UK drinks giant Diageo (DEO), launched a three-tranche $2.5bn bond issue to strengthen the company’s balance sheet as sales stall around the world due to coronavirus lockdowns.

Diageo, which makes Smirnoff vodka and Guinness said on Tuesday the deal included a $750m 1.375% fixed rate note due in 2025, a $1bn 2% fixed rate note due in 2030, and another $750m from a 2.125% fixed rate note due in 2032.

This is the second bond issue launched by Diageo since the health emergency, following a €2.05bn fixed rate euro and pound sterling-denominated bond issue it successfully placed on March 2020.

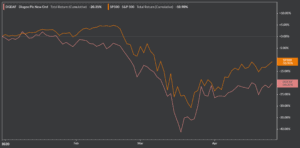

Diageo’s shares have underperformed the S&P 500 so far this year, with the stock losing 20% compared to an 11% drop registered by the index during the same period. Additionally, Diageo shares have also underperformed the recent market rally, as the S&P accumulates a 30-day 11% gain while Diageo shares have only jumped by 1% during that same window.

Moody’s has given Diageo a credit rating of A3 with a stable outlook, while Standard & Poors has rated the company as an A- with a stable outlook as well. Corporate bonds with similar credit ratings are yielding interest rates of 2.34%, according to the ICE BofA Single-A US Corporate Index, while US investment-grade bond issues with similar maturities are yielding between 2.73% and 3.71%.

Diageo is one of the world’s largest distillers of alcoholic beverages and the owner of some of the world’s most popular spirits brands including Baileys and Johnny Walker Whiskey, employing nearly 28,500 people to run its global operations.

Earlier this month, the company, led by chief executive Ivan Menezes, said in a trading update that it was cutting discretionary expenses and deferring discretionary capital spending as part of its plan to save cash. It added it would not give any earnings guidance.

The firm said: “Given the global nature of the covid-19 pandemic, and the uncertainty around the severity and duration of the impact across multiple markets, we are not in a position to accurately assess the impact of this on our future financial performance.”

In February, the company said it expected the health emergency to drag full-year 2020 profits down by up to £200m.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account