3M (NYSE: MMM) stock price lost close to 30% of value since May 2019 amid trade war conflict and lower than expected growth from end markets.

Its shares are currently trading around the lowest level in the past three years. The bearish trend in its share price is likely to extend the momentum according to market pundits. JP Morgan’s Tusa has reduced the price target to $140 a share following the second-quarter results. The analyst has given underweight ratings for 3M shares, saying 3M is “far from out of the woods” around its structural challenges.

Although the company has been aggressively working on restructuring initiatives, it appears that the company needs a longer time for stabilization. The company expects annual pretax savings of $250 million. The reduced manufacturing output and the reduction in operating cost could help it in saving $300 million this year.

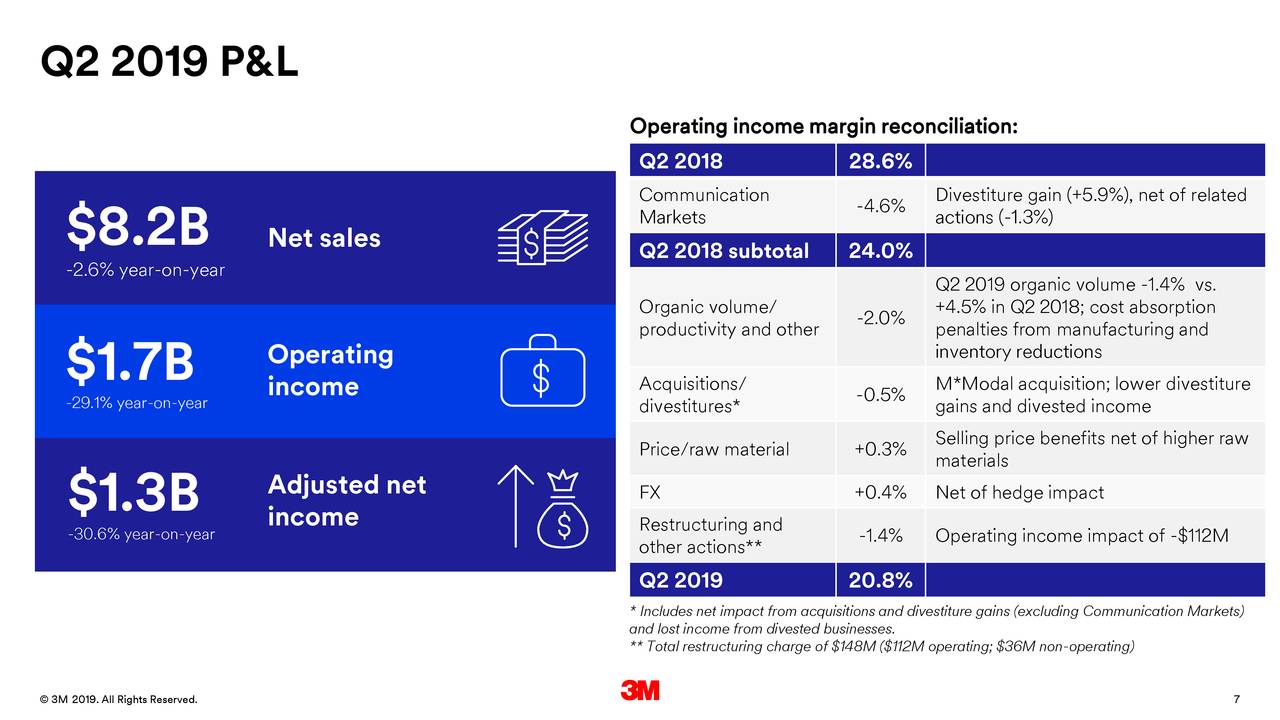

Despite these initiatives, its revenue and earnings are declining from previous year periods. Its second-quarter revenue of $8.8 billion indicates 2.6% drop from the year-ago period. Besides from healthcare and consumer business, its automotive, electronics and industrial businesses are experiencing downtrend.

The pressure on its revenue base has also been impacting margins and earnings potential. Its operating margin declined 7.8% year over year in the second quarter. Consequently, 3M’s adjusted earnings per share $2.20 declined sharply from last year’s earnings of $3.07 per share.

“Our execution was strong in the face of continued slow growth conditions in key end markets, as we effectively managed costs and improved cash flow,” says CEO Mike Roman.

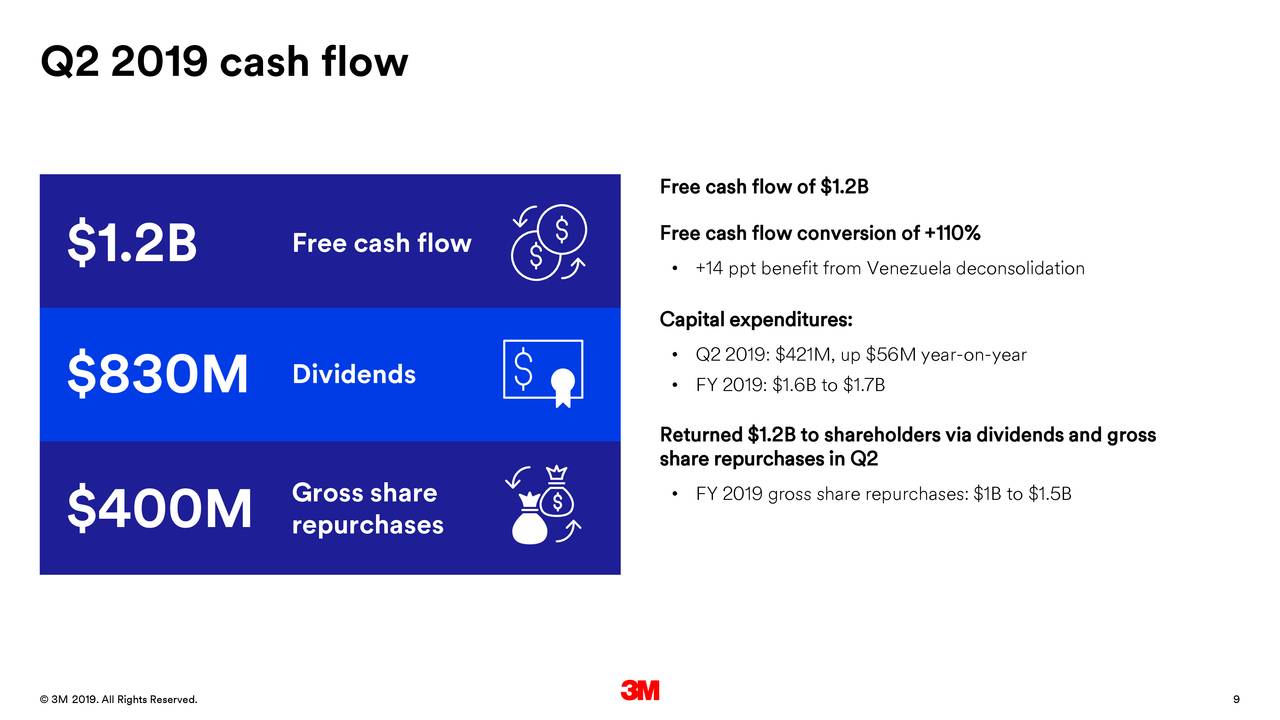

On the positive side, its cash conversion ratio remains strong. 3M’s free cash flow conversion ratio stood around 110% of net income in Q2. Its free cash flows of $1.2 billion were enough for covering dividend payments and share buybacks.

Besides free cash flows, slower market condition and lower than expected growth in financial numbers could negatively impact 3M stock price performance in coming days.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account