Virginia Payday Loans Lender 2020

Are you based in the state of Virginia and need access to emergency funding to see you through the remainder of the month? If so, you might be forced to use a payday loan lender. State lending laws cap the amount of interest that lenders can charge you at 36% APR.

However, a number of Tribal lenders are also active in Virginia, so you could end up paying much more than this. The reason for this is that Tribal lenders are not required to comply with state lending laws, so they essentially have the freedom to charge what they like.

As such, we would suggest reading this guide on Virginia Payday Loans Lenders in 2020 prior to starting your application. We cover everything you need to know about payday loan companies in Virginia, such as how much interest you should expect to pay, how long you’ll have to repay the funds, and the time it takes to have your application approved.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

-

-

Note: As long as you avoid Tribal lenders, your APR will be capped at 36%. However, if your credit profile is damaged and you’ve been turned away from standard lending firms, you might have no choice but to consider a Tribal loan provider.

What are the Laws Surrounding Payday Loans in Virginia?

Although payday loans in Virginia are well governed by state regulations, they are not as stringent as other states in the US like Ohio or California. With that said, payday loans are perfectly legal in Virginia, although the most you can borrow is $500. If you need more than this, then you will need to consider an alternative financing source like a personal loan.

The amount of interest that payday loan companies can charge in Virginia is also capped, standing at 36% APR. However, if you come across a lender that operates under Tribal Indian laws, these caps do not exist so the lender can effectively charge as much as it wants, so tread with caution. In a similar nature to state lending laws in California, Virginia payday loans are capped to a maximum term of 30 days.

In most cases, you will be instructed to repay the money when you next receive your salary. In terms of requesting an extension on your Virginia payday loan, this is capped to a two-time rollover. Once again, if you need longer than the 30-day limit permits, you’ll need to consider an alternative funding source. It is also important to note that payday loan companies in Virginia can charge up to 20% in loan fees.

This could be in the form of an origination fee or late payment charges. Either way, fees outside of the APR rate cannot exceed the 20% limit – regardless of how they are charged. With that said, the 20% fee-limit does not apply to Tribal loan firms operating in Virginia, so always ensure you have a firm grasp of the loan terms prior to signing on the dotted line.

Note: An origination fee is a fee charged by lenders to cover the costs of arranging the loan. They are usually associated with personal loans, although state lending laws in Virginia also permit them on payday loans.Pros and Cons of Payday Loans in Virginia

Pros:

- Payday loans are legal in Virginia

- Borrow up to $500

- Other options in place for larger loan amounts

- Maximum term on payday loans is 30 days

- Payday loan interest rates capped at 36%

- Additional fees cannot exceed 20%

Cons:

- Tribal lenders operating in Virginia are not required to comply with state lending laws

Best Online Payday Loan Companies in Virginia 2020

Reviewers Choice

Viva LoansRatingAvailable Loan Amount$100 - $5,000Available Term Length3 monthsRepresentative APR5.99% to 35.99%Product Details- Appeals most to individuals looking for fast loan processing

Pros- Considers all types of credits in loan processing

- Available throughout the country

- Low interest rate to high credit score borrowers

- Hard inquiry may hurt your score

Key Facts- Fast loan application and approval process

- Highly responsive customer support

- Connects borrowers to a wide range of lenders

Loan SoloRatingAvailable Loan Amount$100 - $1,000Available Term Length6 - 9MonthsRepresentative APR200% - 2290%Product Details- Best for on-phone payday loan application processing

Pros- The huge number of lenders increases your chances of qualifying for a loan

- Fast application processing with next business day disbursement

- Maintains competitive loan interest rates

- Maintains a relatively low maximum loan limit - $1,000

- Some lenders will pull out your credit report

Key Facts- Specializes in different types of loans – including payday loans

- Matches your loan request with numerous low-credit lenders

- Processes both online and on-phone loan applications

Extra lendRatingAvailable Loan Amount$100 - $ 3,000Available Term Length6 months - 2 yearsRepresentative APR4.99% - 1386%Product Details- Best for the protection of the borrower’s persona information

Pros- Borrowers with relatively attractive credit scores benefit from competitive loan APRs

- It’s a loans marketplace and thus higher chances of qualifying for a loan

- Most lenders will only conduct a soft check of your credit history

- Huge loan amounts and competitive interest only available to good credit borrowers

