Best 10 Cash Loan Providers Compared for 2019

What happens when a cash emergency strikes and you don’t have cash at hand and pleas to your friends and relatives run cold? If you are like most people, you will have to turn to the more reliable same day cash advance service providers. These give you access to emergency with little or no regard to your credit score. Their loan application, approval, and funding process is also relatively fast and straightforward with most lenders running 24/7 online cash loan application portals or apps.

How much you get from these loan providers is largely dependent on such factors as your employment status, access to regular employment/self-employment incomes, your credit score, and the lender’s maximum loan limits. Cash loans are better than over-reliance on credit cards as they attract lower interest and more convenient to longer-term loans like the home owner loans as they don’t require collateral as security. Cash loan providers are, however, famed for their extremely punitive penalties on loan repayment delays that often push the amounts due to unsustainable levels.

How then do you find the best low interest and fast application and approval provider that doesn’t ask for collateral on advanced amounts? We scoured the internet and the financial high streets and compiled a listing of what we consider the best cash loan providers in the country. We, however, start by looking at why you may consider relying on a cash loan as well as their merits and demerits.

Difference between cash, personal and payday loans

A cash loan differs from a personal loan in the sense that it carries a shorter repayment period of up to 12 months, involves smaller loan amounts and minimum qualification requirements. Some cash loan lenders won’t even consider your credit score. Personal loan on the other hand involves higher loan amounts and extended repayment periods of up to 60 months. You also need strong credit history and good credit score to qualify for a personal loan.

Unlike cash loans whose repayment can be stretched by up to 12 months, payday loans are designed to be settled during the next payday. They therefore have a maturity period of less than a month. Additionally, payday loans also attract lower loan limits and higher interest rates.

Why should you consider applying for a cash loan?

i. To sort cash emergencies

Cash loans, especially same day payday loans come in handy in addressing time-sensitive emergencies like a broken down car, home repairs or medical care. The loan can then be repaid during the next payday.

ii. They have flexed repayment periods

You will also like the cash day loans because they have flexible repayment periods. Unless you have applied for the payday loan that is deducted during the next payday, most other lenders offer flexible monthly installment payments spread over the next few months.

iii. They have a fast turnaround

Cash loans have the fastest turn around between the time of applying for the loan and having the cash deposited into your checking account. Unlike such other loan types like the home improvements loans that may take months to clear, cash loans are deposited into your account within a few hours or days after application.

iv. Fewer requirements to qualify

They require fewer qualification requirements compared to personal loans and lower interests compared to payday loans

v. Some have attractively high loan limits

In addition to their fast loan processing and approval speeds, some cash loans compete favorably with most other types of loans when it comes to the available loan limits.

Pros

- They are relatively easy to access 24/7

- They are available to the poor and bad credit borrowers

- Most offer unsecured loans

- Minimal loan qualification requirements

- Some lenders will help you build or rebuild your credit score by sharing your loan repayment progress with the reference bureaus

Cons

- Charge higher interests than standard bank loans

- It is easy to get trapped into a debt cycle

- Imposes punitive fees and penalties for late payments

Criteria used to rank the best cash loans:

- Interest rates charged

- Minimum/maximum loan amounts

- Loan repayment periods

- Consumer experience

- Lender registration and regulation

- Loan application requirements

- Loan collateral requirements

- Loan processing and cash deposit speeds

Best cash loan products for 2019:

Marcus is an online lending platform by Goldman Sachs that specializes in offering personal cash loans to good credit borrowers. Here, you can apply for a loan of between $3,500 and $40,000 with repayment periods of between 3 and 6 years. Marcus charges a fixed interest on the cash loan with the rates ranging from 5.99% to 28.99% per annum depending on such factors as your credit score, approved loan amounts, and repayment duration. The loan application is wholly online and is available to virtually every permanent resident in the USA. You, however, must be above the majority age, have an active bank account, and score over 670 points on the FICO credit rating. Interestingly, loan application and processing here is free as Marcus doesn’t charge origination fees.

