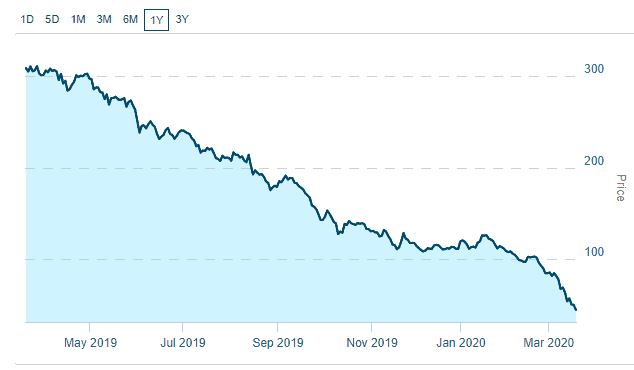

Marijuana stocks have been hit harder by the coronavirus inspired broader market selloff that has slashed 30% of the value of Dow Jones Industrial Average and S&P 500 index. The marijuana index fell to the lowest level in its three-year history – the index plunged to just 43 points compared to its 52-week high of 318 points. Some pot stocks lost more than 90% of value over the last twelve months – but the selloff has created an attractive buying opportunity for the long-term investors as some Wall Street analysts projecting at least $50bn in annual sales by 2030. Many marijuana firms are based in Canada, which became the second country in the world after Uruguay to legalise possession and use of recreational cannabis in October 2018.

This clearly suggests that value hunters are in a position to buy cheap marijuana stocks during the latest market crash. Below are five fundamentally sound marijuana companies that are currently trading at significant discounts.

1. Canopy Growth (NYSE: CGC)

Canopy Growth is the largest company engaged in the production, distribution, and sale of medical and recreational cannabis. Canopy’s stock price lost 80% of the value from its 52-week high of $50 a share. Trader’s concerns on overhyped valuations and excessive supplies have slammed the stock in 2019, which has extended into this year’s broader market selloff. Its management has said it is working on lowering costs and freeing up cash flows.

BMO analyst Tamy Chen has set a price target of $40, expecting restructuring efforts to reduce quarterly cash burn. The Ontario-based company said it will close two greenhouses, Aldergrove and Delta earlier this month, along with suspending the plan of construction of the third greenhouse in Niagara-on-the-Lake.

2. Cronos Group (NASDAQ: CRON)

Cronos Group is a global cannabinoid company with a presence across five continents. Its stock price plunged almost 70% in the last twelve months to the lowest level since 2017. MKM analyst Bill Kirk sees the share price fall as a buying opportunity. He believes investors should concentrate on its healthy cash position and a strong track record. Toronto-based Cronos generated 234% year-on-year revenue growth in the latest quarter.

3. Aphria (NYSE: APHA)

Aphria has been struggling due to liquidity issues and higher operational costs. Its stock price tumbled close to 80% over the past twelve months. The Ontario-based company recently secured $100m of investment, which will help it streamline operations in Canada and international markets. Its revenue jumped almost 450% year-on-year in the latest quarter and the firm said it expects to generate sales of around $600m this year.

4. Aurora Cannabis (NYSE: ACB)

Aurora Cannabis stock is among the biggest laggards of the marijuana industry. Its share price has plummeted 93% over the past twelve months, its shares are currently trading below $1. The Edmonton-based firm produces and distributes medical cannabis products. It missed its sales and earnings estimates in the latest quarter, with its cannabis net revenue falling 11% to $63.2m from the previous quarter.

5. OrganiGram Holdings (NASDAQ: OGI)

Moncton-based OrganiGram Holdings stock price has plunged 77% over the past twelve months despite aggressive growth plans. The company announced the first shipments of its Edison vape pens to jurisdictions across Canada last month. It also beat its first-quarter estimates by a wide margin, revenues doubling from the previous a year ago to adjusted earnings that came in at $4.9m.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account