IBM (NYSE: IBM) stock price soared sharply since it topped fourth-quarter revenue and earnings estimates. The company optimized the trader’s sentiments by breaking the streak of five consecutive quarters of revenue decline. The significant debt reduction along with healthy cash flow generation potential is adding to investor’s sentiments.

IBM stock price is currently trading around $155, representing the highest level in the last 22 months. Its share price rallied close to 14 per cent since the beginning of fiscal 2020. IBM’s strategy of moving its focus towards cloud business is supporting its financial numbers.

Analysts See Further Upside for IBM Stock

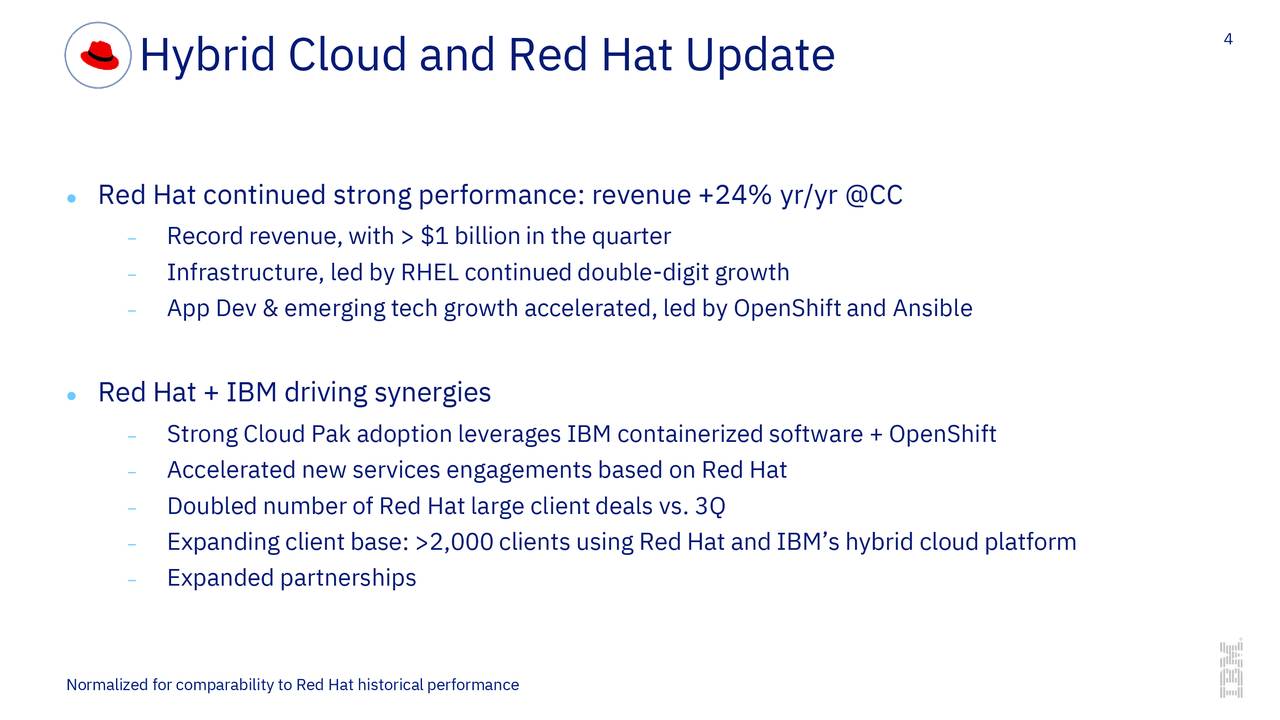

The majority of analysts have raised their price targets for IBM share price. For instance, Morgan Stanley’s lifted the price target from $155 to $164. Its analyst Huberty said, “Some of the strong results came from less sustainable sources like currency and mainframe software but Red Hat is a genuine bright spot in the quarter.” The firm raised its EPS estimate to $13.33 for 2020.

