Levi Strauss shares are jumping for a second day in pre-market stock trading action this morning, following the release of the firm’s financial results covering the first quarter of 2021 as the management team provided positive guidance for what remains of the year.

Revenues for Levi came in at $1.31 billion, representing a 13% drop compared to the same period last year – right at the beginning of the pandemic.

Reduced store traffic resulting from COVID-related restrictions in certain key markets was the primary driver for this downtick in the company’s top line, even though the impact of this situation was partially offset by the positive performance of the company’s e-commerce unit, whose sales jumped 25% during the period.

Sales in Europe – a region that accounts for a quarter of Levi’s total revenues – suffered the most during the three months ended in February this year, sliding 16% compared to a year ago followed by the Americas, with sales in this geographical area diving 14% as well.

The company’s gross margin improved during this quarter, moving 250 basis points higher at 58.2% as a result of positive inventory management tactics while Levi’s operating expenses (SG&A) accounted for 44.6% of its sales, up 70 basis points compared to last year’s report.

Meanwhile, the company’s earnings beat analysts’ estimates, ending the quarter at $0.34 per share vs. $0.25 per share analysts had forecasted according to data from Refinitiv.

A dividend of $0.04 was declared and paid by Levi Strauss while the company raised distributions to $0.06 per share for the second quarter of this year.

Why are Levi Strauss shares up?

Levi provided guidance for the first half of 2021, expecting a 25% jump in sales during the first half of the year while also expecting to see its adjusted earnings per share landing at $0.42.

This means that for the second quarter of the year Levi expects to see its profitability hit by an upcoming wave of store closures possibly resulting from the new variant of the virus that is currently affecting multiple corners of Europe and the Americas.

Meanwhile, the management team shared positive expectations for this year, pointing to the possibility of seeing sales climbing above pre-pandemic levels by the fourth quarter of 2021.

In this regard, Levi’s Chief Financial Officer, Harmit Singh, said: “we are now confident that the fourth quarter revenues will be slightly above 2019 levels with some of our individual markets getting there sooner”.

Additionally, the executive emphasized that the company plans to emerge from the pandemic “stronger”, forecasting an EBIT margin of 12% or higher once sales go back to pre-pandemic levels.

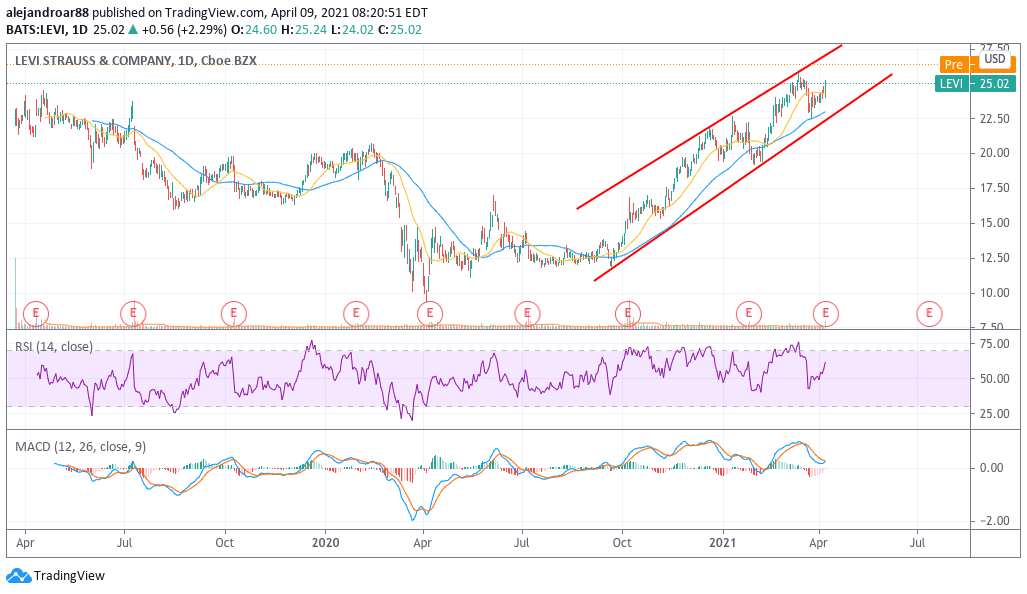

This positive outlook for the company is possibly contributing to lifts its share price this morning for a second day, with Levi Strauss shares advancing 5.6% in pre-market action at $26.41 after jumping 2.3% after these results were published.

What’s next for Levi Strauss stock?

From 2014 to 2019, Levi’s sales jumped from $4.5 billion to $5.76 billion, which results in an annual compounded growth rate (CAGR) of around 5%.

Now, although the pandemic temporarily disrupted the company’s growth, Levi could now be prepared to get back to the horse – and possibly stronger – as the combination of pent-up demand and post-pandemic euphoria could lead to stronger sales over the coming years.

Therefore, with the management team expecting sales to climb to pre-pandemic levels by the end of this year, the company could keep growing at this steady pace in the years that follow, with sales possibly landing above $6 billion by the end of 2022.

So, if we take the management’s forecasted EBIT of 12% as a reference, we can estimate a net profit margin of around 10% for Levi Strauss, which would give us forecasted 2020 net earnings of $600 million.

Based on the market capitalization of the firm as of yesterday, that would result in a price-to-earnings ratio of 16.7 and a price-to-earnings-to-growth ratio of around 3. According to those metrics, it seems that most of the upcoming growth Levi will see is already priced into the stock – a situation that limits its upside potential unless sales grow at a higher rate from 2022 and forward.

Nonetheless, if you believe that growth prospects for Levi justify its current valuation, you can invest in Levi Strauss stock through any of the brokers we have listed in this review of top stock brokers.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account