Lyft (NASDAQ: LYFT) stock price shot up almost 17% as the ride-hailing company dramatically narrowed losses from the year-ago quarter and revenues jumped at a double-digit rate despite the negative impact of coronavirus outbreak. First quarter year over year revenue growth of 23% to $956m topped the consensus estimate of $882m.

However, the San Francisco-based company posted a loss of $85.2m excluding interest, taxes, and other costs, a 61% improvement on a year ago. The coronavirus outbreak has hit hopes of moving towards a profit by the end of 2021.

This is because the March quarter results did not clearly reflect the full impact of lockdowns as the steep decline in rides begun from mid-March and were down 75% year over year in April, with expectations of a small improvement in May from the previous month.

Meanwhile, the consensus estimates from Yahoo indicate a loss of $2.55 per share for this year and a loss of $0.99 per share in fiscal 2021.

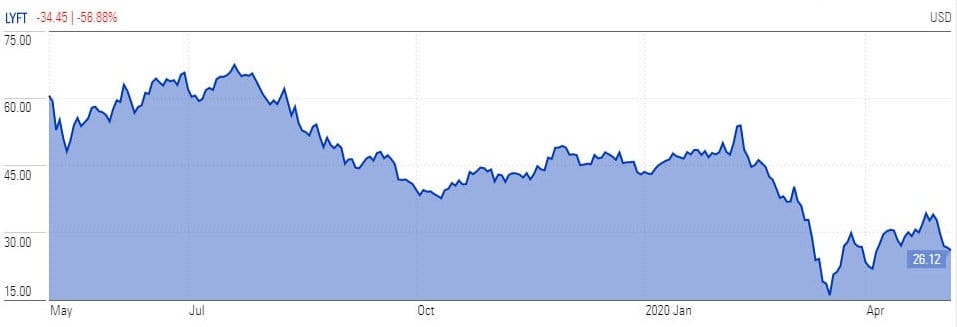

Lyft stock trading price is down significantly from a 52-weeks high of $67 a share despite the latest jump on the earnings announcement.

Seeing the wobbly trajectory of the market, chief executive Logan Green believes only cost cuttings would lead to the path profitability. However, Logan Green did not comment on whether the company is sticking to its previously stated goal of being profitable by the end of next year.

“While the COVID-19 pandemic poses a formidable challenge to our business, we are prepared to weather this crisis,” Logan Green said in the earnings announcement. “We are responding to the pandemic with an aggressive cost-reduction plan that will give us an even leaner expense structure and allow us to emerge stronger.”

Lyft, which employs over 5,000 staff, has already slashed its workforce by 17% in the wake of the virus while it is still exploring other cost-cutting areas to reach a goal of saving $300m this year. Green said they have suspended all ride discounts and plans to decline driver incentives.

The aggressive steps from Uber (NYSE: UBER), the closest rival of Lfyt, also indicate bumpy ride for the emerging companies. Uber said it will cut 3,700 jobs, or 14% of its workforce, and chief executive Dara Khosrowshahi plans to forego his base salary for this year.

“We are looking at many scenarios and at each and every cost, both variable and fixed, across the company,” said Khosrowshahi, in a memo to staff. “You can expect we will have a further, final update for you within the next two weeks.”

If you plan to invest in stocks, you can check out our featured stock brokers here.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account