- One may consider the $3,000 loan limit quite low

Key Facts- Specializes in advancing installment loans

- Fast loan application and processing with next business day funding

- Lends to all borrowers regardless of the credit score

CashUSA.comRatingAvailable Loan Amount$500 - $10,000Available Term Length6 monthsRepresentative APR5.99% to 35.99%Product Details- Best for borrowers looking to boost their success rate by seeking loans from numerous lenders

Pros- High number of lenders increases your chances of succeeding

- Advances high loan limits – up to $10,000

- Encourages extended repayment periods – up to 5 years

- Not a lender but an intermediary

Key Facts- Fast loan approval and processing times – 48hours

- Lends to all types of credit borrowers

- Easy to use interface

My credit advanceRatingAvailable Loan Amount$ 100 - $ 5,000Available Term LengthVaries with the lenderRepresentative APR4.99% - 1386%Product Details- Best personal loans specialist

Pros- Helps you rebuild your credit report by reporting repayment progress to reference bureaus

- Advances high loan limits of up to $5,000 to borrowers with attractive credit scores

- Presents your loan application to a wide range of lenders

- Its hard to qualify for high loan limits and competitive interests

- Fines borrowers for late payments

Key Facts- Lends to all regardless of credit score if they earn a minimum $1,000 per months

- Maintains relatively fast loan application and funds disbursement process – within 24 hours

- Wholly online loan application and e-signing processes

How to Choose a Payday Loan Lender in Virginia?

As payday loans are perfectly legal in Virginia, this has resulted in hundreds of lenders servicing the state. This is good news for you as the consumer, as it forces lenders to become more and more competitive in order to fend off market rivals. However, this also makes it a challenge to know which lender to go with. Whichever Virginia payday loan company you do go with, the vast majority will allow you to complete the entire application online or via your mobile device.

Below we have listed the main factors that you need to look out for when choosing a payday loan lender in Virginia.

No Visit Required

Unless you fancy making the drive to your nearest physical branch, you’ll want to choose a Virginia payday loan company that has an online presence. In doing so, you will be able to complete the application from the comfort of your own home, as well as get a decision in less than a minute.

If you are approved, the funds will then be transferred to your checking account electronically. Some Virginia lenders require you to visit a branch so that you can sign the loan documents in person. If you want to avoid this, go with a 100%-online lender.

Representative APR Rates

You will never know how much interest you are required to pay on a loan until you go through the online application process. This is because lenders in Virginia will base their loan terms on your underlying credit profile. For example, if you’re in receipt of a good credit score and you have a consistent history of repaying your debts on time, you’ll benefit from more competitive rates.

At the other end of the spectrum, those of you with a bad credit rating will pay upwards of 36% – which is the state limit in Virginia. You should visit the lender’s website to ascertain its ‘representative rates’.

These are rates published by the lender to illustrate the sort of interest you will likely pay. Although there is no guarantee that you will get these rates, at the very least it allows you to assess whether or not the lender is competitive in the interest department.

Note: We would also suggest using a Virginia payday loan company that allows you to apply on a soft credit check basis. This means that regardless of whether or not you are approved for the loan, the initial search won’t hurt your credit score.Funding Times

You also need to assess the funding times offered by the lender. For example, if you encounter a financial emergency that requires instant funding, you’ll be best off using a lender that processes approved applications on a same-day basis.

This is often the case with payday loan firms in Virginia, as they can typically verify your information via third-party sources electronically. However, if the lender requires supporting documentation from you, this can delay the process.

Loan Size and Repayment Term

You also need to ensure that the lender offers enough money to cover your financial emergency. Don’t forget, this can’t exceed $500 in the state of Virginia. As such, if you require more than this, you will need to consider an alternative funding source. You also need to ascertain the repayment terms offered by the lender.

This is capped to 30 days in Virginia, meaning you will need to repay the money when you next receive your paycheck. However, state lending laws also permit up to 2 extensions but, this is likely to hit you hard in the interest department.

How can I get a Payday Loan in Virginia Today?

Are you based in Virginia and looking for a payday loan today? If so, follow the quickfire guidelines outlined below.

Step 1: Choose a Virginia Payday Loan Lender

To get the payday loan process underway, you will first need to choose a lender that meets your requirements. Licensed lenders will not be able to offer more than $500, or a loan term that exceeds 30 days – so in this respect, there won’t be much to separate payday loan firms in the state. With that said, the key metric that you should look out for is the amount of interest that the lender charges.

