Brigit Loan App Review 2020 – READ THIS BEFORE Applying!

Living from paycheck to paycheck can be a nightmare, especially when an unexpected emergency arises. Brigit Loan is designed as an alternative to the traditional payday loan to help you get through such situations.

Living from paycheck to paycheck can be a nightmare, especially when an unexpected emergency arises. Brigit Loan is designed as an alternative to the traditional payday loan to help you get through such situations.

But before you sign up to use the app, it would be best to understand its features and how it works. In this thorough review of Brigit Loan app, we take an in-depth look at everything you need to know about the service.

By the end of it, you will be in a position to decide whether or not it is suitable for you. Read on and make an informed decision.

-

- 1. To start using the service, visit Google Play Store or the Apple AppStore and download the app.

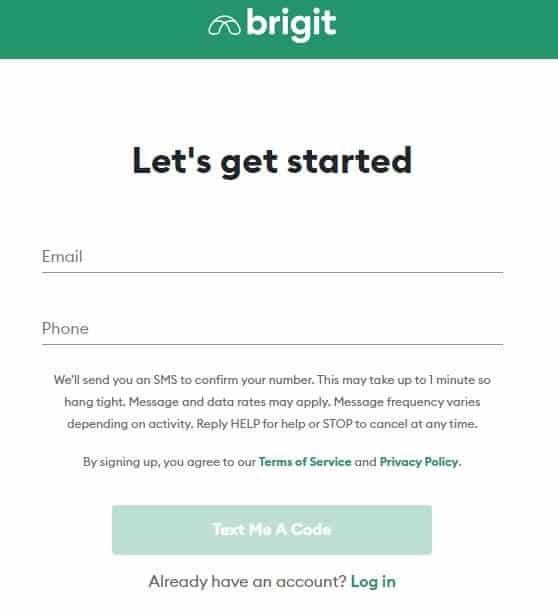

- 2. You will need to enter your email address and phone number.

- 3. Next, enter your full name then select your state of residence from the drop-down menu.

- 4. Search for your bank and confirm that your account qualifies and then connect it to the mobile app. This could take a few minutes.

- 5. Once they connect, add paychecks from your employer then set your pay schedule according to your payday.

- 6. After setting up your account using the above procedure, you can sign up for membership to Safety Net so as to qualify for cash advances from the platform.

-

- 1. To start using the service, visit Google Play Store or the Apple AppStore and download the app.

- 2. You will need to enter your email address and phone number.

- 3. Next, enter your full name then select your state of residence from the drop-down menu.

- 4. Search for your bank and confirm that your account qualifies and then connect it to the mobile app. This could take a few minutes.

- 5. Once they connect, add paychecks from your employer then set your pay schedule according to your payday.

- 6. After setting up your account using the above procedure, you can sign up for membership to Safety Net so as to qualify for cash advances from the platform.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

The Brigit Loan App is an alternative to costly payday loans and bank account overdrafts. It allows you to access little dollar loans of up to $250. But you will need to pay a membership fee every month and after application, it may take a few days for you to get funds.

The Brigit Loan App is an alternative to costly payday loans and bank account overdrafts. It allows you to access little dollar loans of up to $250. But you will need to pay a membership fee every month and after application, it may take a few days for you to get funds.What is Brigit Loan App?

Brigit Loan App is a mobile device platform that allows you to have access to a source of credit to help you when it seems like you are about to overdraw your account. It is still relatively new in the market, having been founded in 2017, but it works all over the US.

The team behind it consists of financial industry experts from leading companies such as Amazon, Deutsche Bank, Credit Suisse, Expedia and Two Sigma among others.

They explain that their purpose for creating the platform was to “empower everyday, responsible people to gain financial stability.” In order to address the weaknesses in the traditional banking model, they built a “simple, transparent and fair alternative” for financial relief.

At present, the app has more than 250,000 users.

Pros and Cons of a Brigit Loan App Loan

Pros

- Cheaper funding model than payday loans and bank overdrafts

- Easy access on mobile platforms

- No fees apart from the monthly subscription

- The app notifies you 24 hours before the due date

- Convenient automatic deductions from your account

- You can get a due date extension if you encounter repayment difficulties

- Algorithmic overdraft predictions help reduce unnecessary bank fees

- No late payment fees

- You do not need to provide your social security number during signup

Cons

- Monthly subscription fee of $9.99 whether or not you use funds that month

- You may have to wait a few days before getting funds

- Low monthly loan limit

- Customer support is only available via email

- You cannot sign up using a joint account

Comparing Brigit Loan App with its competitors

Brigit is a loan app designed to help borrowers access payday loans faster and without the usual overdraft fees. The app is new into the lending scene having been launched in 2017, but unlike most online lenders it offers its services all over the US. It’s unique selling point is that the brains behind the app are drawn from reputable financial experts across various industries such as e-commerce, banks as well as traveling agency. Here is how the lender compares to such other loan lenders as Advance America, Rise Credit, and Cashnet USA; who also have made their name in offering easily accessible emergency loans.

