The cryptocurrency market rallied on Thursday led by Bitcoin , as the Federal Reserve continues to push money into financial markets to contain the fallout of the coronavirus health emergency.

Overall, cryptocurrencies gained more than $35bn in market value over the last 24 hours as the Federal Reserve committed to maintain low interest rates, while Bitcoin’s May halving, an event that reduces the supply of the popular cryptocurrency, is just two weeks away.

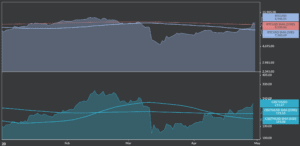

The value of the two largest cryptocurrencies by market capitalization, Bitcoin (BTC) and Ethereum (ETH), have been surging since mid April, with both tokens accumulating 29.6% and 24.3% in gains respectively since April 21. The BTC/USD pair closed yesterday’s session at $8,948 while ETH/USD ended the day at $214.46.

Like most other asset classes, Bitcoin collapsed in mid-March to under $5,000 a coin, having previously sat at above $10,000 on Valentine’s Day, while it has rebounded to nearly $9,000 a coin.

Halving events, which are a scheduled reduction in the reward obtained by Bitcoin miners, have occurred two times in the past, in 2012 and 2016, and they have always been preceded by a surge in the price of Bitcoin. In a little under two weeks the reward for digitally mining Bitcoin will be halved from 12.5 coins per block to 6.25, constricting the supply of the cryptocurrency and therefore, in the view of some, driving up its price.

The next halving is about to take place on 11 May, and commentators also attribute this rally to this upcoming event.

Matthew Dibb, the co-founder of BTC index fund provider Stack, said: “While part of this rebound may be explained by a renewed ‘risk-on’ attitude of global investors, it is also clear that bulls have been triggered by the upcoming halving event”.

Dibb added: “For those buying into bitcoin now, many see this as an opportunity to buy BTC at bargain basement rates before a price pop post halving”.

Traders and investors buy Bitcoin before the halving as they expect a reduction in the supply of the cryptocurrency due to lower mining output.

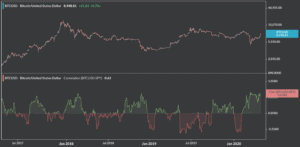

However, the price of Bitcoin has been increasing its correlation with the stock market in recent months, which means that it price fluctuates similarly to the S&P 500, and this could pose a significant risk for traders who are relying on the cryptocurrency to protect themselves from the turmoil caused by the health emergency, as a drop in the stock market may be followed by a subsequent drop in Bitcoin’s price.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account