed to increase profits and drive investments in strategic initiatives. This plans position Medtronic as the perfect recession-proof stock.

PayPal Holdings Stock (NASDAQ: PYPL)

PayPal (NASDAQ: PYPL) is a financial service platform that deals in digital and mobile money transactions between a business and a consumer or between two individuals. PayPal does not play the role of a bank, but customers can get PayPal cash card, a debit card linked to a user’s PayPal balance.

PayPal’s recent tremendous growth is the reason why investors looking for a stable investment platform should consider it. Most of the growth has been witnessed on Venmo, a mobile payment service owned by PayPal. In the second quarter of 2019 earnings, Venmo’s total payment volume (TPV) had increased by 70% year over year to $24 billion. By the fourth quarter of 2019, PayPal is expecting about $100 billion in TPV just from Venmo. Instant withdrawals account for half of Venmo’s monetization, while Venmo cards and Pay with Venmo make up the other half.

On the other hand, PayPal has been growing in terms of active users. The latest data shows that PayPal has 286 million active accounts on its platform. The number of merchants on the platform is 23 million. Internet platform on-boarded 41 million new active accounts in the last 12 months.

Despite having new entrants in the mobile money transfer sector, PayPal is poised to hold the grip in the industry for the future. Analysts have termed PayPal’s leadership as the main thing that should support further share outperformance over the next year. Projections indicate that PayPal has a $108 price target on the payments stock representing a 20% upside potential. Furthermore, looking at wall street, PayPal enjoys a strong buy rating with many analysts projecting a bullish trend in the future.

PayPal is also harnessing the power of partnerships. The company is positioning itself to sign deals with big banks, credit card companies, and tech leaders to reach a bigger market. Recently, PayPal invested in Cambridge Blockchain, a firm that runs technology stores, share, and validate data using blockchain. PayPal is also becoming attractive to the fintech sector that is growing.

Facebook Inc Stock (NASDAQ: FB)

Facebook (NASDAQ: FB) is the largest social networking company, with 2.7 billion monthly users across its apps. That includes Messenger, WhatsApp, Instagram, and Facebook. The company is expected to control 25% of the digital market in 2025.

Several factors make Facebook a recession-proof stock despite the recent drama about privacy. Amid the negative press, Facebook surprised many when it recorded big numbers in the first quarter of 2019. The good posting came after a tough 2018 that saw revenue shares drop. The resilience by Facebook is an indicator that the company is poised for the future despite any persisting privacy concerns.

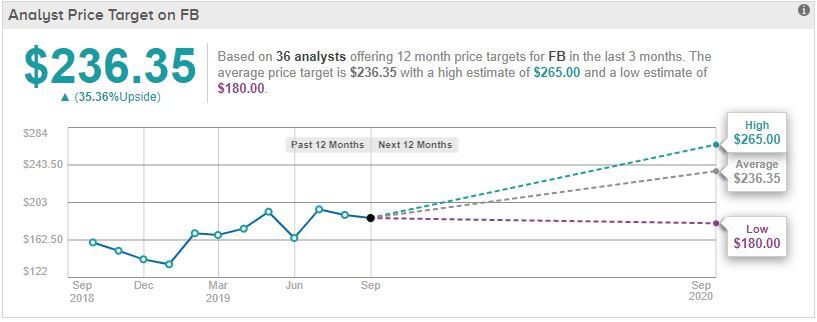

Most importantly, analysts are projecting a steady growth for Facebook stocks with $200 being an ideal number. Technical analysis indicates that Facebook is set to close the year on a strong note. Facebook stock has formed a robust and multi-quarter support line that has tested and held two times prior. Each time it did so, the stock’s relative strength index was tumbling towards the oversold territory. Further, after each successful test-and-hold of this support line, F.B. stock reversed course and rallied over the subsequent several months.

In 2019, Facebook shares have risen by 51% and have been increased at a 26.6% annual rate since its May 2012 IPO. The social network platform has also managed to grow its user base and revenue streams consistently. It impressive to see that Facebook added 178 million monthly active users year over year.

