Find more information about how to buy and trade United Airlines stock in our stock trading guide here.

United Airlines (NYSE: UAL) stock is among the biggest losers as the coronavirus outbreak continues to sap demand for travel across the Asia Pacific and other parts of the world. The company has been cutting both domestic and international flights from its schedule over the past month; the United Airlines recently announced plans to cut international flights by 20% and domestic flights by 10% in March.

The negative impact is not limited to United Airlines. The stock prices of travel and airline companies have been already in a downswing due to tourism restrictions in China and Europe. The cancellation of corporate conferences and business events are adding to the bearish trend.

Airlines could lose around $63B to $113B in passenger revenue this year, according to the International Air Transport Association.

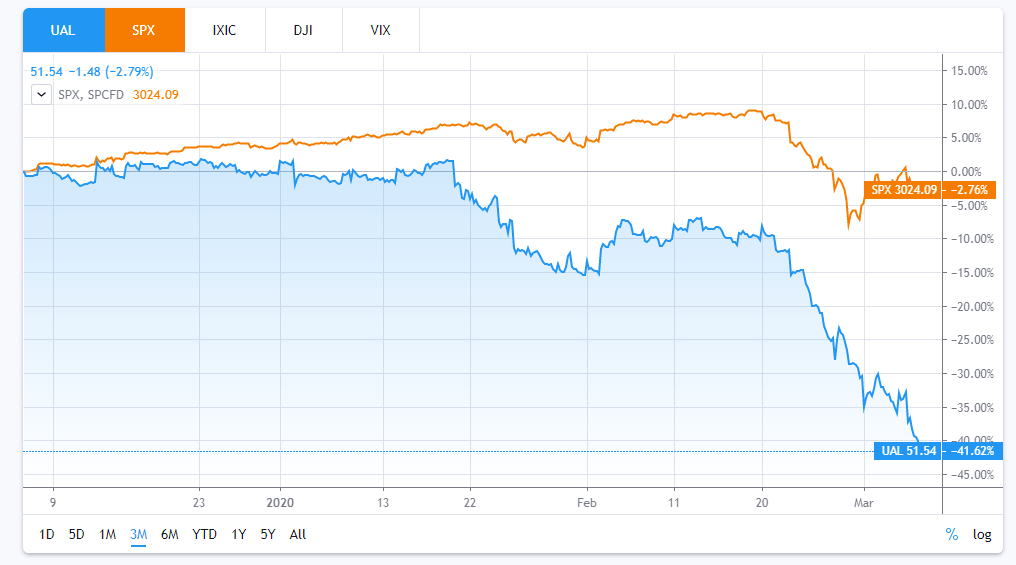

United Airlines stock plunged by 30 per cent in the last month alone, extending the three months price decline to 42 per cent.

United Airlines recently announced they are withdrawing fiscal 2020 guidance, blaming heightened uncertainty due to the coronavirus outbreak. The company says they don’t know about the duration of coronavirus and its impact on overall demand.

The company expects to generate earnings in the range of $11-$13 a share if the virus impact reduces by mid-May and normal travel patterns start for Pacific routes. Despite headwinds, the United Airlines 8-K form indicates a sustainable growth forecast for the following years.

United Airlines is exposed to coronavirus spread as it generates 40 per cent of revenue from international flights compared to 30 per cent for Delta (NYSE: DAL) and 3 per cent for Southwest (NYSE: LUV).

Cowen analyst Helane Becker suggested investors stay away from airline stocks in the short-term.

“Our near term concern is that airlines start canceling flights on the North Atlantic and in the US domestic market. We believe those would be extreme measures, but we also note that a number of companies are limiting corporate travel. That is worrisome, as the large international airlines are dependent on corporate travel,” notes analyst Helane Becker.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account