Google shares are surging in pre-market stock trading action this morning following the release of the firm’s financial results covering the first quarter of 2021 as the company’s revenues and earnings landed at a far distance from Wall Street’s most optimistic forecasts.

The parent company of the world’s largest search engine, Alphabet (GOOG), reported revenues of $55.31 billion, representing a 34.3% jump compared to a year ago while exceeding the consensus estimate by as much as 7%.

Advertising revenues grew 32.3%, including a 48.7% jump in YouTube’s revenues, while cloud revenues were 45.3% higher at $4.05 billion as Google keeps gaining ground in this particularly attractive segment of the market.

Meanwhile, operating profits more than doubled compared to the same period the year before, landing at $16.44 billion. Google informed that it conducted a review of the useful life of its servers and network equipment that resulted in a reduction in depreciation expenses for the period of $835 million.

Finally, earnings per share of the Mountain View-based tech company landed at $26.29, representing a 166% leap compared to a year ago, while shattering analysts forecasts of $15.67 for the period.

Google’s board of directors announced that the company plans to repurchase as much as $50 billion in Class C common stocks as part of its effort to deploy a portion of the company’s massive $135 billion cash reserve – which includes $108 billion in marketable securities.

Alphabet’s free cash low landed at $11.68 billion, twice the amount the company brought during the same period last year, as the firm continues to be a highly profitable cash cow.

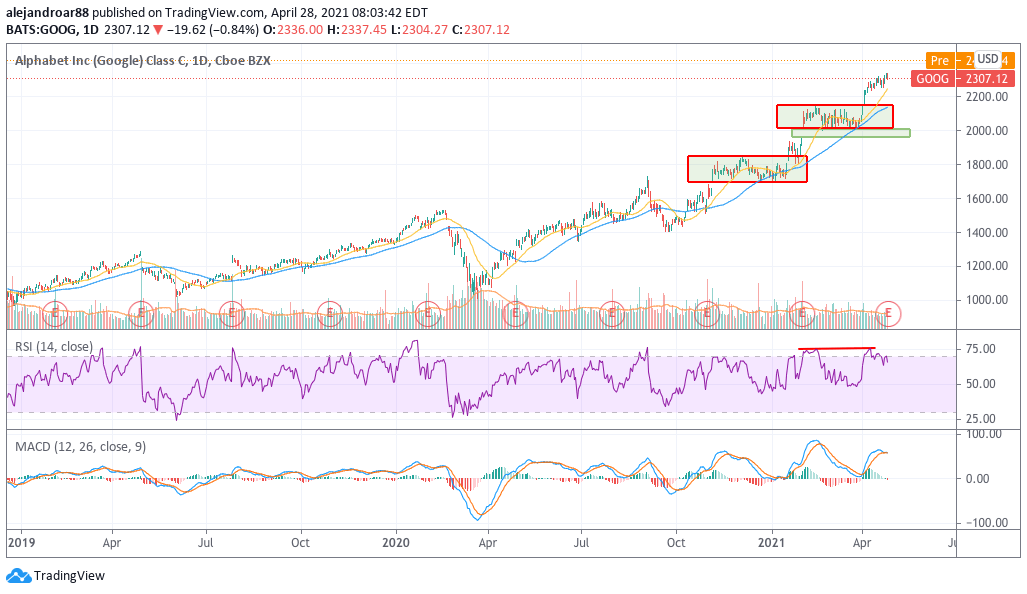

What’s next for Google shares?

The market is reacting quite positively to these quarterly results as Google shares are advancing as much as 4.6% in pre-market action today at $2,413 per share.

In the past 6 years, Google has managed to increase the amount of free cash flow it generates from around $12 billion by the end of 2014 to as much as $43 billion last year and $50 billion in the last 12 months. This results in a compounded annual growth rate (CAGR) of approximately 23%.

Meanwhile, upon deducting cash at hand, Google’s market capitalization would be around $1.51 trillion if the stock surges to the pre-market price once the bell rings. Based on that number, Google shares would be valued at around 23.9 times its forecasted cash flow for the next twelve months.

Based on that estimation, we could say that Google shares are fairly valued as an investor would be paying a price-to-cash-flow-to-growth of 1.

Moreover, the positive impact of Google’s share buyback program would singlehandedly raise the firm’s share price to around $2,480 if the stock is bought at an average price of $2,450 a piece.

This, along with the positive forward-looking growth that lies ahead for the tech firm and its strong balance sheet, creates enough upside potential to deem Google a buy at the current price.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account