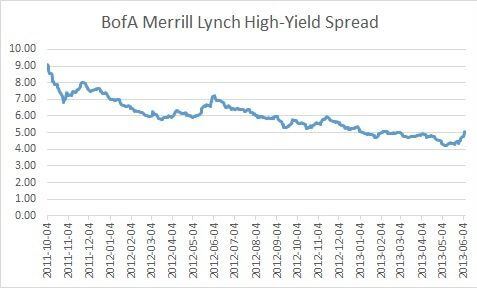

At long last, high-yield bond spreads have started to rise. After peaking on October 4, 2011 at 9.10% (910 basis points), the “BofA Merrill Lynch US High Yield Master II Option-Adjusted Spread” entered a slow but steady downtrend that recently bottomed on May 9, 2013 at 4.23%. Since that time, however, the aforementioned BofA Merrill Lynch high-yield spread changed direction, widening to 5.08% on June 6 (before backing up a bit).

At long last, high-yield bond spreads have started to rise. After peaking on October 4, 2011 at 9.10% (910 basis points), the “BofA Merrill Lynch US High Yield Master II Option-Adjusted Spread” entered a slow but steady downtrend that recently bottomed on May 9, 2013 at 4.23%. Since that time, however, the aforementioned BofA Merrill Lynch high-yield spread changed direction, widening to 5.08% on June 6 (before backing up a bit).

While the 85 basis points of spread widening still does not get high-yield spreads to a level I would categorize as “attractive,” it does move us from what I would call “overly rich” to just “slightly rich” levels. There are two additional things worth noting concerning the recent spread widening.

First, although the most recent bottom occurred on May 9, 85.88% of the move higher happened in the seven trading days immediately after May 28. In other words, the broad-market high-yield spread widened 73 basis points in just seven days. But while that may sound like a big move for such a short period of time, from a historical perspective, a move like that should not surprise high-yield bond investors. Beginning on May 29, 2012, the spread jumped by 57 basis points in three trading days. The October 4, 2011 peak occurred after a 107 basis points move in just four trading days. Even though the recent move is not unusual from a historical perspective, it does help remind us that changes in yields can happen very quickly in the world of “junk” bonds. Knowing that should provide some comfort to the patient investor who is getting antsy waiting for spreads to widen and yields to rise. It should also reinforce the fact that you should have your watch list of bonds you want to purchase by your side during a period of time when spreads are widening. The moves can be swift in both directions, and you don’t want to miss the opportunity to pick up a bond on your watch list at an attractive price.

Second, the recent widening in high-yield spreads is occurring at the same time that benchmark Treasury rates are rising. That combination is something the investment community isn’t accustomed to, and it quickens the pace with which non-investment grade corporate bond yields can rise. In the United States, we are used to rising Treasury rates happening during periods of moderate- to strong economic growth, which raises inflation expectations and pushes yields higher. This time around, however, Treasury rates are rising due to fears of the Fed scaling back on QE. I think the recent widening in high-yield spreads and the selloff in equities on the back of worries about the Fed tapering QE helps demonstrate that market participants believe QE is propping up the financial markets and the U.S. economy. Given that, it makes sense that high-yield spreads are widening at the same time that Treasury yields are rising. And this is great news for buyers who have been waiting to put money to work.

Before concluding, I would like to share with readers the breakdown of Bank of America Merrill Lynch’s high-yield spreads by credit rating. Double-B-rated bonds, which comprise the three highest non-investment grade ratings, saw spreads recently bottom on May 9, 2013 at 3.04% before rising 66 basis points to 3.70% on June 6. Single-B-rated bonds, which comprise the three credit ratings below double-B, saw spreads bottom on May 8, 2013 at 4.04% before rising 92 basis points to 4.96% on June 6. Last, CCC-or-below-rated bonds experienced a spread bottoming on May 9, 2013 at 7.51% before rising 119 basis points to 8.70% on June 6. As one would expect, the lowest-rated bonds experienced the largest spike in spreads. If you are comfortable purchasing mid- to lower-rated “junk” bonds, you can certainly find attractive yields (relative to all available yields in the bond market). The difficult thing is finding attractive credit risk. While I am comfortable purchasing a single-B-rated bond, the CCC-or-below region is one I shy away from.

If you are not comfortable buying individual junk bonds, there are several funds available to you. But even though spreads have widened and yields have risen in recent weeks, the high-yield funds are still not trading at levels that intrigue me. Along with the various individual bonds I own (including individual bonds with non-investment grade ratings), I also own the iShares High Yield Corporate Bond ETF (HYG). I am definitely hoping to add to the position in the future but would feel much more comfortable picking it up several percent lower than it is trading today. Also, if you are an investor who is comfortable purchasing double-B bonds but not venturing into the lower reaches of “junk,” you might consider taking a look at the AdvisorShares Peritus High Yield ETF (HYLD). Roughly three-quarters of its portfolio is in single-B-rated bonds, and another 11.11% is rated CCC+. If you are looking for yield in today’s low-rate environment and have the luxury of not concerning yourself with fluctuations in your principal (you are just looking for interest income/dividends), then HYLD is one to seriously consider when it sells off a bit more.

For investors with money to put to work, it is a good thing that spreads have started to widen. Let’s hope it continues over the coming days and weeks. In the meantime, tighten up your watch list of bonds to buy and be ready to act at a moment’s notice—for just as quickly as spreads widen, they can also narrow.

More from The Financial Lexicon:

Income Investing Insider Newsletter

The 5 Fundamentals of Building a Retirement Portfolio

Options Strategies Every Investor Should Know

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account