Even App Loan Review 2020 – READ THIS BEFORE Signing Up!

Getting from one paycheck to the next can be challenging, especially when unexpected financial situations arise. Even Financial claims to be your ideal solution for such situations, but is it?

Getting from one paycheck to the next can be challenging, especially when unexpected financial situations arise. Even Financial claims to be your ideal solution for such situations, but is it?

In this comprehensive review of the platform, we will take a look at its core features as well as its pros and cons. By the end of it, you should be in a position to determine whether or not it is a suitable solution for you.

Read on to make an informed decision.

-

- 1. Creating an account on the Even app is as simple as downloading the app from Google Play Store or the Apple App Store.

- 2. Once you’ve downloaded it, follow the prompts to install the app on your device.

- 3. The borrowing process is quite straightforward. Simply select the amount you need then choose your preferred payment option, which can either be via bank deposit or cash collection at Walmart.

-

- 1. Creating an account on the Even app is as simple as downloading the app from Google Play Store or the Apple App Store.

- 2. Once you’ve downloaded it, follow the prompts to install the app on your device.

- 3. The borrowing process is quite straightforward. Simply select the amount you need then choose your preferred payment option, which can either be via bank deposit or cash collection at Walmart.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

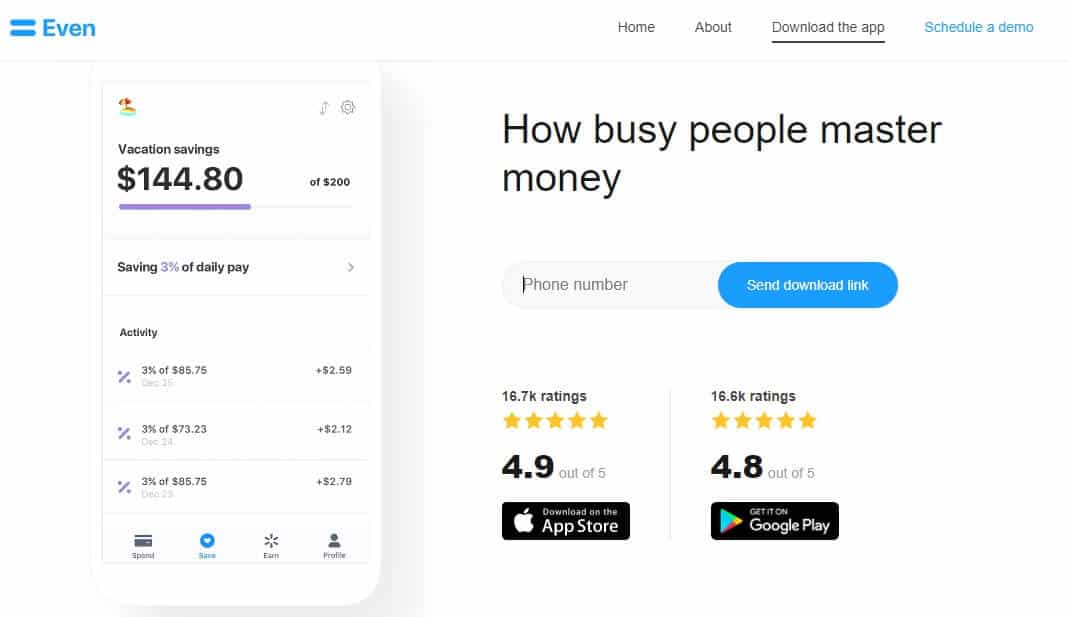

Even App offers a cash advance on the money you have earned but not been paid under its Instapay option. Depending on how your employer sets it, you can use the service for free or for a maximum of $8 monthly subscription. And you can access up to half your earned wages at any time.

Even App offers a cash advance on the money you have earned but not been paid under its Instapay option. Depending on how your employer sets it, you can use the service for free or for a maximum of $8 monthly subscription. And you can access up to half your earned wages at any time.What is Even App?

Even App defines itself as a platform that helps “people turn their paycheck into progress.” It incorporates multiple financial features into one comprehensive platform that aims to facilitate financial wellness.

The website highlights that at least 50% of US residents live from paycheck to paycheck. Its key objective is to fix that by offering new financial services. These services make it easier for users to make ends meet, save money and even pay down debt.

Founded in 2014, the platform brought together a group of people that were passionate about creating economic opportunity.

The Walmart-Even Partnership

Walmart had a program in place offering benefits to help its employees during retirement. However, it identified a gap, a need to help employees today. Following a smooth integration and the launch of Even, its associates quickly adopted the facility.