To make the selection process easier for you, we would suggest reading through the guidelines we outline in the section above. If you don’t have time to research a lender yourself, it might be worth looking at some of the recommendations we have listed further up in this guide.

Step 2: Apply Online

Once you have chosen a Virginia payday loan company that you like the look of, you will then need to head over the provider’s website to begin the application process. This will initially ask you to enter the amount you wish to borrow (maximum $500) and for how long (maximum of 30 days). You will also need to enter the date in which you next get paid.

You will then be taken to the next stage of the application process. The lender will ask you a range of questions pertaining to your identity and financial standing – such as:

- First and Last Name

- Home Address

- Date of Birth

- State ID Number

- Contact Details

- Income After-Tax

- Name and Address of Employer

- How Long You Have Lived at Current Address

Step 3: Review Loan Terms

Once you submit the application, the Virginia payday loan firm will then cross-reference your information electronically. This allows the lender to verify the information you entered with third-party sources. You should receive a decision on your application in less than a minute.

If you are approved on the spot, you will then be able to view your loan terms. This will outline the amount of APR you need to pay on the loan, as well as the date in which you need to repay the funds.

Note: The lender might be required to run a hard credit check on you. This means that the application will be posted to your credit file. In doing so, a rejected application could have a negative impact on your credit score, so do bear this in mind.Step 4: Bank Details and Digital Loan Agreement

If you want to proceed with the loan terms that have been offered to you, the lender will then prompt you to enter your checking account details. This is for two reasons. Firstly, the Virginia payday loan firm will deposit your funds directly into your stated bank account. Secondly, this is the account that the lender will take your repayment from. To do this, you will need to set-up to an electronic debit agreement.

This authorizes the lender to take your repayment automatically. To complete the application process, the Virginia payday loan firm will then ask you to sign a digital loan agreement. Before you do, make sure that you read through it and that you have a firm grasp of the overall costs of the loan.

Am I Eligible for a Payday Loan in Virginia?

So now that you know what you need to look out for when choosing a Virginia payday loan company – as well as how the application process typically works – you now need to make some considerations regarding eligibility. The $500 lending limit means that Virginia loan companies are very flexible in who they lend money to.

However, not everyone will be eligible for a payday loan, so be sure to review the following metrics that lenders in the state typically look for.

Regular Source of Income

Most payday loan companies in Virginia will ask that you have a regular source of income. This can come in the form of part-time or full-time employment. With that said, some lenders will consider applicants that possess an alternative form of income.

For example, this could include state benefits or a verifiable pension. Most lenders in the state will also stipulate a minimum monthly income amount, so check that you meet this requirement before starting the application.

Minimum FICO Credit Score

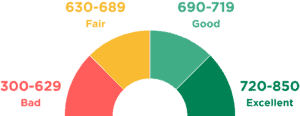

You might also need to meet a minimum FICO score. For example, some lenders in Virginia will ask for a minimum credit score of ‘fair’, meaning that your score needs to be at least 630. If your FICO score is less than this, you might be forced to use a bad credit loan.

If your credit profile is really damaged, you might need to consider a Tribal lending firm, as such providers are even more flexible in who they loan money to (which comes at a huge cost).

History With Repaying Debt

On top of your FICO score and monthly income after tax, Virginia payday loan lenders will need to assess your historical relationship with debt. Your credit file will illustrate whether or not you are responsible with credit. Crucially, if you have a history of missing payments or worse – defaulting on loans, you might find it difficult to find a payday loan company in Virginia that is willing to approve your application.

Virginia Resident and 18+

All applicants must be a resident of Virginia to get a payday loan in the state. This is why you are asked to enter your state ID number during the application process, as the lender will attempt to verify your residency status electronically. If it is unable to, you’ll likely be asked to upload a copy of your ID. You will also need to be aged at least 18 years old to get a payday loan in Virginia.

Alternatives to a Virginia Payday Loan

Do you need to borrow more than the $500-limit imposed by payday loan firms in Virginia? Or, do you need to borrow the loan funds for more than 30 days? Either way, you might need to consider an alternative funding source. Rather than get ripped off by a Tribal loan firm in Virginia, you might be best to consider a personal loan. Not only will the interest rates be more favorable, but you can borrow the funds over a much longer period of time.