Pros:

- Marcus doesn’t set restrictions for the use of the loan

- Easy online application and speedy loan approval

- Marcus doesn’t require collateral for the loan

Cons:

- The lender penalizes late payments with added interests

- Charges high interest for loans with extended repayment periods

Prosper, a pioneer peer-to-peer lending marketplace – is also offering unsecured cash loans of between $2,000 and $40,000 with repayment periods of between 3 and 5 years. One may consider their loan approval process relatively fast as they promise to debit your checking account with the requested amounts within 3 days of applying. Interest starts from 6.95% and extends to 35.99% depending on your creditworthiness. One of the most interesting factors about Prosper cash loans is that you have a higher chance of accessing funds here than with most other online lending sites. This is premised on the fact that Prosper presents your loan application to thousands of online lenders, and most are willing to consider poor credit borrowers with 640 points in minimum ratings.

Pros:

- Speedy loan processing and approval – within three days

- Wholly online and relatively straightforward loan application process

- Relatively low minimum credit score qualification

- Attractively extended loan repayment periods

Cons:

- Charges loan origination fees of between 2.4% and 5%

- Imposes a fixed fee for late loan repayments

Lending Club is a legacy peer to peer lending platform that advances unsecured cash loans of between $1,000 and $40,000 to their members. The lender appeals most to individuals with good credit with the minimum score for applying for a cash loan here set at 600+ points. Lending Club has nonetheless launched a loan feature with a co-sign option that caters for borrowers with lower credit scores. This is a joint cash loan application where one of the co-signatories has a credit score of 600+ and the other 540+ with their debt-to-income ratio set at below 35%. Like most other P2P lenders, Lending Club presents your loan application to different lenders and this increases your chances of landing friendly loan terms. If approved, you will have the funds deposited into your checking account within three days and between 3 and 5 years to repay the loan. Interests start from 6.95% to 35.89%.

Pros:

- There are prepayment fees for early loan settlement

- Relatively high maximum loan limits and extended repayment periods

- Readily accessible in most states across the country

- Fast and straightforward online loan application process

Cons:

- Charges multiple loan application fees like the 1%-6% origination and $7 check processing fee

- Imposes a $15 or 5% penalty on late loan repayments

You will like LightStream and their cash loan services if you are looking for a lender with the highest maximum loan limits and some of the friendliest interest rates. The direct lender and the online arm of SunTrust bank will advance you between $5,000 and $100,000 with repayment periods of between 2 and 7 years. The lender is also famed for their straightforward online loan application process and fast approval and cash deposit into your checking account – as fast as same day approval and account funding. But you must have a minimum credit score of 680 and annual personal income or business revenue of above $100,000 to qualify for a loan with the lender. Interest rates range from 3.99% to 16.99% if you chose the autopay option during loan application. Your actual rate will nonetheless be dependent on the type of cash loan applied, your income levels, credit score, the amount applied for, and your preferred loan repayment periods.

Pros:

- Maintains some of the most competitive loan interests

- Posts relatively extended loan repayment periods of up to 7 years

- Exposes you to high maximal loan limits

Cons:

- Strict loan application requirements that one may consider prohibitive

- Sluggish customer support

CashnetUSA is an online direct lender and a leading cash loan processor that avails cash loans within minutes of allocation. These are payday loans that have to be paid during the next payday with the maximum loan term capped at 35 days. Here, you can apply between $100 and $1,500 depending on your states cash loan regulations with the loan fees ranging $15 to $375. To qualify for the CashnetUSA cash loan, you need to be an American resident above the age of majority, have an active bank and account and earn a regular monthly income of not less than $1,000. Some of the interesting features about the lender are that they will consider your loan application even if you are not in formal employment after proving the ability to repay the loan. More importantly, the lender considers more than your credit score in assessing your creditworthiness making it ideal for poor and bad credit borrowers.