Pros and Cons of an Even App Loan

Pros

- Instant access to earned wages

- Little or no costs for using the loan app

- Comprehensive platform offering financial management features

- Available all over the US

- Lots of positive customer reviews

Cons

- You can only use the app if your employer signs up

Comparing the loan aspect of Even App to online loan serve providers

Even App embraces a unique approach to the provision of payday loans as it only lets you borrow against the amounts you have already earned. It is integrated with the employer’s payroll and bank account and this helps you and the app keep track of how much you have earned and how much you can access as salary advance. More importantly, it has integrated numerous personal finance and budgeting tools to help you organize your finances and avoid the paycheck to paycheck lifestyle. But how does it compare to online payday and personal loan providers like Cash Net USA, Rise Credit, and Oportun.

Even App

- Borrow as much you have already worked for the month

- No credit score limit (only employed by a company that Supports Even systems)

- Company dependent (Walmart doesn’t charge the first 8 salary advances per year)

- Cash advanced paid in full during the next payday (up to 30 days)

CashNet USA

- Borrow limit extends from $100 to $3,000 depending on the type of loan and the borrower’s state of residence

- Requires a credit score of at least 300

- Annual interest rates starts from 89% to 1,140% on payday loans

- 2 weeks to 6 months payback period

Rise Credit

- Offers loan from between $500 to $5000

- Bad credit score is allowed

- Annual rates starts from as low as 36% to as high as 299%

- Depending on the state, the repayment term ranges from 7 to 26 months

Oportun

- Loan limit starts from $300 to $9,000

- No minimum credit score required

- Annual loan APR of 20% – 67%

- Loan should be repaid in a span of 6 to 46 months

How does an Even App loan work?

The Even Financial wellness program targets both employers and employees. It acknowledges the benefits that both groups could enjoy from financial wellness.

To start with, it helps employers to attract as well as retain talent by helping employees enjoy financial progress. For an employer to enjoy the benefits, they need to partner up with Even, under the Instapay program and provide payroll information.

On the other hand, it boosts employee morale by ensuring some level of financial freedom. They simply need to log in to the app to view their financial information and access cash advances when necessary – more on that shortly.

The payday loan apps are now available in all 50 states. Based on the product design, it aligns with sound practices concerning the different state wage-and-hour laws, employment tax laws and federal and state lending laws.

Integrating the platform could take anywhere between 4 and 8 weeks. They integrate the service with payroll, attendance, and banking systems. The purpose of this comprehensive network is to ensure that they can understand the full picture of individual employees’ financial health so as to impact it.

All through the process, a dedicated partner sees to it that everything works out smoothly. Once integrated, the system strives to provide on-demand pay, enabling employees to access earned wages instantly.

The technology handles every other aspect of the platform, automating various processes to provide a seamless financial experience. The app makes use of a four-pronged approach to make its objectives possible:

Plan

The lender says that budgeting should not be a burden. Technology takes over from you and does the math automatically.

As an app user, you need to connect it to your bank account. Once you do, it automatically creates a plan for your expenses. In order to do this, it outlines the cash you have available and upcoming bills. It also lays out your future income and bills.

For many people who are unable to break the paycheck to paycheck cycle, one major problem is budgeting. You might forget about certain payments or spend more on one expense than you actually should.

But with the app, all of that is automatically taken care of. All you need to do is stick to the plan it lays out.

Another merit of this feature is that you get to pay your bills on time and avoid late payment penalties.

Spend

After planning, the app helps you to stick to your plan as the service provider believes spending should not be stressful. It does this by letting you know how much money you can spend as well as when to stop spending.

The app actually has a feature known as “Okay to Spend” which shows the total amount at your disposal and the average you can spend every day until payday. To calculate this figure, it uses a cash flow projection feature to deduct upcoming bills from your expected pay. The balance is the “Okay to spend” amount.

On any given day, it lays out how much you have spent and what you have spent it on. That makes it easy to identify unnecessary expenses and plan better for the next day. And if you do not spend the total allocation for any given day, it evens the day’s budget with the remaining days.

With this feature, one of the most prominent benefits you may enjoy is keeping overdraft fees at bay. By spending what you should and sticking to your budget, you will not have to deal with surprise fees and interests that arise from unnecessary borrowing.

Save

Next, the app makes use of your plan to facilitate saving, automating the process to save as you earn. Having a clear spending plan makes it easy to save towards specific goals. And having the app on hand allows you to identify the goal, set a saving target and track progress.

For example, if you need to save $200 for a vacation, every time you dedicate funds to that target, it adds to the total savings. It also lets you know what percentage of your goal you have reached, providing the necessary impetus to keep going.

