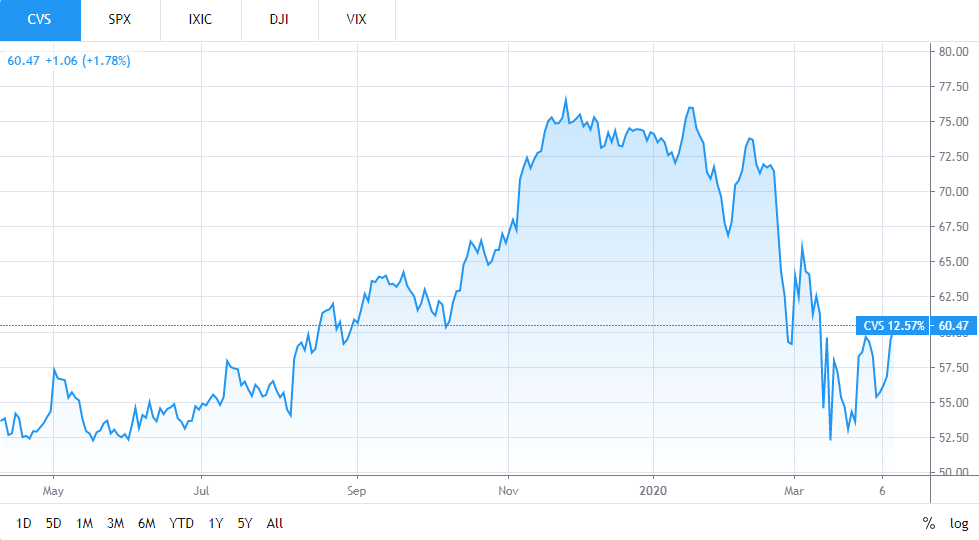

Despite an almost 20% decline in stock since the beginning of this year, CVS Health (NYSE: CVS) stock retains a strong price of $60 per share and boats a significant upside. CVS Health’s stock is 20% lower than it was at the beginning of 2019 and around 11% lower than it was at the start of 2018.

Part of the reason for the decline of the stock price over the last two years was due to the company’s massive $69 billion acquisition of Aetna, resulting in $42 billion incremental debt between 2017 and 2019. The company experienced revenue growth of 39%, led by the Aetna acquisition from 2017 to 2019. At the same time, net income margins dropped 27.9% from 3.6% to 2.6% over the same period. Higher employee costs, financing costs, and goodwill impairments were all contributing factors. Given the Aetna acquisition, total share count also increased by 27%. All these factors led to a 21% decline in EPS between 2017 and 2019.

With the latest developments in the nationwide lockdown as a result of the looming coronavirus pandemic, analysts expect to see growth in CVS Health’s P/E multiple and the company’s EPS in the coming years. The company in February guided for GAAP EPS to be in the range of $5.47 and $5.60 in 2020, compared to $5.08 in 2019.

CVS Health’s near term performance is likely to feel the effect of the global spread of the coronavirus, particularly in its insurance business. The company is waiving cost-sharing for certain Aetna members, who are hospitalized for coronavirus treatment. As such, CVS Health’s stock has lost 16% of its value between January 31st and April 8 (vs. about an 18% decline in the S&P 500).

Now, that the US has become the new epicentre of the outbreak, there is an increase in the demand for private health insurance. Total uninsured non-elderly population was nearly 30 million in 2018. With the current outbreak, people are looking for alternatives for their health insurance for protection, with the uninsured rate expected to take a dip in the near term. As CVS’ retail pharmacy stores remain open across the globe while most of the other stores remain in the lockdown, the near term impact from the current crisis will likely produce some potential upside returns.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account