Pros:

- Fastest loan approvals with cash at hand in minutes

- Doesn’t run a credit check and therefore doesn’t affect your credit score

- Straightforward loan application process

- Avails credit services to poor to bad credit borrowers

Cons:

- One may consider their $1,500 maximum loan limit uncompetitive

- Their interest charges are highly prohibitive

Speedy Cash is an online direct lender operating in 24 states across the country. Here, you can borrow from $100 and up to $5,000 depending on cash loans applicable in your state of residence. The loan application process if purely online and the lender promises to deposit these funds to your checking account on the next day if approved. The loan repayment period is also dependent on your residence. And so are the loan interest rates that are subjected to the state laws on cash loan interest maximums but usually range from 176.61% to 729.82% APR. Some of the Speedy cash loan features that you will probably like include the fact that they don’t check your credit scores and are welcoming to poor and bad credit borrowers.

Pros:

- Has some of the highest loan application and processing requirements – next day funding

- 24/7 customer support

- Relatively straightforward online loan application process

Cons:

- Complicated loan pricing and prohibitive interest rates

- Not available throughout the country

SoFi cash loans are most ideal for good credit borrowers seeking access to significant loan amounts with the lowest interest rates but no collateral to secure these loans. Here, you can apply between $5,000 and $100,000 with flexed loan repayment periods of between 2 and 7 years. You are also exposed to friendly interest rates of between 5.99% and 17.66% or the discounted rate of between 5.74% and 14.70% if you chose autopay during loan application. You will be interested to note that SoFi doesn’t impose such additional loan costs as origination or closing fees. The interest rates offered are largely dependent on your creditworthiness and you have the option of settling for a fixed or variable interest rate. Plus they recently launched the co-applicant program that lets you increase your chances of getting your loan approved when you apply for a joint loan.

Pros:

- SoFi website has an integrated calculator that lets you understand the loan implications early on

- SoFi loans are available to residents of over 48 states across the country

- Maintains some of the lowest interest rates with no additional loan costs

- Relatively fast and straightforward online loan application process

Cons:

- Loan processing, approval and funding may take up to 30 days

- Strict loan application requirements like a minimum credit score of 680

If you have a credit score of above 660 points and an annual income of $25,000+, you have high chances of qualifying for a cash loan with Discover. These plus other creditworthiness assessment requirements will earn you a chance to apply between $2,500 and $35,000 with flexible repayment periods of between 3 and 7 years. The loan will attract annual interest in the range of 6.99% and 24.99% depending on your creditworthiness, and the preferred repayment period. But you can negotiate for a discount if you choose the autopay option during loan application. Other unique features of Discover cash loans is that they don’t attract closing or origination fees. Missed payments are however subjected to a fixed penalty of $39.

Pros:

- Relatively affordable interest rates

- You can return the loan in full within 30 days interest-free

- Helps you rebuild your credit score by reporting loan progress to reference bureaus

- Fairly extended loan repayment periods

Cons:

