Johnson & Johnson (NYSE: JNJ) stock price has been under pressure since the start of this year. The stock price currently trades around $130 – well below from the 52-weeks high of $145 a share. Traders concerns over slower revenue growth are impacting its share price performance.

JNJ’s revenue declined 1% in the second quarter compared to last year period. The revenue drop is driven by lower revenue from its medical devices segment – which plunged 6% from the year-ago period.

On the other hand, its consumer and pharmaceutical business segment generated positive revenue growth in Q2. The company says they are working on new products to enhance their revenue base.

Alex Gorsky, Chairman, and Chief Executive Officer, “our pipelines continue to progress with the launch of new products and several regulatory submissions and approvals, which positions us well to deliver the next wave of transformational products and solutions.

Despite slower revenue growth, the company has generated robust growth in earnings and cash flows. Its second-quarter adjusted earnings per share rose 22% from the previous year period. The earnings growth is driven by cost savings, investments in high margin products and the focus on share buybacks.

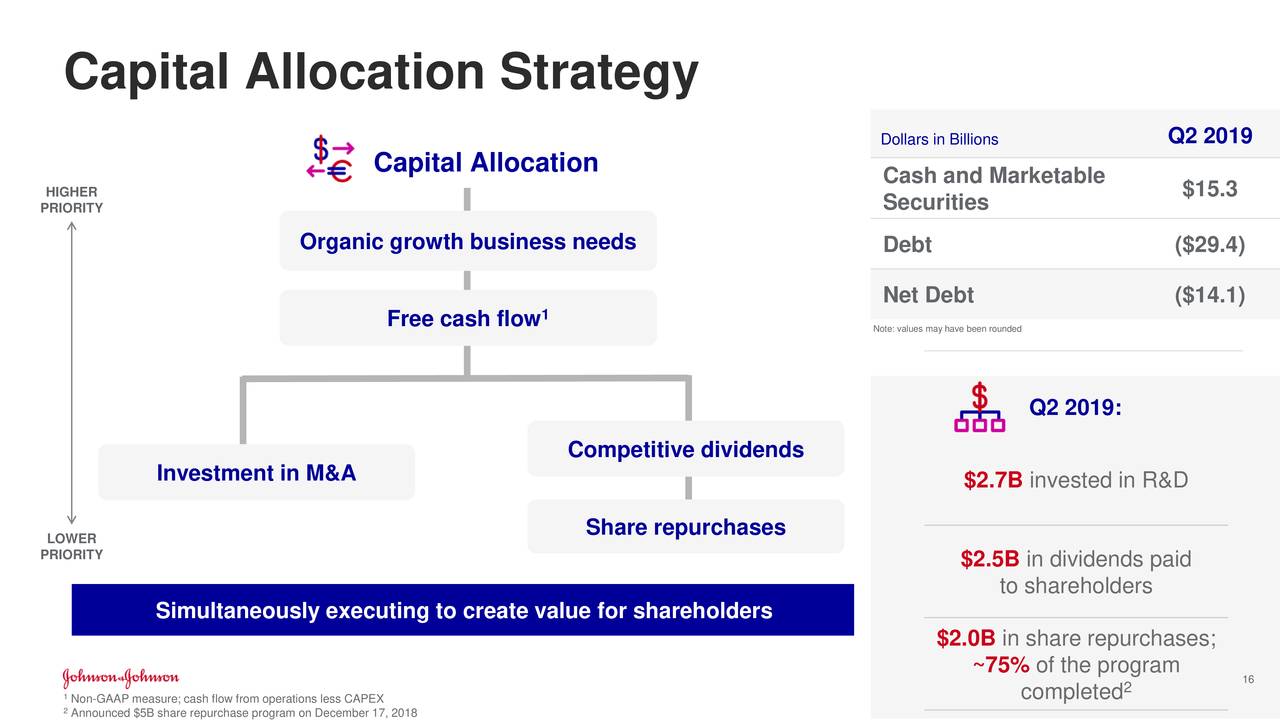

The company generated $5.9 billion in operating cash flows while its capital investments stood around $2.7 billion. JNJ was left with $3.2 billion in free cash flows – which is more than enough to cover dividend payments of $2.5 billion. It has used the rest of the cash flows for share buybacks. It currently offers a quarterly dividend of $0.95 per share, yielding around 3%. JNJ has increased its quarterly dividend in the past 57 consecutive years.

Johnson & Johnson stock price looks undervalued based on strong cash flows and solid earnings growth. Its stock is currently trading around only 15 times to earnings when the industry average is hovering around 20 times.

Buying Johnson & Johnson stock following the recent selloff appears like a good strategy for dividend investors. The company is well set to offer sustainable growth in dividend along with steady share price appreciation.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account