Microsoft (NASDAQ: MSFT) stock price received strong support from its first-quarter results. The double-digit growth in financial numbers has been strengthening bullish sentiments. MSFT shares already rallied 34% since the beginning of this year.

MSFT shares are currently trading around an all-time high of $140. Microsoft stock price has further upside potential in the days to come amid significant support from financial numbers. The increasing market share in the cloud is among the biggest catalyst.

Q1 Vindicates Bull Case for Microsoft Stock Price

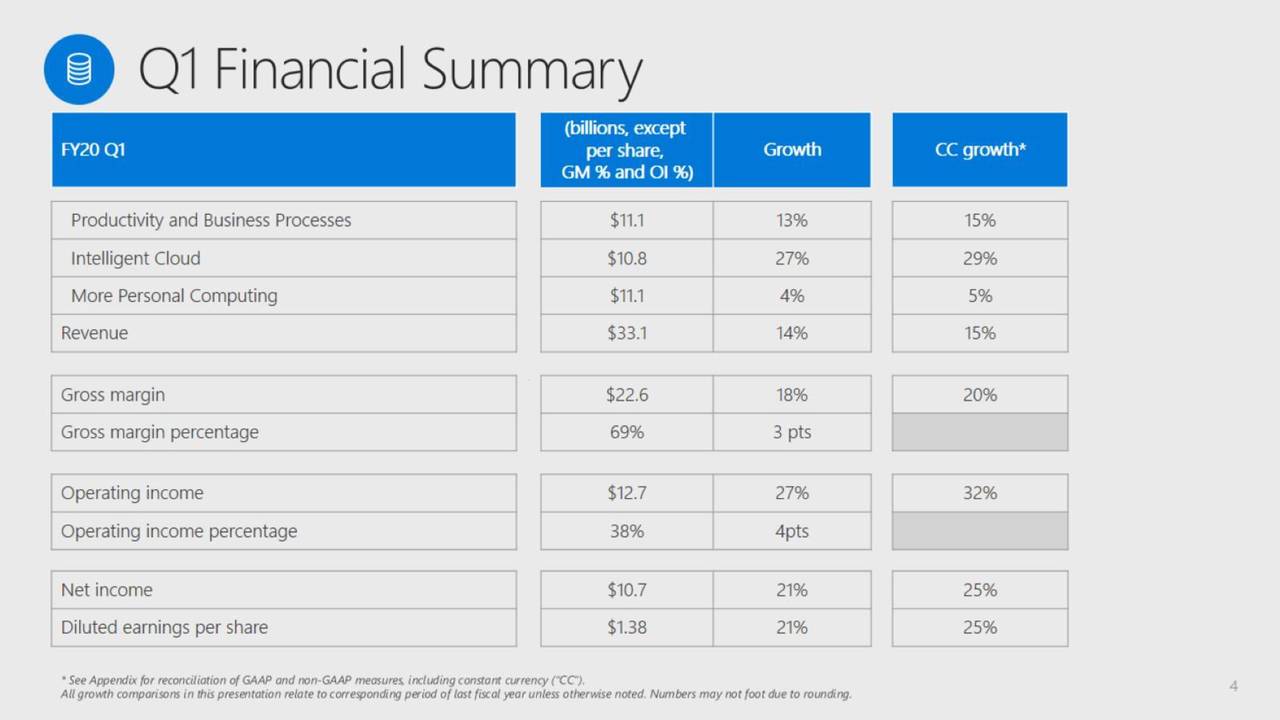

The largest tech company has generated substantial financial growth in the first quarter. The company’s revenue of $33.1 billion grew 14% from the year-ago period. The revenue has also beaten analysts estimate by $860 million. The revenue growth is driven by its extensive share in cloud markets.

