Lufthansa said it will permanently decommission more than 40 of its jets and axe its Germanwings low-cost arm, as the airline industry comes to terms with the sweeping effect of the coronavirus.

Germany’s largest airline said it “does not expect the aviation industry to return to pre-coronavirus crisis levels very quickly”.

The group said it would also reduce fleets in its other businesses, which include Austrian Airlines, Swiss and Eurowings.

“It will take months until the global travel restrictions are completely lifted and years until the worldwide demand for air travel returns to pre-crisis levels,” the business said in a statement on Wednesday.

“You can’t understate the disaster that’s unfolding right now in the world’s airline industry. There’s no sugar coating it,” said Richard Aboulafia, aviation analyst at Teal Group.

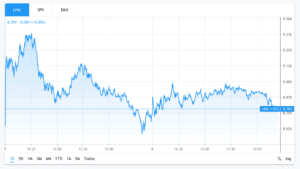

Lufthansa shares have lost nearly 50% of their value year-to-date as a result of the virus-triggered market crash, and are currently up 2% at €8.91 on Thursday morning trading in Frankfurt, as investors seem to like its cost-cutting measures.

Lufthansa, founded in 1926, employs 138,000 people and travels to more than 220 destinations. It runs a fleet of around 300 aircraft.

Moves by the German flag carrier come as government lockdowns sparked by the global health emergency have resulted in 90% capacity cuts across the industry and a 40% reduction in revenues, according to the International Air Transport Association (IATA).

America’s big three airlines – American Airlines, United Airlines and Delta Air Lines – have furloughed staff and slashed capacity. Experts add that they may also have to make lasting cuts to get them through the crisis.

“We’re going to be smaller coming out of this,” Delta Airlines chief financial officer Paul Jacobson told employees. last month “Certainly quite a bit smaller than when we went into it, and we’ll have the opportunity to grow.”

Henry Harteveldt, president and founder of travel data group Atmosphere Research, added: “I would not be surprised to see not only Delta return as a smaller airline, but also American, United and even Southwest use this as an opportunity to cull some aircraft from their fleet.”

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account