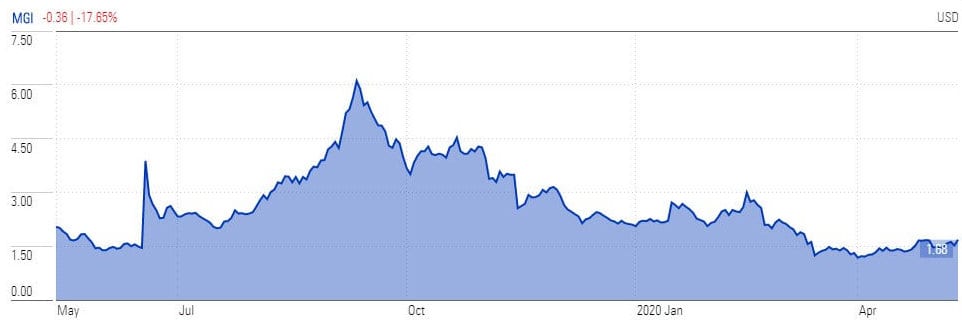

Struggling MoneyGram’s (NYSE: MGI) stock price has received a much needed support from the robust growth in digital channels last month, helping offset the negative impact of coronavirus related-lockdowns at its outlets.

The Dallas-based firm, which handles remittances and cross-border payments. said that its digital transactions surged 81% year over year in April, accounting for more than a quarter of all transactions. The company says that momentum is extended into May.

“Over the last few years, we’ve invested heavily in our digital transformation by building the best digital customer experience in the industry and then rapidly launching those capabilities to new markets,” Alex Holmes MoneyGram chairman and chief executive officer said in a press release on Tuesday.

Its digital channels — that include MoneyGram online, account deposit & mobile wallet services — helped in generate 57% growth in digital transactions since the first three months of the year .

“We’ve built a valuable digital business that has quickly grown from a fintech start-up to a sizable and profitable piece of the overall business,” said Kamila Chytil, chief operating officer, and leader of the company’s digital business.

Shares lifted almost 10% to close at $1.68 on Tuesday, but fell 6% to $1.58 on Wednesday morning. The stock has fallen by a quarter this year.

This contrasts with overall trading it the first quarter of the year, which earlier this month posted revenue of $290.9m year over year, a decline of 8% or 7% on a constant currency basis. It also reported a net loss of $21.5m, and an adjusted diluted loss per share of 5 cents over the same period.

MoneyGram stock, which was over recent quarters was on the brink of standing among penny stocks. The stock trading of remittance company remained under pressure over the past two quarters amid rising competition from rivals such as market leader Western Union and UK fintech TransferWise, which offer greater scale and lower fees.

If you plan to invest in stocks, you can checkout our featured stock brokers here.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account