Earnin App Loan Review 2021 – READ THIS BEFORE Applying!

But is it a good idea to borrow from this platform? How does it work? How can you tell if it is right for you?

In this comprehensive review, we seek to uncover everything you need to know about Earnin App.

Read on to find out its features, benefits and downsides so as to make an informed decision.

-

-

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

What is Earnin App?

Founded in 2014, the app originally used to operate under the name Activehours. But they rebranded to Earnin in November 2017 and are among the first platforms to offer this type of service.

Earning is a mobile device app that lets you access advances on your salary to bridge the gap between paydays.

Designed as an alternative to traditional payday loans, it works on a completely different premise, letting you borrow against your paycheck.

Pros and Cons of an Earnin App Loan

Pros

- Does not charge fees or interests, instead charges an optional fee

- Offers a facility that can prevent bank overdrafts (Balance Shield)

- Easily accessible on both Android and Apple mobile devices

- Only offers an advance on wages you have earned, not on future work

Cons

- You have to sacrifice some privacy to use the app

- It sets limits on the amount you can borrow based on earnings and financial history

- It can encourage poor financial habits and overreliance on debt

- You take full responsibility for any overdraft fees

- Poor communication between users and the customer support team

- The total loan limit per pay period is relatively low

- Eligibility depends on your kind of job and method of payment

- The app connects to your bank account and stores a lot of your data

How is Earnin different from most other emergency loan service providers online

Earnin is specially designed to help you access your day’s pay for up to $100 to sort any emergencies. This means that’s its only available to employed individuals who need access to their day’s earning before payday. The payday loan app’s biggest selling point is the fact that it is free, unlike its counterpart payday lenders that burden you with insane charges. We compared Earnin to such payday lenders as Speed Cash, TitleMax, and Chec ‘n’ Go and this is what we found out:

Earnin

- Borrow up to $100 everyday with a $500 maximum per month

- No minimum credit score (just proof of employment)

- No fees and charges – optional tip

- Loan repaid in full during the next payday

TitleMax

- Borrow up to $10,000 (secured title loans)

- No credit score check

- Annual loan APR ranges from 400% – 1,000%+ (payday loans)

- Loan repayment period of 30 days to 72 months

Speedy Cash

- Online payday loan limit is $100 – $1,500

- Accepts bad credit score

- Payday loans should be paid within 7 to 14 days depending on your pay schedule

- Annual rates of 459.90% but varies depending on state of residence

Check ‘n’ Go

- Borrow from $100 to $500

- Minimum credit score of 300 FICO

- Fee rate starts from $10 to $30( depending on the State)

- Payday loan repayment period of between 2 and 4 weeks

How does Earnin App loan work?

Earnin works using a simple tagline: You worked today, get paid today. That sums up the idea behind the app and how everything works.

The team behind it explains on the website that the app seeks to fight unfairness in the current financial system.

The site goes on to highlight the ills of the pay cycle, overdraft facilities and traditional lending methods. On one hand, the pay cycle holds back workers’ money, and on the other, overdraft facilities attract high fees and penalties.

At the same time, there are lots of situations that end up putting people in debt. With this in mind, the app lets you cash out ‘your pay’ as soon as you work. And unlike conventional lending facilities, it charges no interests or fees.

Using this app, you can access daily loans based on the wages you are expecting. In return for this ‘cash advance’ you can choose whether or not to leave a tip. Come payday, the app will automatically deduct the borrowed amount plus the tip.

The app allows you to borrow amounts ranging from $100 to $500 every month. On any given day, you can only access a maximum of $100. And the total you can access over a pay period is a maximum of $500.

However, the exact amount for which you are eligible will depend on a number of factors. These include your financial history and your earnings.

When you download the app, you will need to go through a short signup process. Earnin will then take some days to verify the details you submit. For instance, it will verify your bank account by sending two minimal test transactions simply to check ownership. Account verification and activation might take up to 72 hours following signup.

Once that is done, you can request money, and it will first verify the number of hours you have worked during the week in question. If you are an hourly worker, you will need to upload photos of your timesheet.

But if you happen to be salaried, you will need to allow the app to access your mobile location tracking. It will confirm that you actually commute to and from the given location where you claim to work.

Basically then, this loan app is unsuitable for persons who work from home and those who have an irregular work schedule. Furthermore, if you need more than the set limit of $100 daily, it might not be ideal.

To use this app, you also need to have direct deposit into a checking account that is set up through your employer. Additionally, you need a consistent pay schedule. Your pay rate must be $4 per hour at the very least, after taxes and deductions.

In case you are unemployed or receive disability payments or supplemental security income, you would not qualify to use the service. Similarly, extra earnings such as commissions and tips are not included in earnings.

However, an exception to this rule is a partnership between Earnin and Uber that lets drivers use the app.