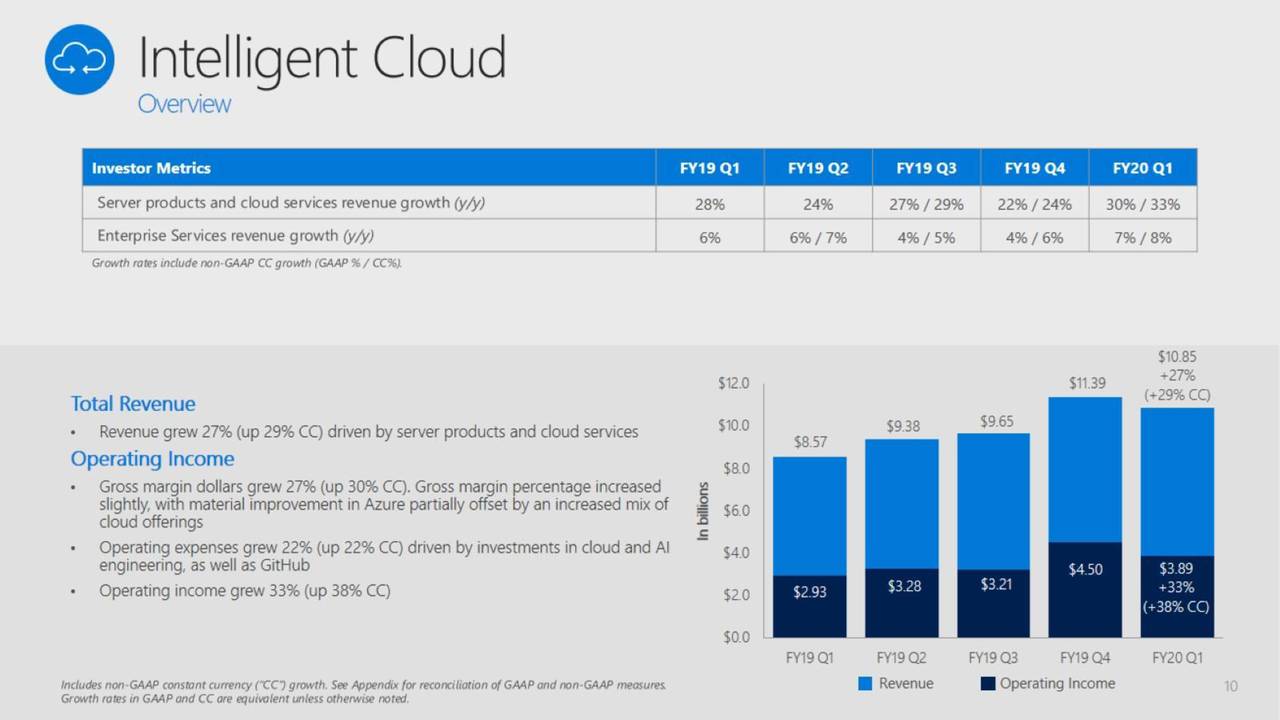

Its revenue from productivity and business processes segment surged 13% to $11.08B while intelligent cloud revenue rose 27% to $10.85B.

The more personal computing segment jumped 4% to $11.13B. The company achieved strong revenue growth despite declining capital expenditure by 6% compared to the past year.

“The world’s leading companies are choosing our cloud to build their digital capability,” said Satya Nadella, chief executive officer of Microsoft. “We are accelerating our innovation across the entire tech stack to deliver new value for customers and investing in large and growing markets with expansive opportunity.”

Cash Returns Are Among the MSFT Shares Catalyst

Microsoft has always been considered as best stock for defensive investors. This is because of its history of offering considerable cash returns in the form of dividends and share buybacks.

It has increased the quarterly dividends in the past 9 consecutive years. It currently offers a quarterly dividend of $0.51 per share, yielding around 1.5%. The company is likely to make a double-digit dividend increase this year.

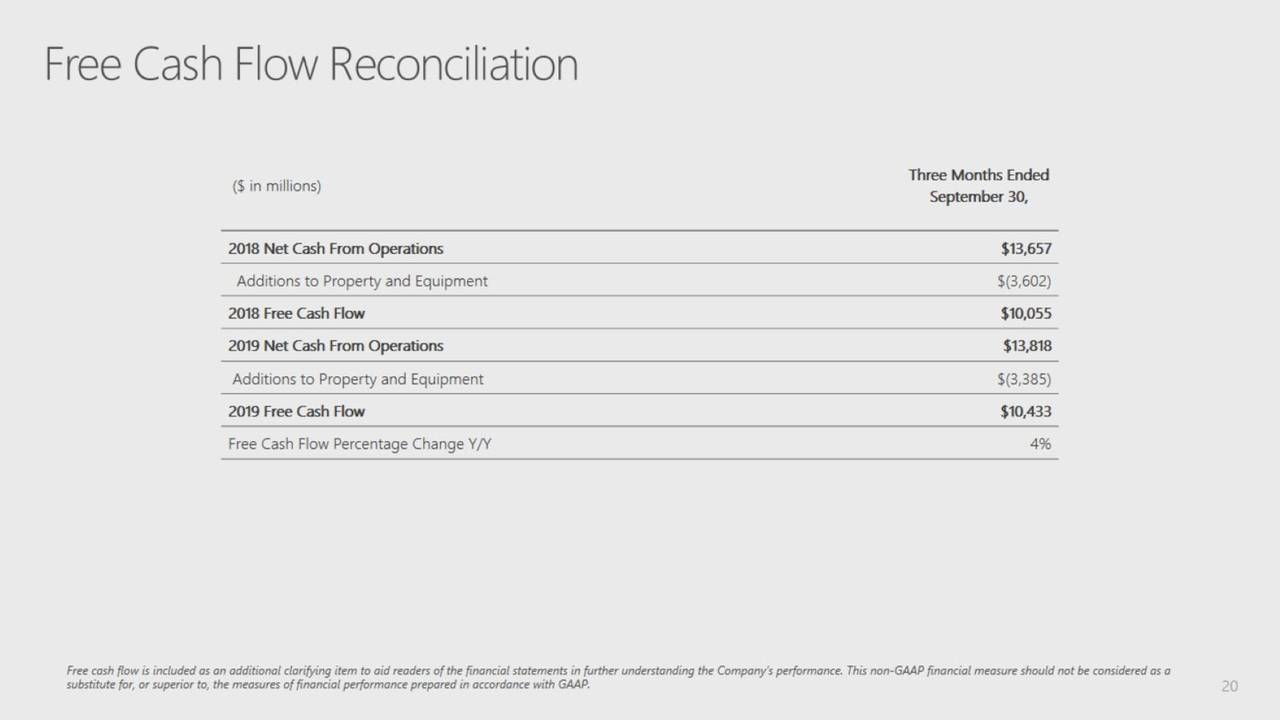

MSFT has returned $7.9 billion during the first quarter in the form of dividends and share repurchases. This represents a growth of 28% from the first quarter of the fiscal year 2019. Its free cash flows are offering a complete cover to cash returns. Overall, Microsoft stock price appears in solid position to extend the momentum.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account