General Electric (NYSE: GE) stock price rose to the highest level in the last twelve months, thanks to the strengthening balance sheet and future fundamentals. GE shares run up more than 17% since it announced stronger than expected third-quarter results. Its market capitalization jumped back above $100 billion after four quarters.

GE shares rallied 29% in the last month and up almost 41% year to date. General Electric stock price has outperformed 69 stocks comprising the SPDR Industrial Select Sector ETF in the last month. Despite the recent rally, GE shares have further upside potential according to market analysts.

General Electric Stock Price Still Presents a Buying Opportunity

Although GE shares have already gained substantial value and the stock is trading around 52-weeks high, market pundits are seeing further upside potential. They believe it’s good to reconsider GE amid clear signs of progress along with improvement in future fundamentals.

Barclay’s analyst Julian Mitchell believes the new CEO took the right steps to lift the struggling company. The analyst claims they are seeing clear signs of progress; the long-term investors should take a closer look at GE.

The analysts are also showing confidence in the balance sheet. They expect a significant reduction in indebtedness amid the potential expansion in free cash flows and asset sales. Market pundits are anticipating its debt to decline to 4.4x EBITDA by the end of next year.

The New Business Strategy is Supporting GE Shares

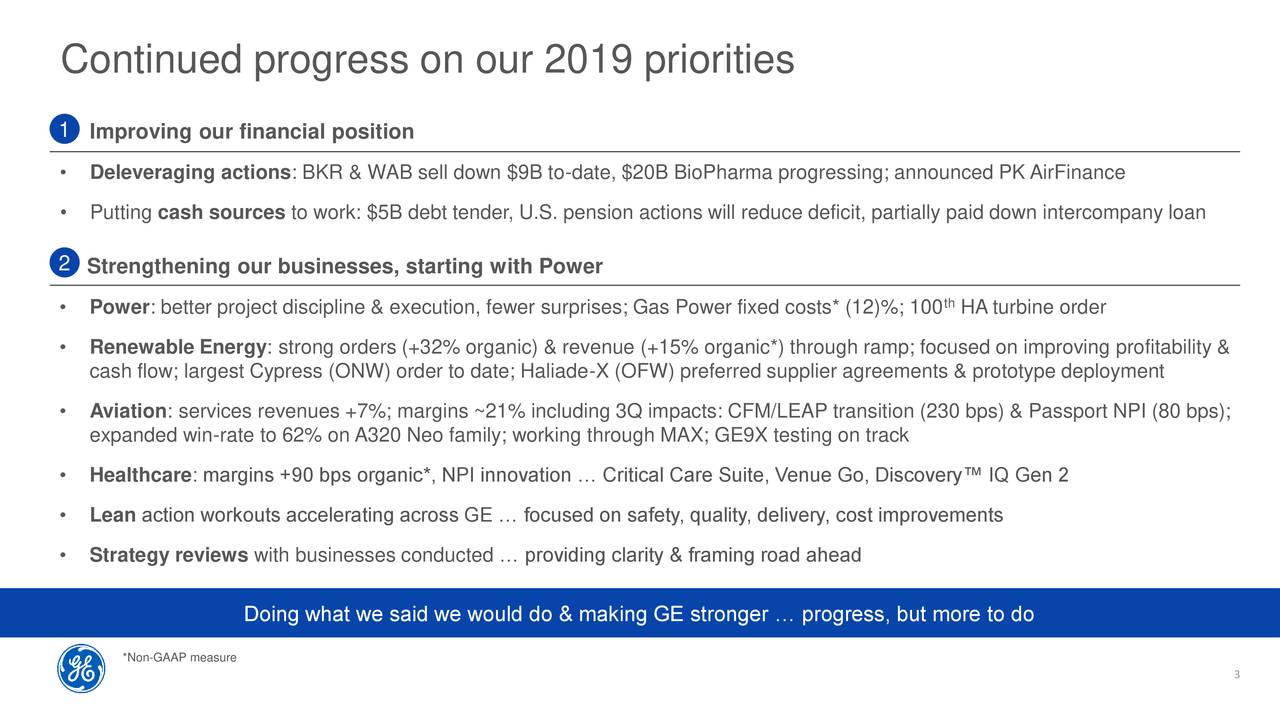

The company has been working on the strategy of selling noncore assets while focusing on industrial and power businesses.

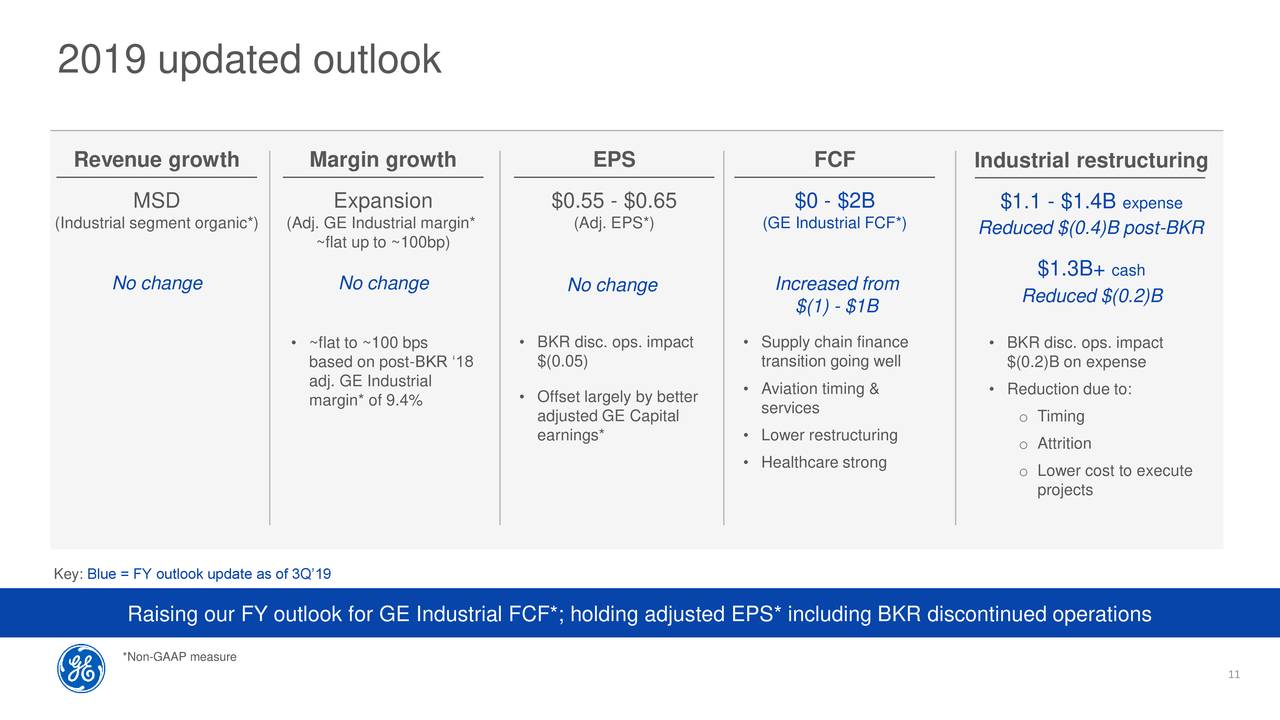

The strategy appears to be working considering the expectations for industrial free cash flow between zero and $2B. This represents a significant improvement from the previous forecast of negative $1B to a positive $1B.

However, the new CEO says it’s a transformational year; they are expecting a meaningful improvement in the next two years. On the whole, General Electric stock price fundamentals are improving at a robust pace. Therefore, analysts are suggesting to buy GE shares.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account