Buying strong but underrated stocks amid a market selloff, and ahead of a potential recession, could be the best way to beat the market trends. It is a trusim that buying undervalued stock during the bear market is a great way to boost returns. This is because panic selling lowers valuations of several high growth stocks below their real worth. Analysts say investors should buy stocks that are immune to coronavirus headwinds amid prospects for sluggish economic growth for 2020 along with slow demand for several industries even if the pandemic ends in a few months. Below is the list of five top stocks to buy that have strong future fundamentals despite slowing economic growth.

Facebook (NASDAQ: FB)

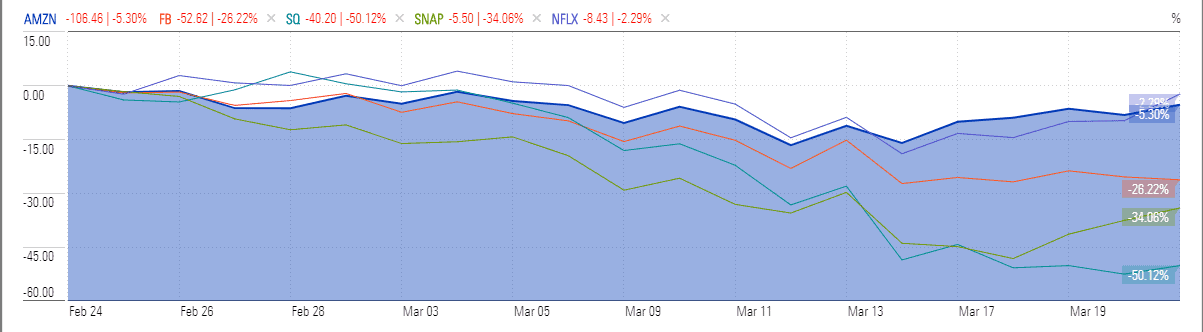

The Facebook stock price is looking cheap after losing more than 25% of the value in the last month. Jefferies claims that Facebook is in a perfect position to stand taller in front of uncertainties due to its strong cash position. The firm said that staying at home has resulted in improved demand for social media stocks. “Facebook is seeing big surges well beyond the usual annual spike the company sees on New Year’s Eve – in particular voice and video calls, on WhatsApp and Facebook Messenger,” said chief executive officer Mark Zuckerberg (pictured).

Snap (NYSE: SNAP)

Snap stock price selloff has created an attractive buying opportunity for value investors in the analyst’s view.

Deutsche Bank has increased its price target to $19 with a buy rating, saying it is among the top mid-cap advertising companies that are set to make a big recovery this year. Argus has also upgraded Snap stock to Buy from Hold, claiming substantial growth in users and revenues. The messaging app firm generated year-on-year revenue growth that hit 44% in the latest quarter.

Square (NYSE: SQ)

Square stock is the biggest laggard in this list, losing more than half of its value over the last month alone. However, analysts are making buy calls because of its strong future fundamentals. Cowen analyst George Mihalos provided a price target of $70 with an outperform rating. The mobile payments group has generated net revenue growth of 40% year-on-year in the latest quarter and gross profit growth of 104% year-on-year.

Netflix (NASDAQ: NFLX)

Streaming service and production company Netflix is set to generate larger revenue and user growth amid a sharp increase in traffic following the coronavirus outbreak. Credit Suisse said: “Netflix has seen a sharp growth in Hong Kong and South Korea, indicating first-time app downloads inflected positively starting in January and continued into March.”

Netflix stock price rebounded sharply after a brief slump on the broader market selloff. Its shares are currently trading around $360, slightly down from a 52-weeks high of $390 a share. The market analysts have increased first-quarter domestic net subscriber additions to 510,000 from the previous target of $480,000 while the outlook for the international subscribers raised to 7m from 6.52m.

Amazon (NASDAQ: AMZN)

Amazon stock price bounced back in the last week but it is still trading well below the all-time high of $2100. The market analysts are expecting a significant upside in the coming days amid an uptick in demand. Oppenheimer provided Outperform rating with the price target of $2,400, citing stronger-than-expected growth. The broker raised tech giant’s online store segment growth to 20% year-on-year compared to the previous estimate for 15%. JPMorgan analyst Doug Anmuth expects Amazon to generate first-quarter sales around $74bn, which is up almost $1bn from prior guidance.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account