Reviewers Choice

Fundsjoy – Personal LoansRatingAvailable Loan Amount$100 - $5,000Available Term Length2 weeks to 12 monthsRepresentative APR4.99% - 1386%Product Details- Best loan marketplace with hundreds of verified personal and institutional lenders

Pros- Maintains high maximum loans limit – up to $5,000

- Gives loans to poor credit score borrowers and others with no credit history

- Fast loan application process

- Imposes punitive fees and charges on late payments

- One may consider their interest rates quite high

Key Facts- Lends to all types of credit rating borrowers

- It’s a loans marketplace and not a direct lender

- Doesn’t pull your credit history in making credit decision

Marcus By Goldman SachsRatingAvailable Loan Amount$3,500 - $40,000Available Term Length3-5 yearsRepresentative APR5.99% – 28.99% (variable)Product Details- Best for individuals looking for a lender with a variety of loan options

Pros- Soft credit inquiry on loan application doesn’t hurt your score

- Embraces a fully automated loan application process

- No penalties for late payments or prepayment

- Unsecured nature of all Marcus loans makes them expensive

Key Facts- Doesn’t impose extra charges on the lending process or penalties for late payment

- Appeals to above-average borrowers

- Offers unsecured loans dedicated to salaried employees

LightstreamRatingAvailable Loan Amount$5,000 - $100,000Available Term Length2 to 7 yearsRepresentative APR3.5% to 16.8%Product Details- Best for borrowers with good credit who need cash immediately

Pros- Offers same-day cash in your bank account

- Extremely low starting interest rates

- Requires strong credit

Key Facts- Owned by SunTrust Bank

- Stands behind application process with a $100 guarantee

- Will match the APR from another lender

Avant CreditRatingAvailable Loan Amount$2,000 - $35,000Available Term Length2-5 yearsRepresentative APR5.99% – 28.99% (variable)Product Details- Appeals most to individuals with an average credit score and low-income earners

Pros- Embraces a highly transparent loan pricing model with transparent fees and charges

- Considers more than just the credit score in awarding loans

- Straightforward loan application and fast processing

- Imposes high administration fees and late payment penalties

Key Facts- Loans available to anyone with a minimum annual income of $20,000

- Overlooks poor credit history in advancing loans

- Greater flexibility in interest rate calculation i.e low interest for high monthly payouts

Brigit Loan App LoanRatingAvailable Loan Amount$10 - $250Available Term LengthVariesRepresentative APR0%Product Details- A mobile device platform that allows you to have access to credit to help you before you become overdrawn on your account

Pros- Due date extensions available

- Overdraft predictions

- Monthly fee at $9.99

- No joint bank accounts

Key Facts- No fees apart from the monthly subscription.

- No late payment fees.

- The app notifies you 24 hours before the due date.

Conclusion

By reading our guide all of the way through, you should now be able to make an informed decision as to whether or not a Virginia payday loan is right for you. Although payday loans in the state are perfectly legal, a number of restrictions are in place. Notably, payday loan firms operating in Virginia cannot lend you more than $500, nor can the term of the loan exceed 30 days. Perhaps most importantly, lenders cannot charge you more than 36% in interest, and ad-hoc fees (such as origination fees or late payment charges) are capped at 20%.

However, it is also important to note that heaps of payday loan companies operating in Virginia operate under their own Tribal laws. As Tribal lenders are not required to comply with state lending regulations, this paves the way for such firms to charge as much interest as they like. Unfortunately, desperate borrowers that have been turned away elsewhere will often use Tribal payday loan firms as a last resort. If this sounds like you, we urge you to consider an alternative funding source to avoid being crippled by huge interest rates.

FAQs

Can I apply for a payday loan online if I live in Virginia?

Payday loans are perfectly legal in the state Virginia. As such, you can apply for financing from the comfort of your own home or via your mobile device.

How much interest can payday loan companies charge in Virginia?

Although payday loans are legal in Virginia, state lending laws prohibit the amount of interest that lenders can charge. This stands at 36% APR, with other fees capped at 20% of the loan amount.

How much can I borrow on a payday loan in Virginia?

’State lending laws in Virginia cap payday loans to $500. As such, if you need to borrow more than this, you will need to consider an alternative funding source – such as a personal loan.

How long can I take out a payday loan for in Virginia?

The maximum payday loan term in Virginia is capped at 30 days. With that said, lenders are allowed to authorize a maximum of 2 rollover periods, albeit, this is going to cost you much more in interest.

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

Reviewers Choice

Reviewers Choice