On the other hand, Citi looks optimistic over the arrival of new Chief Executive Officer Arvind Krishna. This is because Arvind Krishna has considerable experience in the cloud business – which bodes well for IBM’s cloud growth strategy.

IBM Fourth Quarter Beat and Upside Financial View Supports Higher Price Target

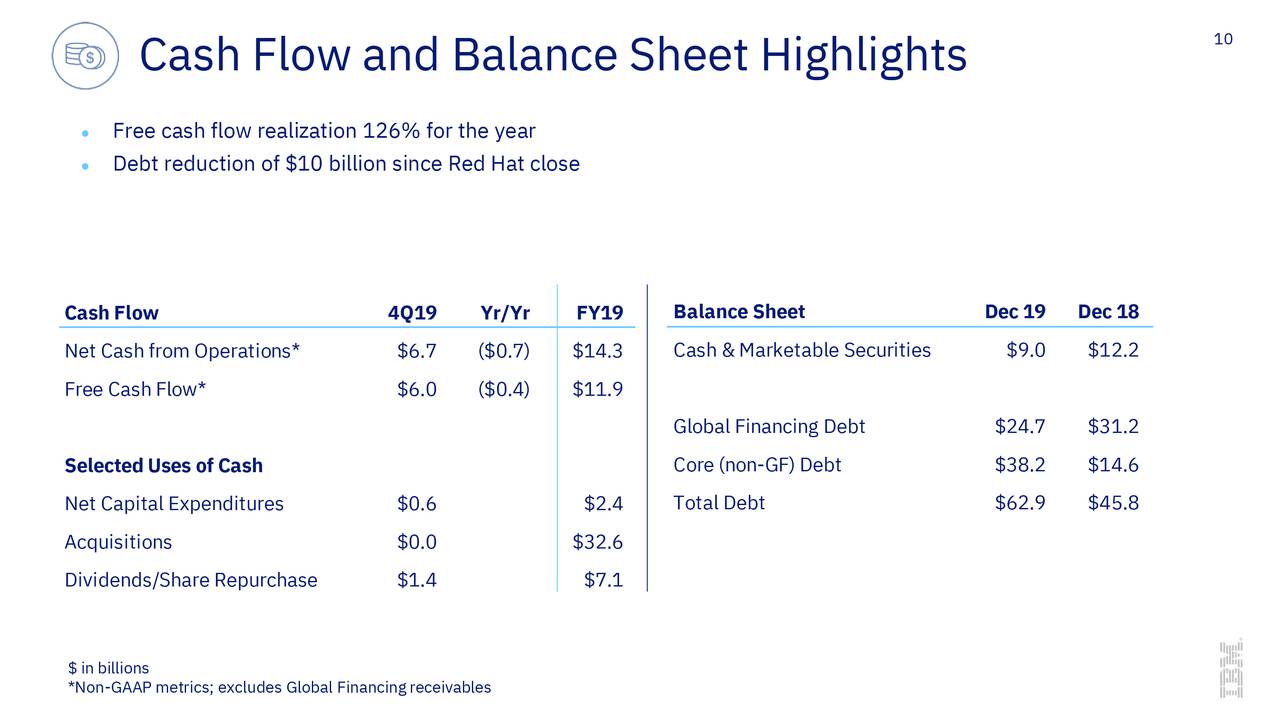

IBM topped fourth-quarter revenue and earnings estimate by $150ml and $0.02 per share. Its fourth-quarter revenue of $21.78bn increased by 0.08 per cent from the past year period. The revenue growth is driven by a strong performance from cloud business. The cloud revenue of $6.8bn grew 21 per cent from the year-ago period. Its gross margin jumped 190 basis points while the company reduced debt by $10b since the closing of the Red Hat acquisition.

“Looking ahead, we are positioned for sustained revenue growth in 2020 as we continue to help our clients shift their mission-critical workloads to the hybrid cloud and scale their efforts to become a cognitive enterprise,” “said Ginni Rometty, IBM chairman, president, and chief executive officer.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account