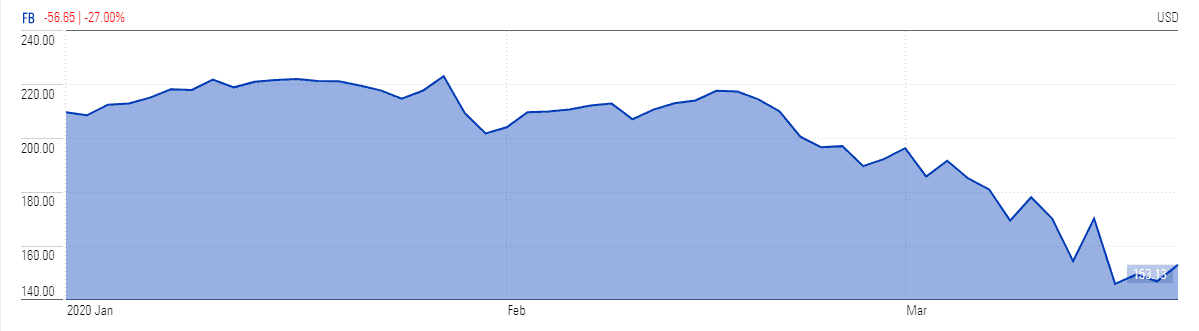

Facebook (NASDAQ: FB) stock price lost a quarter of its value during the coronavirus market selloff, but market pundits believe internet stocks are in a good position to face uncertainties.

Tech firms are seeing more users on their platforms, who stay for longer, because people are being forced to stay at home due to pandemic. While Facebook is also not immune to the economic meltdown, analysts expect a rebound once shares pull out of one of the most significant market pullbacks in years. The higher viewership and customer engagement could also help it beat the consensus estimate for the following quarters.

Facebook’s other brands, such as Instagram, Messenger, and WhatsApp are also experiencing higher than usual user engagement.

“The diversification of Facebook indicates stronger resilience and likely a greater ability to endure dramatic body blows,” said MKM Partners analyst Rohit Kulkarni.

Wedbush calls the Facebook stock a “best idea” with strong long-term positioning against the coronavirus pandemic.

However, Facebook may also experience the worst impact of tumbling traveling, airline and hotel industries, as these industries spend heavily on advertisement campaigns. All these industries are among the biggest laggards of the worst market crash in years. The S&P 500 index lost 28% of its value over the last month.

The stock markets, however, started showing some optimism after bailout packages and interest rate cuts all over the world to shore up the economy. All the US stock indices generated small gains in Thursday trading while oil prices rebounded more than 20% in a single session. The US president has been actively working with economists to avoid economic meltdown and the stock market crash. The Trump administration is seeking to make a $1trn stimulus package, which may see close to half of that going in direct cash payments to ordinary Americans.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account