Netflix (NASDAQ: NFLX) stock price plummeted sharply in the last month amid investors concerns over slower than expected growth in subscriber base. Its shares plummeted from 52-weeks high of $380 to close to $300 at present, a loss of more than 15%. The stock is currently trading at the lowest level since the beginning of this year.

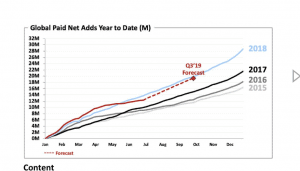

In the latest quarter, the company was expected to add 5M paid U.S. subscribers. Unfortunately, it only added 2.7M, down from past year addition of 5.5M. It ended the quarter with 151.56M global paid memberships, Y/Y growth of 21.9%.

Its revenue of $4.92 billion grew 27% in Q2 from a year ago period, but revenues missed the consensus estimate and management’s guidance of $4.93 billion.

Although Netflix performance was not convincing in the latest quarter, the company believes they are in a position to meet future guidance. Warren Buffett, the legendary investor, always suggests investors buy stock on a dip or be greedy when others are fearful. However, it’s important to check the fundamentals and market dynamics of that company.

Some market pundits are bullish about the future fundamentals of Netflix. For instance, Piper Jaffray’s has set Netflix stock price target of $440. The firm is optimistic that Netflix is in a position to capture a significant portion of traditional content dollars.

Guggenheim believes Netflix stock price has the potential to hit $420, citing globalized content, strong scalability, and improving profitability combined with a bull’s focus on longer-term subscriber penetration.

The company expects to add 7 million paid subscribers in Q3 compared to 6.1 million in the year-ago period. They expect Q3 revenues in the range of $5.25B and EPS at $1.04. The company is looking to invest heavily in growth opportunities to expand its subscriber base. For instance, they plan to invest more than $520M to make three big-budget Hollywood films. On the whole, Netflix future fundamentals are strong enough to support the upside movement in the days to come.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account