New IBM (NYSE: IBM) boss Arvind Krishna (pictured) took over as a chief executive on Monday, and vowed to boost the 109-year-old tech company’a presence in cloud computing and artificial intelligence (AI).

Krishna, 57, said the firm had to “deepen our understanding” of hybrid cloud and AI, adding that the company needs to “win the architectural battle in cloud” by establishing “Linux, containers and Kubernetes as the new standard,” in an email to staff.

IBM has been struggling to generate positive revenue growth over the past several quarters. IBM’s 2019 sales came in at $77bn, a 3% decline on the previous year.

The New York-based firm no longer dominates the tech landscape the way it did a generation ago. IBM market value stands at around $100bn, less than a tenth of rivals Microsoft and Amazon.

Arvind Krishna, replaces Ginni Rometty who will stay on as executive chairman until the end of the year. Krishna also played a key role in the group’s $34bn Red Hat acquisition, completed last July. The Red Hat acquisition has enhanced its presence in hybrid cloud and artificial intelligence markets. IBM generated cloud revenue of $6.8bn in the latest quarter.

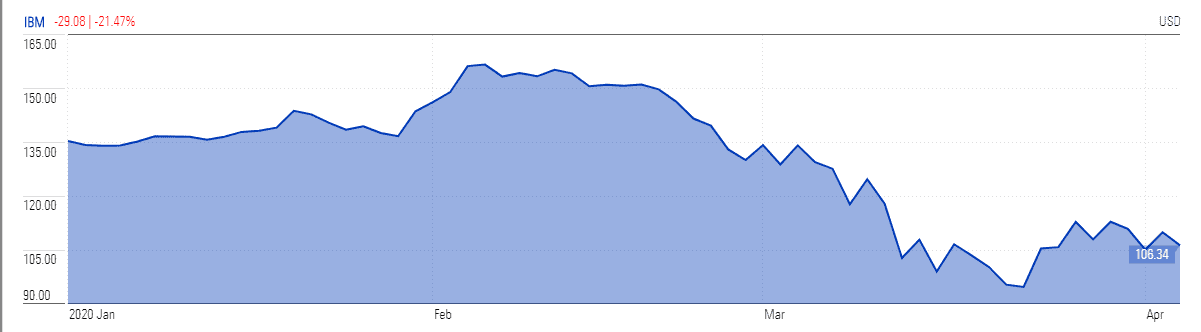

Sustaining cloud revenue growth is not an easy task because IBM has to compete with the market leaders in the public cloud business including Microsoft, Google, and Amazon. Krishna also showed concerns over the impact of slower economic growth. IBM stock price has already lost more than 20% of value this year amid coronavirus related concerns.

Krishna said: “The first thing I have to worry about is all of our employees and clients and all our businesses…that we can continue, that we have resilience. We have to maintain a healthy balance sheet, healthy cash flows.”

While the company currently doesn’t have any liquidity issues but the new chief executive officer is planning to extend the debt reduction strategy. Its debt stood around $62.9bn in the latest quarter. It ended the latest quarter with $9bn of cash in hand while the company expects to generate $12bn in free cash flows this year.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account