Ford Motor Company (NYSE: F) and GE Healthcare (NYSE: GE) said they will produce 50,000 ventilators over the next 100 days at a plant in Michigan, to treat people struck down by coronavirus. The two groups added that they will also produce 30,000 venerators every month as needed.

The GE/Airon Model A-E ventilator is licensed and designed by GE Healthcare from Florida-based Airon Corp with the potential to operate on air pressure without electricity.

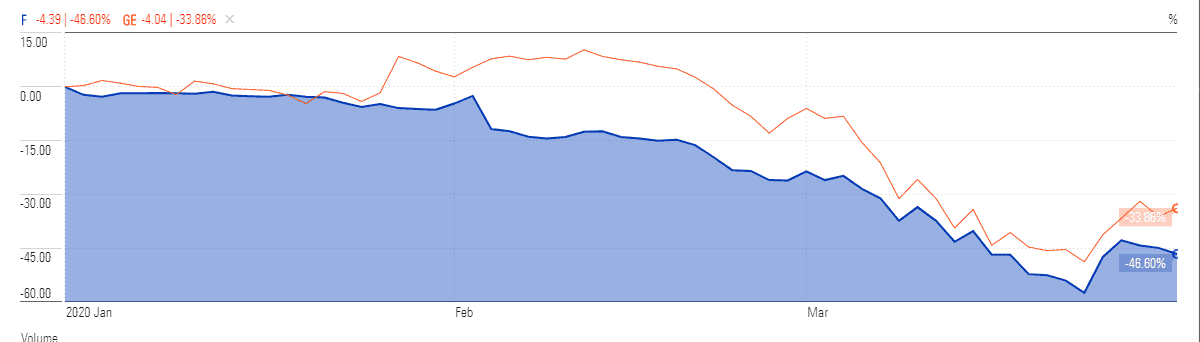

Ford has closed its manufacturing plants due to the outspread of the virus; the company is likely to reopen the plants in May as US President Donald Trump has extended the lockdown date to April 30. Ford stock price currently trades around $5 after bottoming around $3 a share last week. Its shares are down by almost 50% since the beginning of this year. It closed down 3% at $5.03 on Monday.

Meanwhile, GE stock price rose sharply in the past couple of sessions as the company is working hard to increase the manufacturing capacity of medical devices that can combat the disease- including ultrasound devices, CTs, patient monitors, mobile X-ray systems, and ventilators. It lifted by 3.5% to close at $7.89 on Monday, though its stock is down 33% this year.

The company has also said it will slash $1bn of costs and lay off 10% of aviation workers. It has also closed the sale of its BioPharma business to Danaher, which the company said will enhance its cash position in this critical time.

“With regard to our financial position, our company is sound. However, what we don’t know about the magnitude and duration of this pandemic still outweighs what we do know. Closing the sale of BioPharma to Danaher will help us solidify our financial position further,” chief executive officer Larry Culp says.

However, some analysts are still showing concerns over the short-term performance as its aviation and capital aviation services units account for 75% of GE’s profit. It’s still unclear whether GE would tap into government loans in the future; the company had received billions in government assistance during the 2008 financial crisis.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account