Brigit Loan App

- Lends a maximum of $250 to $1,000 depending on the type of loan

- No minimum credit score required

- No interest rates charged but there is a standard $9.99 monthly membership fee

- No fixed payment period nor late fee payment

Advance America Cash

- Loan limit starts from $100 to $5,000

- Requires a Credit Score of above 300

- For every $100 borrowed an interest of $22 is incurred

- 30 days loan repayment period

Rise Credit Loan

- Offers loan from between $500 to $5000

- Bad credit score is allowed

- Annual rates starts from as low as 36% to as high as 299%

- Depending on the state, the repayment term ranges from 7 to 26 months

Cashnet USA

- Loan limit starts from $255 to $3,400

- Requires a Credit Score above 300

- Interests rates range from 86.9% to 1140% ( depending on the type of loan)

- The loan is paid back within a week or 1 year depending on the type of loan. ( Missed payments attracts a 5% – 15% penalty fee)

How does a Brigit Loan App loan work?

Brigit Loan App differs vastly from the traditional payday loan and is more comparable to lines of credit. But unlike a line of credit, which charges interest, this form of credit has the aim of helping you avoid fees and costly APRs.

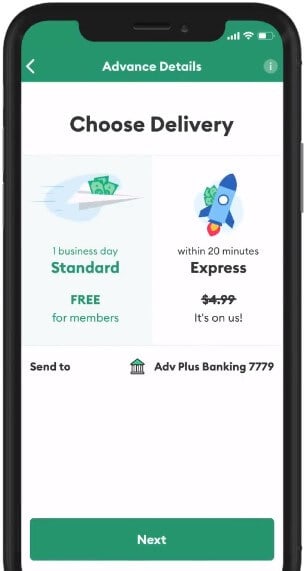

When you sign up for services on the app, you can access a maximum of $250. Though there are no borrowing fees or interests, you have to pay a monthly membership fee of $9.99.

The app works automatically using advanced algorithms to predict when your bank account is about to run out of funds. Instead of having to use an overdraft which comes at hefty fees ranging between $20 and $40 for most banks, it sends you a notification and then funds your account.

These funds may vary in amounts from one borrower to another. But in all cases, they are repayable on the next payday.

In addition to avoiding overdraft fees, you also get to avoid non-sufficient fees (NSF) which attract penalties. And you would also avoid late payment fees, credit card debt and even costly payday loans.

Being a subscription model, it does not attract any fees (apart from the monthly fee), not even late payment fees. After you repay the loan on your payday, you are free to take it again and again.

Though you need to have a regular income so as to qualify for this loan, you do not have to have perfect credit or any credit whatsoever.

However, you do have to have a checking account that receives your wages via direct deposits. It needs to have been operational for a minimum of 60 days and cannot be a joint account.

In order to qualify for a loan from the service, your monthly income needs to be higher than the amount you want to access. Note that this has to be from the same source of income. The site explains that different income sources will not count towards their minimum income requirements.

Additionally, you will need a minimum of 3 recurring paycheck direct deposits from one employer. If you get your pay via paper check, cash transfer or ATM deposits, you will not qualify for the service.

Another requirement is that you need to have a cash cushion in your bank account at the end of the day on payday. This refers to a minimum average balance in the account that shows you can afford to pay back the loan without an overdraft.

In the same vein, you would not qualify for the loan if your account balance reads $0. The site explains that users with a nil balance often have problems repaying funds after they get paid.

The service provider will consider your account information and calculate what they call a Brigit score. Ranging from 0-100, this score qualifies you for advances and is based on account health, earnings profile and spending behavior.

They calculate account health using your average balance over time and the number of bank fees you have had to pay. Another factor is how long the account has been active and how often you use it.

In addition to these, they consider the amount you earn against how much you spend and how often you make routine bill payments. Scores normally range from 40 to 100. But to get approval, you would need a minimum score of 70.

24 hours before repayment is due, you will get a notification from the team so as to prepare accordingly. When due date comes, the lender will automatically deduct the amount from your account.

Your due date should be the same as the payday to avoid non-payment issues. If you experience challenges in repaying your loan by the due date, you can get a due date extension. In fact, you can extend the due date up to 3 times if necessary, a highlight of flexibility.

