Facebook (NYSE: FB) stock price rallied sharply since the beginning of this year. The shares have breached $200 level at one stage before retreating to $190 range. Its shares are up 35% year to date.

Despite Libra related headwinds, the upside momentum is backed by traders’ confidence in future fundamentals. Increasing financial numbers are adding to Facebook stock price momentum. Some market pundits suggest investors buy FB shares ahead of earnings.

Barclays Set Higher Facebook Stock Price Target

Barclays claims that Facebook is presenting an attractive buying opportunity ahead of earnings.

Its analyst Ross Sandler believes demand for Facebook products remained strong during the quarter – which could support the share price. He has set a price target of $240 with an Overweight rating.

“Positioning is far less crowded and the sentiment is mixed compared to prior quarters, which we think helps the set-up,” analyst Ross Sandler says, adding advertisers are mostly ignoring the gloomy regulatory headlines.

RBC has also set a Facebook price target at $260 with Outperform ratings, citing intrinsically attractive valuation and strong fundamentals.

Financial Growth Support Uptrend

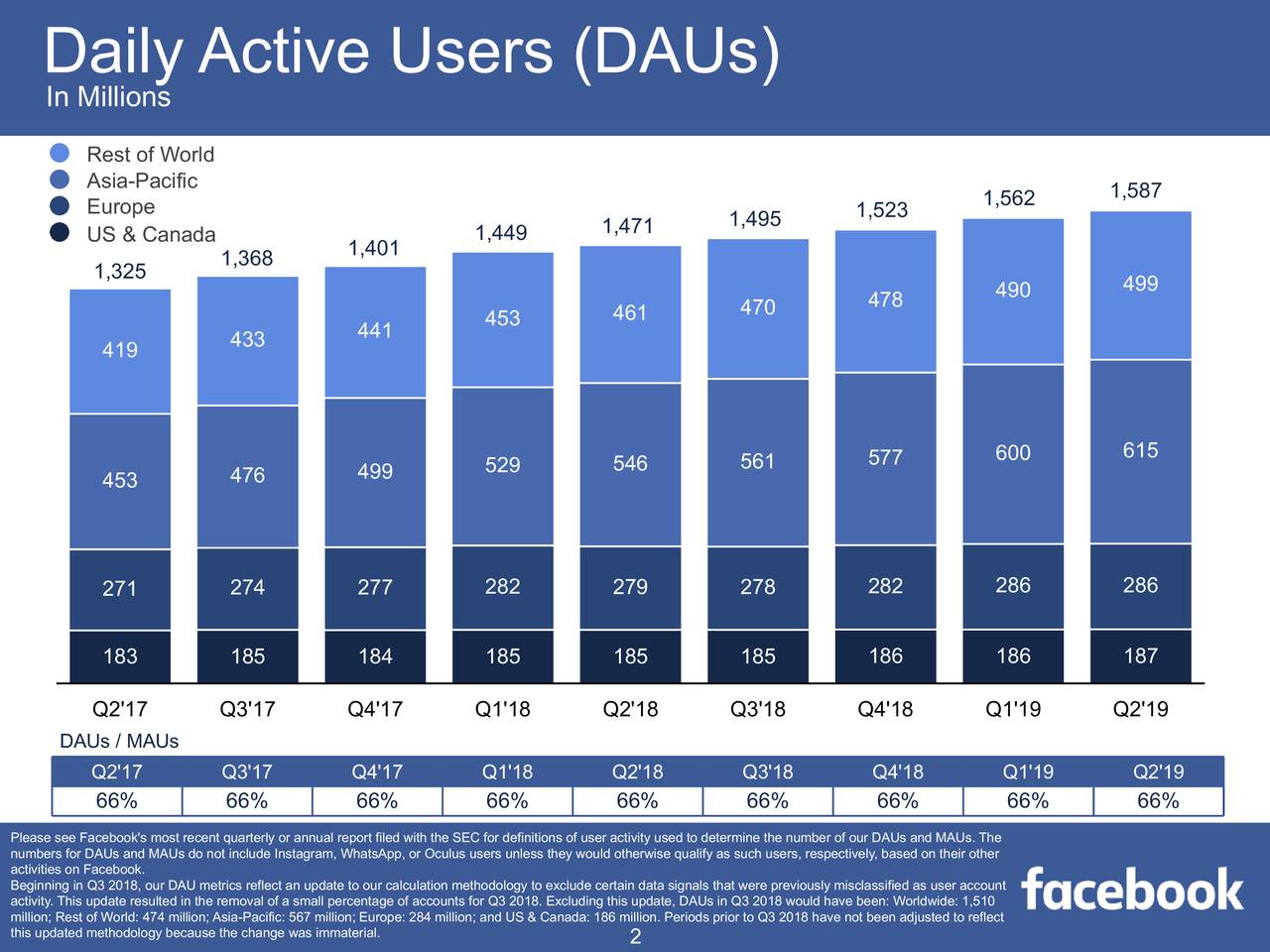

The company is likely to generate double-digit growth in revenue and earnings. It had generated year over year revenue growth of 28% to $16.9 billion in the latest quarter. Its daily active users grew to 1.59B, representing 8% Y/Y growth. Monthly active users jumped 8% year over year to 2.41B.

The company appears in solid position to invest in growth opportunities.

Its cash and cash equivalents stood at $48.60 billion at the end of the latest quarter. It had made several small acquisitions in the past few months. In addition, it has launched innovative products for users. For instance, Instagram announced a new camera-first messaging app.

Overall, the Facebook stock price appears like a good play for value investors. Its low valuations and the double-digit growth in financial numbers are among the biggest catalysts. Therefore, several analysts are suggesting to buy this stock.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account