Intel (NASDAQ: INTC) stock price outperformed the border market trends amid a shift towards remote working. Laptops sales rose 10% year-on- year in the first two weeks of March while computer monitor sales doubled and business-to-business notebook sales jumped 50%, according to NPD data. The data also shows robust growth for computer accessories like mice, keyboards and laptops.

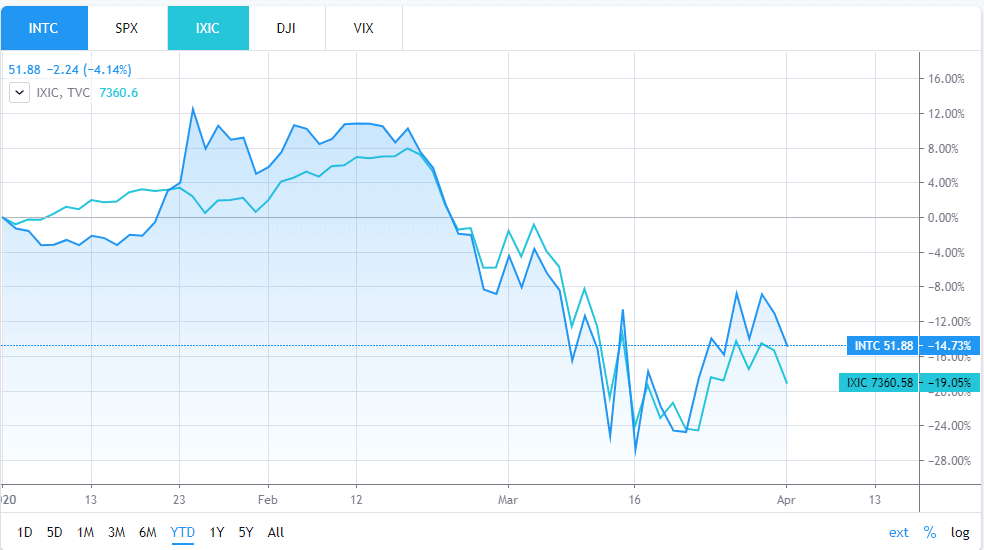

The improving demand trends have begun to be reflected in Intel’s stock price performance over the last month. Its shares have declined close to 14% this year, compared to the NASDAQ index drop of almost 19%.

Its shares bounced above the $50 level after hitting lows of $42 during early coronavirus-related selloff. Intel stock is still down significantly from 52-weeks high of $67 that it hit early this year. Citi and Barclays analysts believe Intel stock is undervalued at current valuations, expecting higher revenue from personal computer (PC0 markets.

Barclay’s lifts Intel’s price target by $6 to $58, citing a short-term increase in the data center and PC demand due to the coronavirus remote work shift.

Intel has slashed its share buyback program to support its cash flows and preserve cash ahead of the potential recession. The company had purchased more than $7.5bn of stock in the last quarter out of its $20bn worth of stock buyback program. The company was planning to complete this program in 15 months.

However, the company sustained its dividends. Intel currently offers a quarterly dividend of $0.33 per share, yielding above 2.4%. Intel expects to generate first-quarter revenue in the range of $19bn and anticipates earnings per share to enlarge 33% year over year. Full-year 2020 revenue outlook stands around $73.5bn. Its client computing revenue came in at $10bn in the latest quarter while data center revenue surged to $7.2bn.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account