Borrow

Once in a while, you might need a financial bailout to keep your finances on track. The Even app claims to break the paycheck to paycheck cycle. How does it do this? App users get the opportunity to request for cash advances from the app. They get to borrow these funds against the wages they have earned but are yet to be paid through a feature known as Instapay.

In order to facilitate responsible borrowing the app tracks how much you have made. If you get paid frequently, for instance daily, weekly or bi-weekly, it makes it easy to see how much you have already earned from the total amount due.

Based on this information, you can tell how much to borrow. The app will also access payroll information to determine your earnings so far and how much you are eligible to access. At any point during a pay period, you can access a maximum of 50% of your earnings as at that point.

You can either access the funds you need via a bank deposit or via a cash pick-up. The cash pick-up is available instantly and all you need to do is visit a Walmart store for collection. But in case you opt for the bank deposit, the app will let you know how soon you can get the money in your account.

Employers determine the number of times you can use the service. For instance, Walmart employees can use the service up to 8 times annually without any charges but need to pay for any extra requests.

No matter the employer’s preferences, the lender will withdraw the total amount that you request on your next payday directly from your connected bank account. Alternatively, your employer can process the repayment as a deduction from your paycheck.

What loan products does Even App offer?

Even app offers a borrowing facility known as Instapay. This lets users access parts of their earnings before payday. Therefore, it is technically not a loan.

Even App Account Creation and Borrowing Process

1. Creating an account on the Even app is as simple as downloading the app from Google Play Store or the Apple App Store.

You can also click on a link on the website to initiate the download.

2. Once you’ve downloaded it, follow the prompts to install the app on your device.

3. The borrowing process is quite straightforward. Simply select the amount you need then choose your preferred payment option, which can either be via bank deposit or cash collection at Walmart.

Though you do not have to connect your bank account to the app, it is only by doing so that you can use the Spend section of the app.

It’s essential to be cautious during the sign up process for these products. This is because you can end up owing two to three times what you borrow on the longer-term loans, and many have difficulty repaying the short-term loans without reborrowing.Eligibility Criteria for Even App Loan

The only requirement you need to meet to use the app is to have your employer sign up for the service.

Information Borrowers Need to Provide to Get Even App Loan

When signing up for the service, you will need to provide the following information:

- Phone number

- Bank account details (optional)

What states are accepted for Even App loans?

Even app works in all 50 states.

What are Even App loan borrowing costs?

There are no interests or fees associated with Instapay. The only cost is a monthly subscription fee.

When it comes to pricing, you can offer Even to employees at subsidized costs, covering some of the costs yourself. Alternatively, they can foot the cost and it will cost you nothing.

To illustrate, a Walmart employee can access a portion of their earnings without any costs for a total of 8 times every year. But if they want more Instapays, they would need to pay a $6 monthly fee.

Check the monthly subscription fee applicable for you by going to the “Membership” section of the app.

Even App Customer Support

Even app has a high rating on both Google Play Store and Apple App Store. It has a 4.8 out of 5 rating on the former and a 4.9 out of 5 rating on the latter. Among the top features that users hail is its great customer support.

Is it safe to borrow from Even App?

Even app makes use of 256-bit end to end SSL encryption to keep your information safe. Its systems also undergo periodic security and compliance audits by some of the top employers nationally.

Even App Review Verdict

Even app is a comprehensive platform that employers can use to improve their employees’ financial health. It offers multiple features for planning, saving and borrowing as the need arises. The app is a great alternative to traditional payday loan models as the costs are much lower and in the long run, it can help improve one’s money management skills

It is unfortunate that you can only use it if your employer signs up for the service. But based on features, the app gets our full recommendation.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

FAQ

Why do I need to connect my bank account to the app?

Connecting your bank account to the app is not mandatory. But if you do so, the app will privately and securely track the money coming in and going out of your account. It will thus power the budgeting feature of the app.

What should I do if I cannot find my bank on the app’s list?

Though Even strives to connect with as many banks as possible, some banks’ online technology is incompatible. If you are not able to connect your bank, select the “Continue without a bank” option. It appears at the bottom of search results.

Can I delete my information from Even app?

Yes. To do so, go the “Settings” on the app then select the “Delete account and data” option.

Can my employer view my information on Even app?

No. Even app functions as a third-party provider for existing customers. Therefore, the financial information that you share with the app is strictly used to help you manage finances and is not visible to other parties.

How can I add or withdraw cash to savings?

Tap the “Save” tab then go to “Options” which is on the top right corner and select “Deposit” or “Withdraw.”

US Payday Loan Reviews – A-Z Directory

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up