- Imposes punitive extra charges on late payments

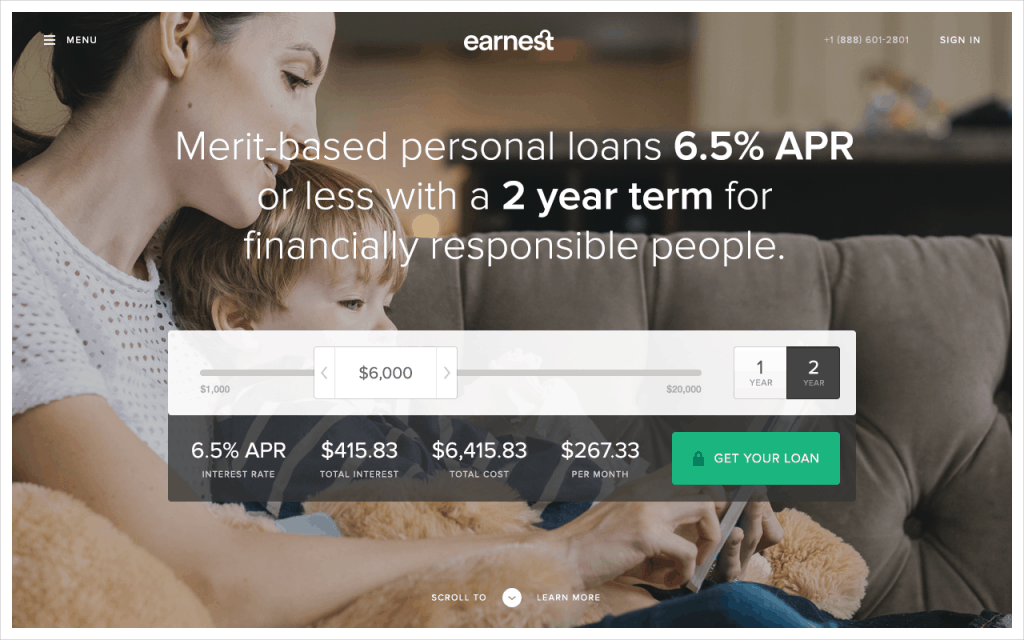

Earnest is most ideal for borrowers with a good credit score and a solid source of consistent incomes but not enough assets to serve as collateral. With a credit score of 680+ and proof of consistent income and timely-payment of your previous loans, you can qualify for a loan of between $5,000 and $75,000. The loan processing, approval, and funding may take up to a week after which you will be expected to make monthly repayments for the cash loan in between 3 and 5 years. Interests for such approved loan would range from 6.99% to 17.24% per annum.

Pros:

- There are no additional loan cost like origination or closing fees

- Flexible monthly installment loan repayments

- Fast loan approval process

Cons:

- Earnest loans are not available throughout the country

Upstart is willing to advance you a cash loan of between $1,000 and $50,000 with repayment periods of between 3 and 5 years if you meet their basic qualification requirements. These include posting a minimum credit score of 620+, reporting an annual income of $12,000+ and having a maximum debt-to-income ratio of no more than 45%. And if approved, you will pay interest rates of between 7.69% and 35.99% for the loan. You also get to benefit from the lender’s relatively fast loan application processing and approval time – as fast as same or next day funding.

Pros:

- Maintains some of the fastest loan approval and funding speeds

- You also get to benefit from high loan limits

- Friendly to average creditworthiness borrowers

Cons:

- Imposes an origination fee of up to 8.0% for the loan

- One may consider their 35% interest rate quite uncompetitive

How can one boost their chances of accessing a cash loan?

i. Know your credit score

Your credit score plays the biggest role in assessing your creditworthiness and influencing the rates with which the lender may advance you cash. Maintaining a good to excellent score goes a long way in boosting your chances of securing the loan and lowering interest rates due.

ii. Apply with the right lender

Only apply with a cash loan lender if you fulfill their minimum loan application requirements. Pay particular emphasis to their credit score requirements, additional loan fees, and basic loan requirements.

iii. Apply for the right loan

Your cash loan lender will also take into account such factors as your debt-to-income ratio when determining your creditworthiness. Applying for as much as is necessary therefore helps maintain a low debt-to-income ratio effectively boosting your chances of securing the loan.

Bottom line

Cash loans come in handy in addressing varied cases of cash emergencies. Whether you looking to pay different bills or other personal and business dues, most lenders won’t dictate the use of the loan. And there is no limit to the number of cash loans lending services providers across the country advancing different types of cash loans with varied loan limits. When searching for the best broker however, you have to take into account such key factors as their interest rate charges, maximum loan limits, repayment periods and additional loan costs like penalties and origination fees. And if you want to boost your chances of securing a loan with either of these lenders, consider maintaining a flawless credit history that effectively boosts your credit score and only apply for loans that you actually qualify for.

FAQs

How much cash loans can I borrow?

Do I need collateral when applying for a home loan?

Will bad credit affect me when applying for a cash loan?

How long will it take to have the cash deposited into my bank account?

What happens if I miss a cash loan repayment?

What factors does the lender consider when deciding whether to advance me a loan?