Amazon chief executive Jeff Bezos sold $3.1bn of stock in the tech giant this week.

The world’s richest man sold around one million of stock on Monday and Tuesday at prices ranging from $3,103 to $3,183 per share, according to filings with the Securities and Exchange Commission.

Bezos, 56, also sold more than $4.1bn worth of shares in the company in February, bringing his total cash out this year to around $7.2bn so far.

The tech titan still owns more than 54 million shares in the business, worth more than $170bn.

Bezos: Richest man in the world

The boost to online shopping this year due to the closure of many non-essential stores for months at a time around the world due to coronavirus outbreaks has lifted Amazon stock and added $75bn to the online chief’s fortune.

Bezos’ total wealth is put at $190bn, according to the Bloomberg Billionaire index. This places him ahead of Microsoft’s Bill Gates in second on $120bn and Facebook’s Mark Zuckerberg on $94.5bn in third place.

The reason for the stock sale is unclear, but three years ago Bezos committed himself to selling about $1bn of Amazon stock a year to fund his space flight tourism company, Blue Origin, which he founded in 2000.

The sales come after Bezos testified before the House Antitrust Subcommittee last Wednesday, which is concerned about the growing power of large tech companies, alongside Facebook CEO Mark Zuckerberg, Apple CEO Tim Cook and Sundar Pichai, CEO of Google parent Alphabet.

Bezos read out a prepared statement to the committee about the birth of the company in 1994.

He said: “Amazon’s success was anything but preordained. Investing in Amazon early on was a very risky proposition. From our founding through the end of 2001, our business had cumulative losses of nearly $3bn, and we did not have a profitable quarter until the fourth quarter of that year.”

Amazon stock jumps on lockdown measures

Lawmakers questions to him focused on how Amazon uses data from customer behavior to compete against third-party sellers who market their products through the Amazon Marketplace.

Amazon also posted its second-quarter earnings last Thursday, which saw it benefit from locked-down shoppers who drove sales 40%, year-on-year, to $88.9bn, helping the company record $5.2bn in net income.

That was double what it earned in the same period last year, far higher than analysts’ expectations and an all-time quarterly record for the ecommerce group.

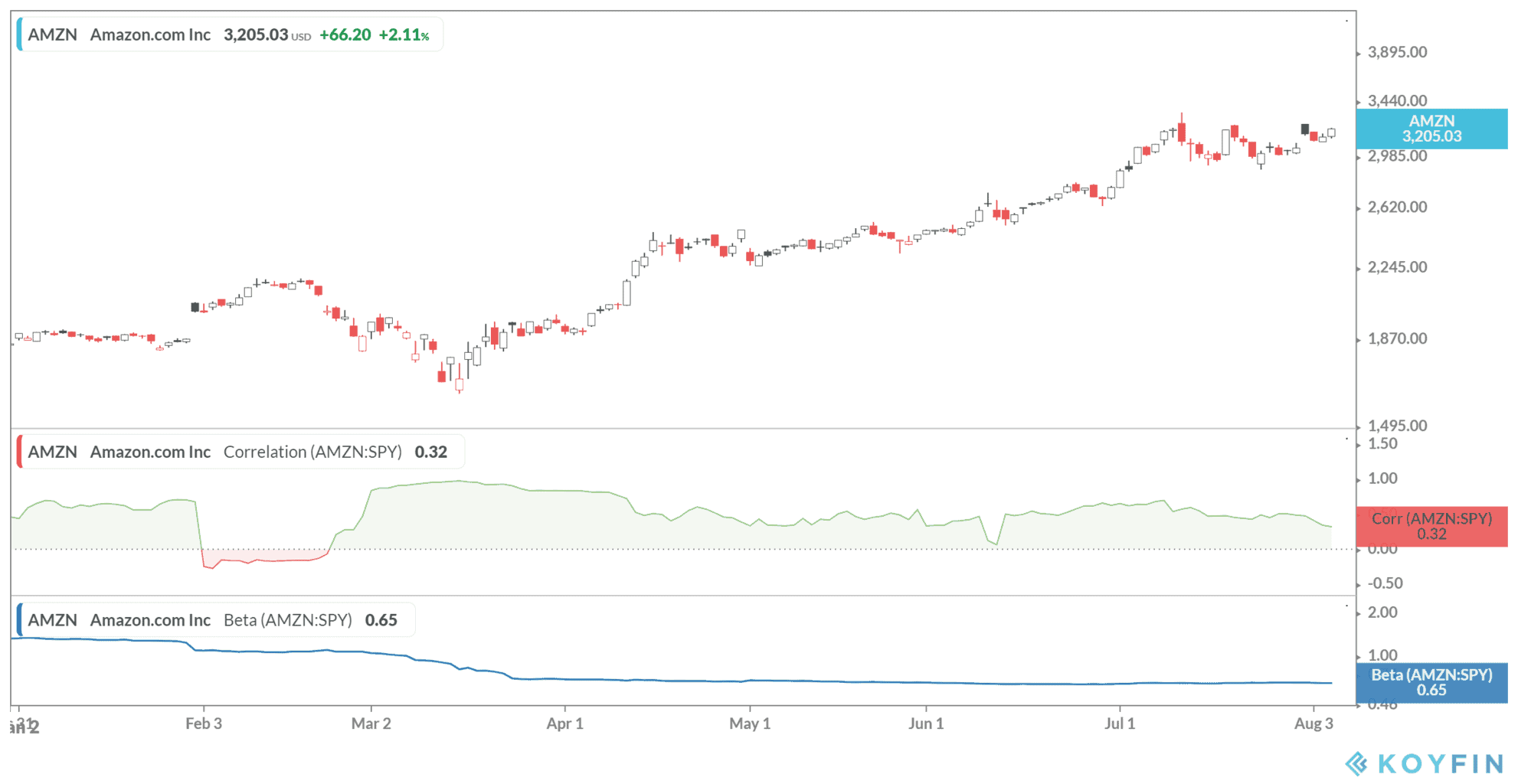

Amazon, valued at 1.6trn, has seen its stock jump almost 70% this year to stand at $3,205.03 at the end of the market on Wednesday.

Amazon’s stock relative strength index (RSI) score is 58.85 over a 14-day average, which suggests the company is trading in technically neutral territory. RSI scores range from 0 to 100, where the stock is considered overbought when the index is above 70 and oversold when below 30.

You can check out a list of recommended stock brokers if you want to invest in stocks.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account