Cisco (NYSE: CSCO) stock price retreated sharply from 52-weeks high of $58 that it had hit three months ago. In addition, CSCO shares are currently trading slightly high from this year’s low of $40.

Trading around $46 analysts believes Cisco stock price is presenting a strong buying opportunity for long term investors. Analysts claim it’s a perfect entry point for both short term value investors and long-term dividend investors.

The Dip in Cisco Stock Price is a Buying Opportunity

Evercore analyst Amit Daryanani says Cisco is in a position to capitalize on demand from emerging markets. This is because of its extensive footprints in global markets.

The analysts expect the company to maintain a leadership position in key categories. Daryanani has set a price target of $60 for Cisco with outperform ratings.

Piper Jaffray and RBC Capital Markets have set the Cisco price target at $55.

The analysts believe Cisco’s strategy of investing in non-organic growth opportunities would add to the revenue base. The company recently announced two acquisitions. These acquisitions include CloudCherry and Voicea.

Financial Numbers are Supporting Dividends

The company appears in a position to support its dividends. It currently offers a quarterly dividend of $0.35, yielding around 3%. It has increased quarterly dividends in the past eight consecutive years. Its financial numbers are supporting dividend growth.

The company generated year over year revenue growth of 6% to $13.4B in the fourth quarter of FY2019. Moreover, the revenue of $52.5 billion for the full year rose 7% from the past year.

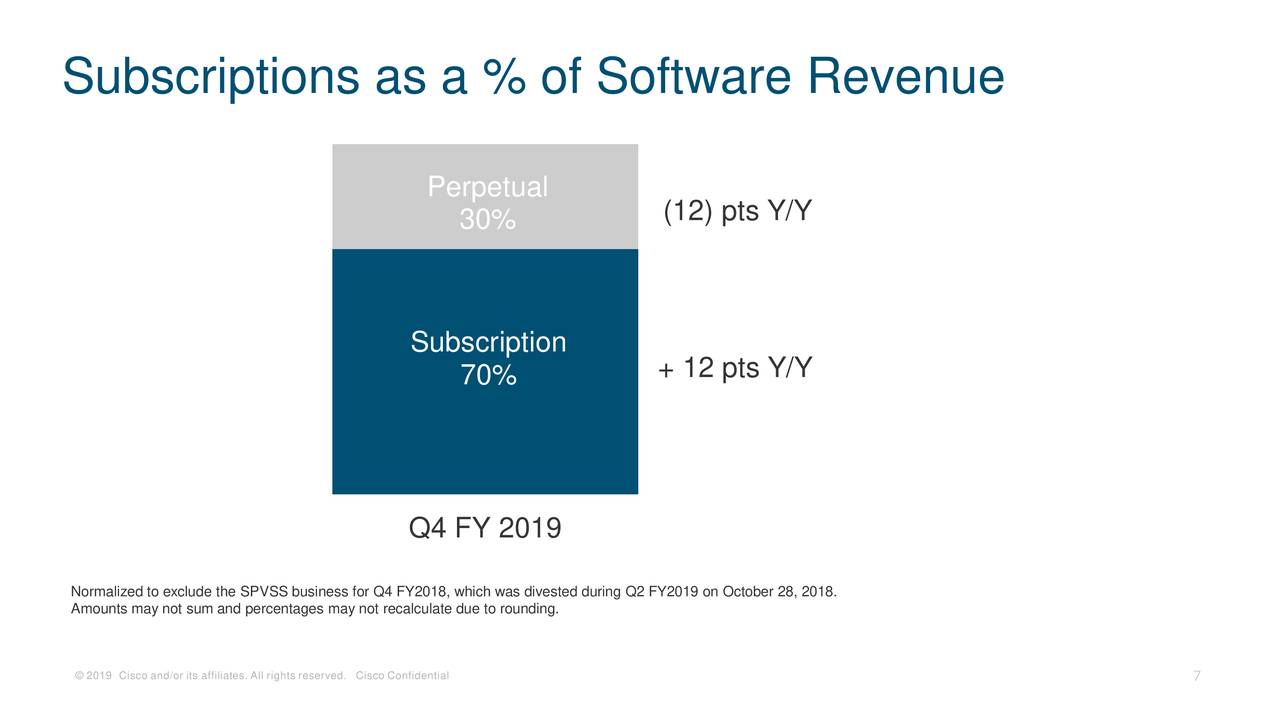

Its CFO says, “We continue to transform our business model with software subscriptions now at 70% of our software revenue. The returns on our investments in key strategic areas position Cisco for long-term growth and shareholder value.”

In addition, its cash flows are strong enough to cover dividends. It generated an operating cash flow of $4 billion in the latest quarter. The dividend payment stood at $1.4 billion. The huge gap in dividend payments and operating cash flows offer a room for investment in growth opportunities. On the whole, Cisco stock price has strong fundamentals and its dividends are safe.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account