General Motors (NYSE: GM) stock price has been trading in a narrow range over the past couple of years. The range-bound movement is due to modest revenue growth along with macroeconomic headwinds.

General Motors stock price traded in the range of $30 to $40 in the past five years. The stock has hit a 52-weeks high of $41 at the beginning of the third quarter.

Its shares are currently hovering around $37, yielding around 4%. The sluggish share price movement is making its valuations attractive to investors.

The share price is trading around only 6 times to earnings when the industry average is around 20 times. A lower price to sales also makes the stock price attractive for investors.

Uncertainty related to China has been negatively impacting its share price performance. President Trump’s recent tweet signals that the president is not happy with GM’s production in China.

China has also been imposing tariffs on U.S. auto companies. This situation continues creating pressure on its margins.

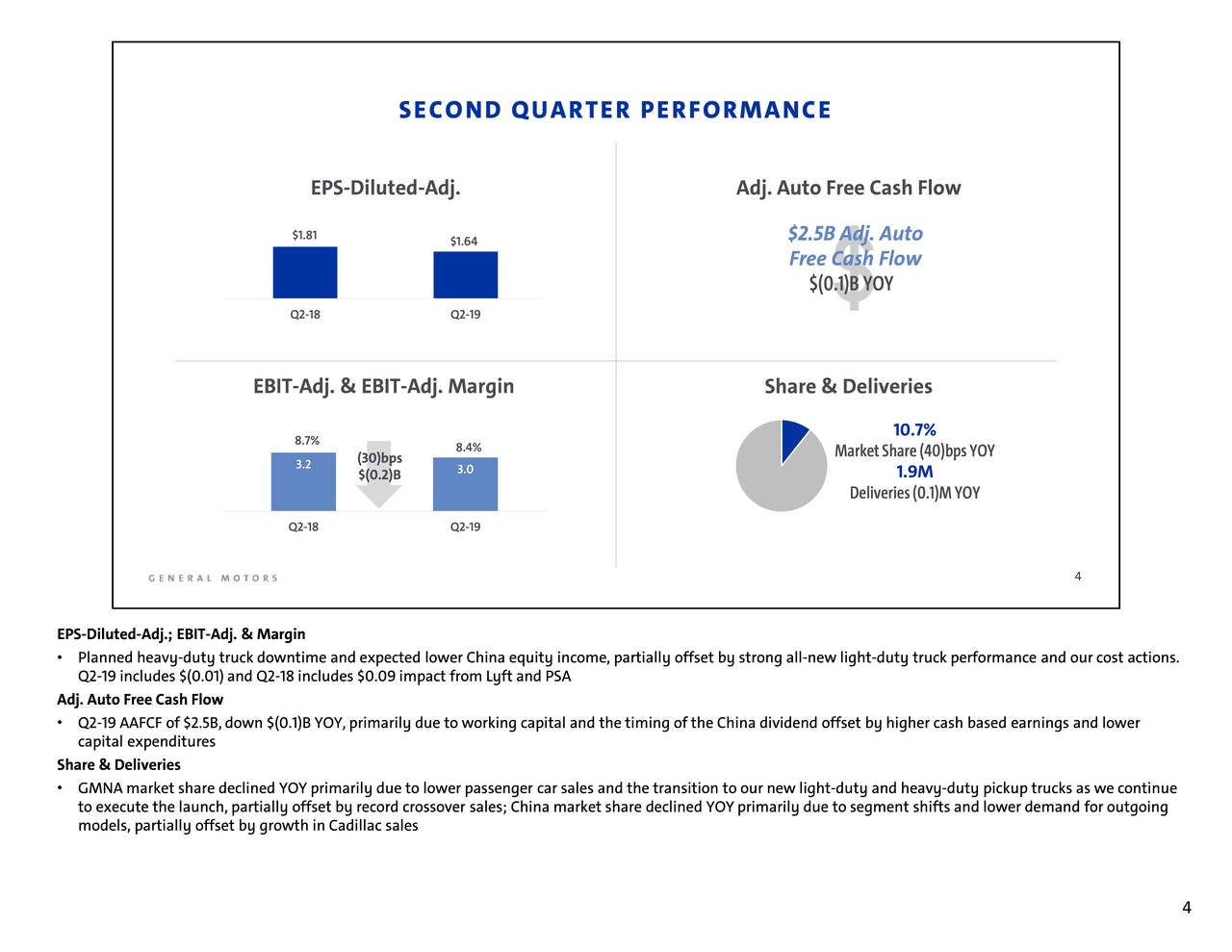

Its second-quarter revenue of $36 billion was down 1% from the year-ago period. Its adjusted EBIT fell 5.6% in the second quarter from the previous year period.

On the positive side, General Motors has generated strong results from its North American operations. It’s North America EBIT-adj. margin stood around 10.7%. The margin growth was driven by the launch of full-size light-duty pickup trucks.

The company’s dividends are safe despite sluggish financial performance. Its operating cash flow of $3.8 billion was more than enough to cover dividend payments and capital investments.

It’s capital expenditure stood around $1.4 billion in Q2. Thus, the company was left with $2.5 billion in free cash flows. The dividend payments accounted for $1.1 billion in Q2.

Analysts are suggesting investors keep a close eye on the trade war conflict. This is because the company has extensive footprints in both countries. On the whole, General Motors stock price is likely to trade in a narrow range in the coming days. Fortunately, its dividend growth is safe.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account