3M (NYSE: MMM) stock price has been under pressure since the beginning of this year. 3M shares slumped more than 25% from 52-weeks high of $225 a share.

The selloff is supported by traders’ concerns over the gloomy global economic outlook and soft financial performance.

3M stock price trades around $160 after hitting 52-weeks low of $150 a share. Analysts are seeing limited upside potential for 3M shares amid slow global economic growth. This is because 3M is an industrial company and its business model is directly correlated to economic situation.

Bleak economic Outlook Limits 3M Stock Price Upside Potential

The economic situation is among the biggest headwind for 3M’s financial and stock price performance. The global economy is entering into a synchronized stagflation situation according to research by the Brookings Institution and Financial Times.

Some market players are seeing signals for the global recession amid trade war conflicts between the largest countries.

IMF Managing Director Kristalina Georgieva has recently revised its economic outlook for this year. The Managing Director said they are again likely to revise forecasts for this year. In addition, the IMF expects slower growth in almost 90% of the countries this year.

IMF claims that trade tensions, geopolitical risks, political instability, and doubts with the effectiveness of monetary stimuli could be the biggest contributors for the slow economic growth.

Sluggish Financial Numbers Are Among the Headwinds

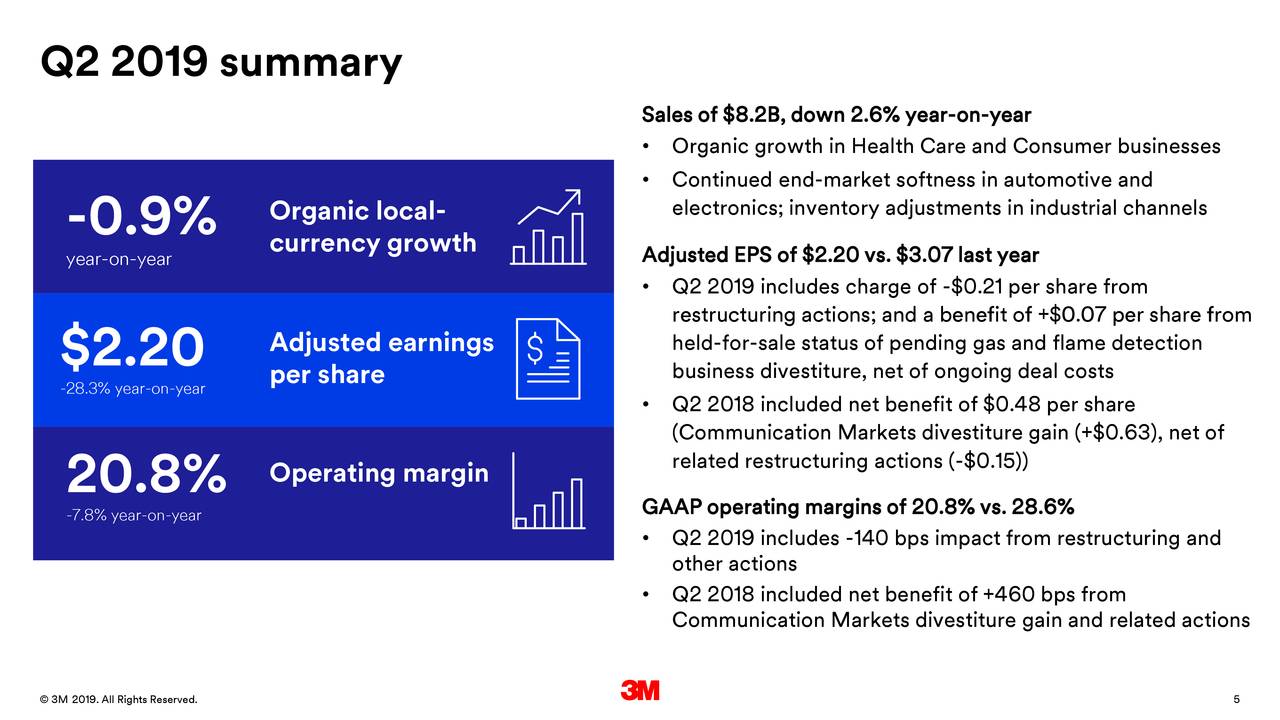

3M has reported second-quarter sales of $8.2 billion. This represents a decline of 2.6% from the year-ago period. In addition, its earnings plunged significantly from previous quarters. Its Q2 net income of $1.13B slid 39% from the year-ago period.

Despite the huge decline in second-quarter results, the company expects to achieve full-year guidance. It expects FY 2019 earnings guidance around $9.25-9.75. The analysts are expecting earnings to stand in the range of $9.36. The company anticipates free cash flow conversion around 95%-105% of net income. Overall, the 3M stock price performance is dependent on the economic situation.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account