General Motors (NYSE: GM) stock price performance remained volatile since the start of this year. Following steady growth in the first half of the year, the stock lost almost 11% of value in the last month alone.

General Motors stock price is currently trading close to $36, down from 52-weeks high of $41 a share that it had hit last month. Worries regarding China and slower growth from international markets have supported the bearish trend. General Motors has a significant market share in China. It’s market share reduced to 12% in the latest quarter from 13.2% in the year-ago period.

Its second-quarter revenue of $36 billion decreased 1.90% year over year in the second quarter. It’s North American business segment generated robust revenue growth, thanks to the continued truck and crossover strength. However, negative revenue growth from China impacted the overall performance. The company expects a further decline in revenue from China. This is due to new tariffs on U.S. auto products from China in response to tariffs from the United States on Chinese products.

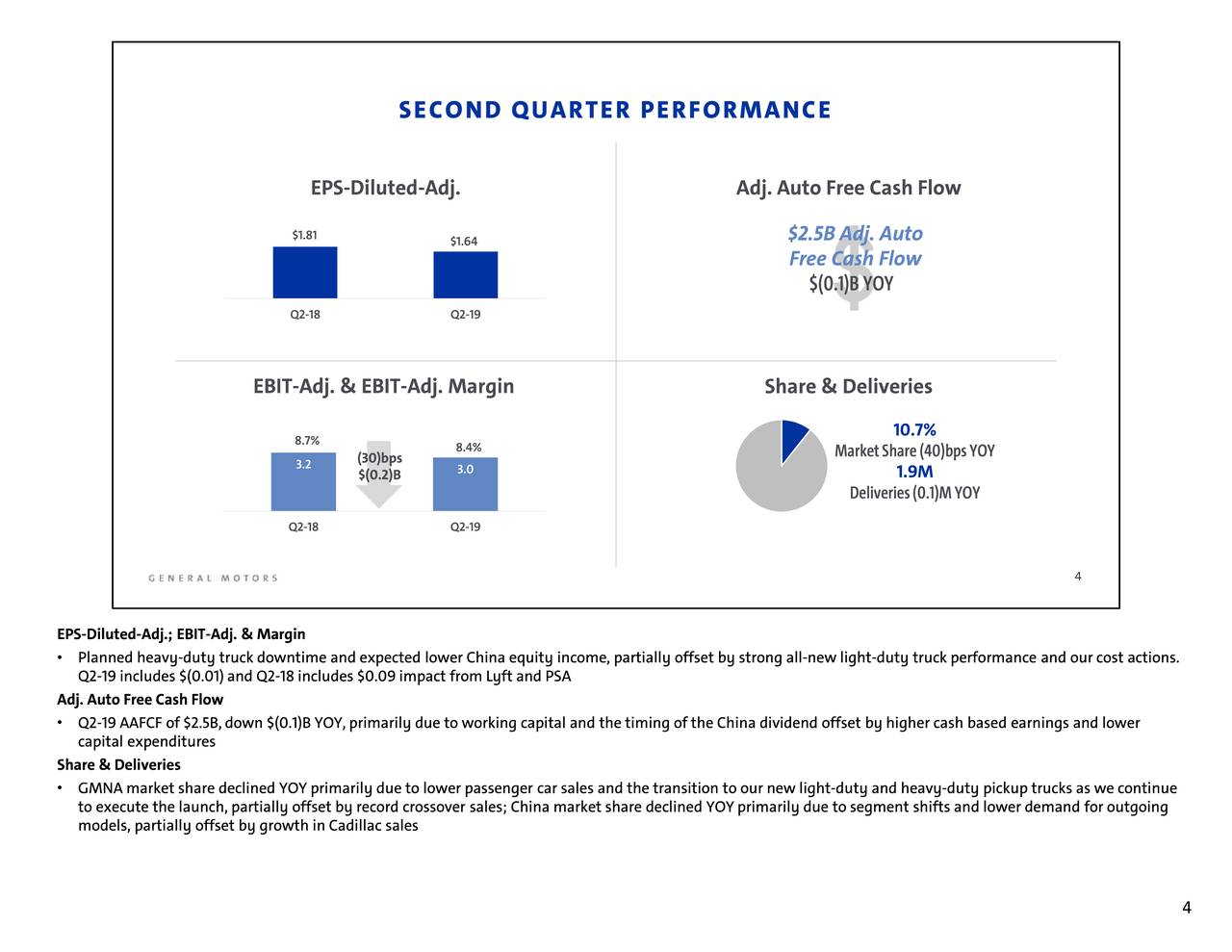

Its adjusted EBIT decreased to $3 billion in Q2, down from $3.2 billion in the year-ago period. The company’s earnings per share also declined to $1.64 in the second quarter from $1.81 in the year-ago period. The drop in earnings was attributed to lower revenues and higher operational costs.

Despite negative financial growth, General Motors dividends look safe. The company currently offers a dividend yield of 4.4%. Its free cash flows are providing a complete cover to dividend payments. Its free cash flows were standing around $2.5 billion in the latest quarter, significantly higher from dividend payments of $1.1 billion. Indeed, the huge gap in its dividend payments and free cash flows are offering a room for more dividend increases.

Overall, General Motors stock price has limited upside potential amid slowing revenue growth from China along with declining margins. However, it is still a good stock for dividend investors.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account