Most importantly, Facebook has an effective strategy for monetizing its impressive user base. The company generated $6.42 on average for each user, which was ahead of expectations and 16% higher than in 2018.

By 2025, Facebook is expected to record a $160 billion-plus revenue with 40% operating margins. Such numbers will be able to generate about $19 in 2025. If you consider a growth stock average 20x forward multiple, it means that by 2024, the Facebook stock price will be $380.

Alphabet Inc Stock (NASDAQ: GOOGL)

Alphabet Inc.(NASDAQ: GOOGL) is an American multinational company created through a corporate restructuring of Google in 2015. The firm became the parent company of Google. Alphabet’s Google is an $835 billion tech company that controls the majority of daily internet operations globally.

Daily, the Google website handles 3.8 billion. Apart from the search engine, Google runs popular applications like Gmail, the most popular email service. On the other hand, we have YouTube, the leading video platform, and the second most-visited website. Another product is the Android smartphone operating system. Alphabet has all the attributes that fit a recession stock to own.

Historically, Alphabet has been a good performer. Looking at the last ten years, Alphabet shares have managed to grow by 405% easily outpacing the S&P 500’s 251% return. In 2019, Google Class A and C shares have performed well. However, their recent momentum has been strong. All the stocks on all classes have improved by almost 15%, based on the company’s second-quarter earnings. The earnings outperformed analysts’ expectations.

Generally, Alphabet has a history of exceeding expectations from analysts when it comes to market performance. This gives Alphabet a strong chance to continue soaring.

Like other tech companies, Google is exploring new ideas to keep its business alive. The firm has been focusing on cloud computing services keeping at par with competitors like Amazon and Microsoft. Alphabet’s cloud computing has been growing fast. In the second quarter, Google Cloud had a 9.5% share, up from 8.7% the previous year. Estimates indicate that hat the entire global market grew nearly 38% to more than $26 billion.

Google has already tested and survived the great recession of 2008. This was a massive test for most companies, but Alphabet managed to survive the storm. Google was affected by the selling pressure, falling 65%. Once the market recovered, Google recovered all its losses in just three years.

iRobot Corporation Stock (NASDAQ: IRBT)

iRobot Corporation (NASDAQ: IRBT) is an American advanced technology company founded by members of MIT’s Artificial Intelligence Lab who designed robots for space exploration and military defense. iRobot’s stocks serve as an excellent platform for buying recession-proof stocks. In 2019, iRobot’s stock has risen by over 15%.

At the same time, iRobot stocks dropped in April after first-quarter results failed to meet expectations. This was a setback considering that the company was on an upward growth trajectory. However, this drop was temporary as the firm has put measures in place to revive the stocks by the first quarter of 2020.

The firm has aligned several new products set to be launched soon like the highly anticipated robotic lawnmower Terra. The Terra robotic lawn mower will start in Germany, and as a beta program in the U.S. This robot will propel iRobotics into the multi-billion dollar push mower and robotic lawn mower markets. Also, with very few households owning a robotic vacuum cleaner, there’s certainly room for more companies entering the market.

The good news for investors is that factors that contributed to the slowdown in growth are just temporary. With new products, the company expects to have fresh revenue streams. Global growth rates were affected by price hikes which the company linked to offset tariffs. Investors should not be worried because both sides will eventually strike a deal. Once the tariffs have been eliminated, iRobot’s products should have reduced prices, providing a tailwind for international growth.

Analysts predict that iRobot will be a good investment over the next 12 months. Based on technical analysis, a long-term increase is expected. With a 5-year investment, the revenue is expected to grow by around +132.11% by 2024.

Conclusion

A recession is scary as many entities go out of business. However, not all companies suffer diverse effects during such economic meltdowns. Ironically, some companies can withstand the impact of the recession, meaning that investors can put in their money.

For investors, it is essential to research the companies where you can put your money. The more you know about investing, the less likely you are to lose money. Doing your homework before investing will increase your chances of settling on the stable stock. In the event a recession hits, do not engage in panic selling since some companies emerge stronger after the economic meltdown.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account