Earning app is a mobile platform that allows you to borrow against your paycheck without charging any fees or interests. Rather, you only pay a minimal tip, which is optional. But qualifying to access funds on the platform is not easy for everyone.You can also check out for the best loan providers for those with poor credit score

If you meet the eligibility requirements for accessing funds on the app, use it to apply for a loan. Before approving your application, it will verify the number of hours that you have worked during the week.

You should get funds by the next day if you make your request on a weekday or by the second business day if you apply over the weekend. But with some banks, you can get cash immediately as we will see below.

When it comes to repayments, the app will automatically deduct the loan amount from your checking account on the day that it expects you to get wages. Once again, it makes use of your timesheets as well as mobile location tracking.

With this information, it monitors how often you go to work and how often you get paid and uses this to determine your due date. Consequently, you can never withdraw more than what you earn.

What loan products does Earnin App offer?

Earnin App offers an alternative to the payday loan or cash advance by letting you borrow against pending wages.

What other services does Earnin App offer?

When using the app, you get access to some additional services other than borrowing loans. Take a look:

Balance Shield

Balance Shield is an optional provision that helps you avoid overdraft fees which can be as high as $35 or even more. Under this feature, you need to keep adding timesheets regularly. And every time your account balance drops below $100, it will automatically deposit a maximum of $100 to your account.

Note that the tip amount that you set when you first sign up for Balance Shield will automatically apply with every top up unless you change it in settings.

Lightning Speed

In case your bank supports the Earnin Lightning Speed program, you will not need to wait a full business day for your loan to process. The feature lets you withdraw pending earnings in a matter of minutes rather than hours. That means you can use the funds you have earned as soon as you need them.

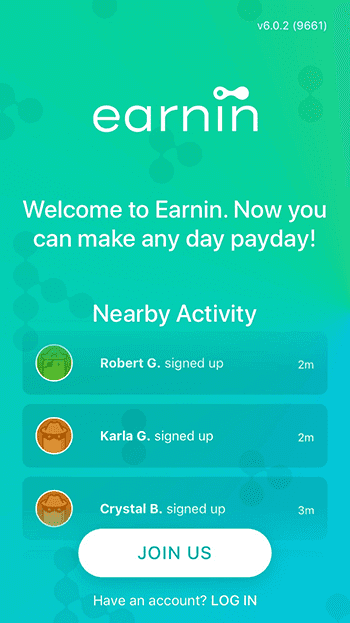

Earnin App Account Creation and Borrowing Process

1. To get started, you will need to download the app from Google Play Store or Apple App Store.

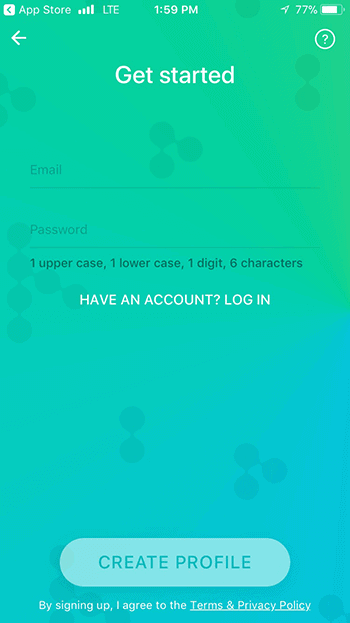

2. Follow the prompts on the screen to create an account and sign up for the service. You will need to provide your email address and create a password.

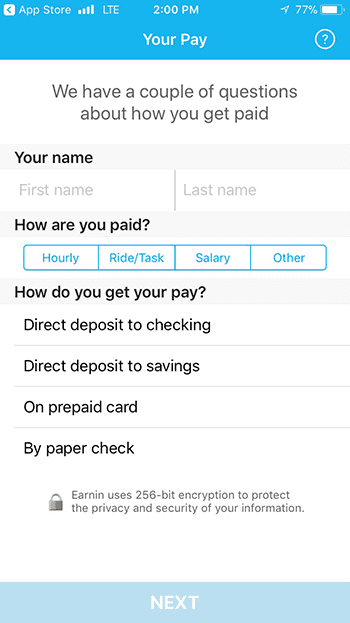

3. Next, add your pay information starting with full name, frequency of pay and how you get your pay. Click ‘Next’ to continue.

