Facebook (NASDAQ: FB) stock price plummeted from the highest level despite reporting a strong fourth quarter and fiscal 2019 results. Although the company topped expectations for the fourth quarter, the hints of slowing growth impacted the analyst’s confidence. The market pundits dropped their price targets following fourth-quarter results.

Facebook stock plunged almost 5 per cent on lighter than expected guidance for the following quarters. FB share price is currently trading around $200, down from a record level of $225. Despite the latest share price selloff, the stock is up 20 per cent in the last twelve months. Its shares are trading around 21 times to earnings compared to the industry average of 25 times.

Facebook Stock Plunged On Soft Outlook

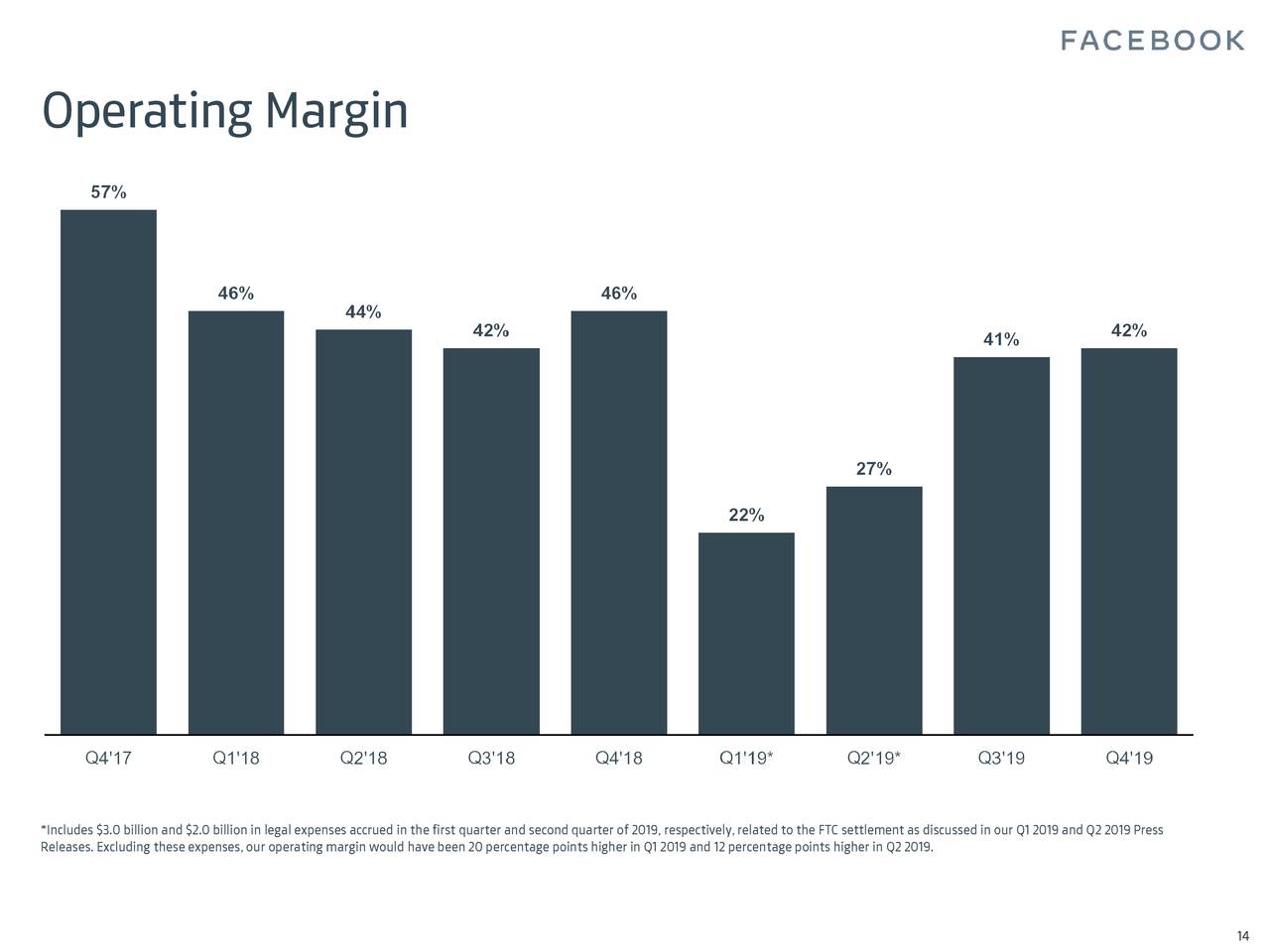

FB daily active users grew 9% to 1.66bn while monthly active users jumped 8% to 2.5bn. Its fourth-quarter revenue of $21bn increased by 25 per cent from the year-ago period. The full-year revenue of $69bn grew 27% from fiscal 2018. On the negative side, the 25% increase in costs and expenses reduced its year over year earnings growth to 7%.

The company also presented a soft outlook for the first quarter of 2020. It expects first-quarter revenue to decelerate by low to mid-single digits compared to the previous quarter.

“That’s due in part to the maturity of our business as well as the increasing impact from global privacy regulation and other ad targeting-related headwinds. While we have experienced some modest impact from these headwinds to date, the majority of the impact lies in front of us,” says Chief Financial Officer Dave Wehner.

Analysts Dropped FB Share Price Targets

Pivotal Research is among the firms that reduced the price target for Facebook. The firm declined the target price to $215 from the prior target of $245. Pivotal Research also lowered financial estimates for fiscal 2020. KeyBanc has set the price target at $248, expecting pressure on margins in the following quarters. JMP has provided a price target of $250. Its analysts are showing concerns over slower than expected growth in the United States.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account