What loan products does Brigit Loan App offer?

Brigit offers an alternative to traditional payday loan apps.

What other services does Brigit Loan App offer?

The service provider does not offer any other services.

Brigit Loan App Account Creation and Borrowing Process

1. To start using the service, visit Google Play Store or the Apple AppStore and download the app.

Follow the prompts to install it on your device and once the process is complete, tap “Sign Up.”

2. You will need to enter your email address and phone number.

Once you do, you will get a 6-digit code, which you need to enter into the app. For extra security during login, set a 4-digit PIN.

3. Next, enter your full name then select your state of residence from the drop-down menu.

4. Search for your bank and confirm that your account qualifies and then connect it to the mobile app. This could take a few minutes.

5. Once they connect, add paychecks from your employer then set your pay schedule according to your payday.

6. After setting up your account using the above procedure, you can sign up for membership to Safety Net so as to qualify for cash advances from the platform.

It’s essential to be cautious during the sign up process for these products. This is because you can end up owing two to three times what you borrow on the longer-term loans, and many have difficulty repaying the short-term loans without reborrowing.Eligibility Criteria for Brigit Loan App Loan

Brigit Loan sets a significant number of qualification requirements for potential users. Take a look at some:

- Monthly income above the required amount from a single income source ($1,500 monthly)

- At least 3 recurring paycheck direct deposits from the same employer

- A checking account with sufficient activity (at least 60 days)

- A minimum average end of day balance in your account on payday

- Have some funds left in your bank account up to two days after your payday

- Your checking account should be in a bank that Brigit supports

Information Borrowers Need to Provide to Get Brigit Loan App Loan

When signing up for the service, here are some of the details you will need to provide:

- Full name

- Email address

- Phone number

- State of residence

- Bank account information

- Paychecks from your employer

What banks does Brigit Loan App support?

Brigit Loan works with more than 6,000 banks as well as credit unions. To check if they support your bank, use the search form on the app.

What are Brigit Loan App loan borrowing costs?

In order to access funding from Brigit, all you need to pay is a monthly subscription fee:

- Monthly subscription fee – $9.99

Brigit Loan App Customer Support

Probably because it is still relatively new, the app does not have a review page on Better Business Bureau or Trustpilot. But on Google Play and App Store, it has excellent reviews. iPhone users give it a 4.8 out of 5-star rating while Android users give it 4.2 out of 5 stars.

Some of the reviews complained about delays in getting responses from the customer support team.

Notably though, the support team is available 24/7. The only problem is you can only contact them via email, hence the delays.

Is it safe to borrow from Brigit Loan App?

Using a 256-bit SSL encryption system, the platform seeks to keep user information as well as sensitive banking data secure. And unlike most lending platforms, this one does not require your SSN during sign up.

In addition to these features, the site’s privacy policy is clear on the information it collects, how it uses the data and whether it may share information. If you want to stop using the platform, it also explains the information they will delete and what they will retain.

Brigit Loan App Review Verdict

Brigit Loan app provides a viable alternative to the traditional payday loan and other short term loan options. Unlike such loans, it does not charge any interests. Rather, it only requires a monthly subscription fee which is lower than bank overdraft fees.

Its automated system alerts you when it seems you may require an overdraft allowing you to access their credit facility. You may get multiple loan extensions to push the due date when you face challenges and there are no late payment fees.

You, however, have to pay the monthly fee whether you use the service or not. And you have to connect your app to your bank account. With those two exceptions, it is a good platform when you need a low amount of money to sort out an unexpected expense.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

FAQ

Why does Brigit require my bank account information?

It requires your bank account information so as to know when to send funds and where to send them. Using its automated system, it analyzes your income history and expenses to determine the best time to send a cash advance.

Does borrowing from Brigit affect my credit score?

No. It has no impact whatsoever on your credit score.

How can I extend my due date and what happens when they run out?

You can qualify for a maximum of 3 extensions. It is only possible to do so one business day before your due date. Simply go to Safety Net on the app and select Extend Your Due Date. When they run out, you need to pay back two advances without using any extensions and you will qualify for another extension credit.

What is an Auto Advance?

This is a feature of the app that lets you get a cash advance automatically before your account balance drops below zero. It aims to prevent declined card transactions and unwanted overdraft fees. In case you want an advance sooner than that, you can make a manual request.

How does Brigit determine my cash advance limit?

It bases the calculation on your earnings and past expenses. Using this calculation model, you can access anywhere between $80 and $250, customized to your circumstances. The service provider cannot change this amount.

US Payday Loan Reviews – A-Z Directory

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up