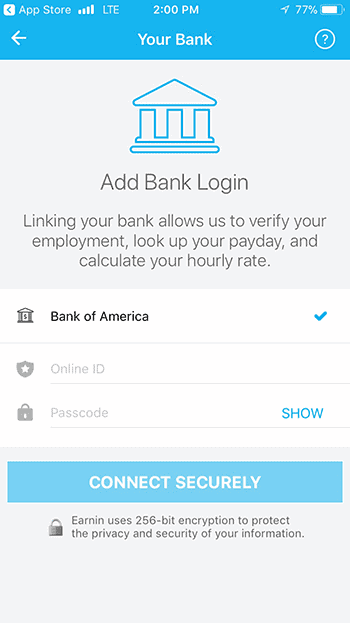

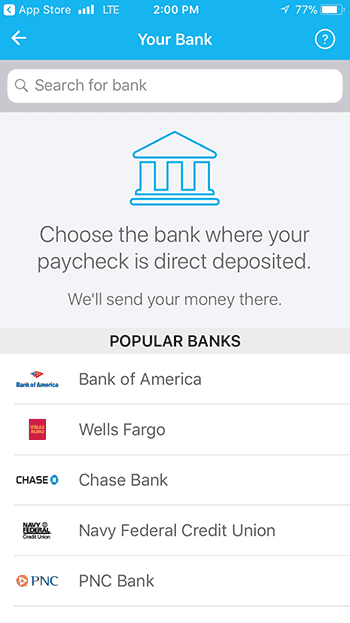

4. Select the bank your employer uses to pay your wages, enter your online ID and passcode then click ‘Connect’

5. Login to your bank account and allow Earnin to get access so as to track and verify your income.

It’s essential to be cautious during the sign up process for these products. This is because you can end up owing two to three times what you borrow on the longer-term loans, and many have difficulty repaying the short-term loans without reborrowing.Eligibility Criteria for Earnin App Loan

In order to be eligible for a loan from Earnin app, you need to meet the following criteria:

- Have a checking account

- Receive your paycheck via direct deposit

- Have a regular pay schedule

- Have an online timekeeping system at your place of work or a fixed work location

- $4 minimum in hourly wages after taxes and deductions

- Have a smartphone

Information Borrowers Need to Provide to Get Earnin App Loan

Here is the information you will need to provide during the signup process:

- Email address

- Paycheck information

- Bank name and bank account information

- Employer information

What banks does Earnin App support?

Earnin supports a number of banks including:

[one_third]- Capital One

- PNC

- Navy Federal Credit Union

- TD Bank

- USAA

- Simple

- JP Morgan

- Citibank

- Suntrust

- Regions Bank

- Woodforest National Bank

- Huntington Bank

- Fifth Thrid Bank

- BB&T

- Bank of America

- Chase Bank

- Wells Fargo

- BBVA Compass

What are Earnin App loan borrowing costs?

Borrowing using this app is technically cost-free. There are no interests or fees but you can pay an optional tip.

- Optional tip amount – $0 to $14

Earnin App Customer Support

The app has a mixed review on the internet. It is not accredited by the Better Business Bureau (BBB) but has an A+ rating based on highlights such as transparency.

While a good number of reviews especially on Play Store and AppStore are positive, there are a significant number of complaints too.

In many cases, these have to do with a lack of communication between the app users and the customer support team.

Here are the providers we consider the best no credit check loan providers in 2026

Is it safe to borrow from Earnin App?

Earning makes use of 256-bit SSL encryption to keep user data secure. They also claim to comply with US privacy and data security regulations and never store bank login credentials.

However, according to BBB reports, a number of users have reported unauthorized debits from their bank accounts. Others have had repayments withdrawals from their accounts before their paycheck cleared. As a result, they have had to pay hefty overdraft fees.

Therefore, before using the service, it is important to weigh these potential issues against the benefits.

Earnin App Review Verdict

The operational model of Earnin app is vastly different from the typical payday loan and offers a significant improvement. It is much cheaper as there are no fees or interests. Furthermore, the fact that you can only borrow against what you have already earned is protection against poor financial habits.

However, to access its convenience, you have to sacrifice your privacy and reveal a lot of sensitive data. Additionally, the loan limits are quite low and you may need to look elsewhere if you need more funding.

All in all, the app may be a great choice if you periodically need small amounts of extra funds before payday. But if you find yourself in such situations continually, you may need financial assistance.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

Glossary of Loaning Terms

FAQ

How will I know if my bank supports Earnin Lightning Speed?

When registering your debit card, you can find out. Simply log in to the app and tap the Lightning Speed icon. Scan your debit card to add it and after verification, Earnin will let you know if your bank supports the feature.

If my bank is not on the list of supported banks, can I use the app?

No. Earnin app only supports transfers between the banks it supports.

What happens if my wages delay?

If for any reason the amount you borrow from the app is not available for repayment on the due date, you cannot use the app again until you make full repayment.

Why do I have a $100 limit on the amount I can borrow?

The limits set on the app are meant to facilitate lending at no fees. With time, you can gradually increase this limit to the $500 maximum per pay period.

Will I be able to use the app if I work for a temp agency?

Yes, you can. In order to understand how this will work, reach out to the customer support team.

US Payday Loan Reviews – A-Z Directory

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up