The situation turned even worse for Chevron (NYSE: CVX) stock and other oil producers as President Donald Trump’s ban on travel from Europe increased the threat of economic slowdown and global recession. Dow futures plunged more than 800 points after a prime-time address by the President, Asian and European markets fell more than 3 per cent.

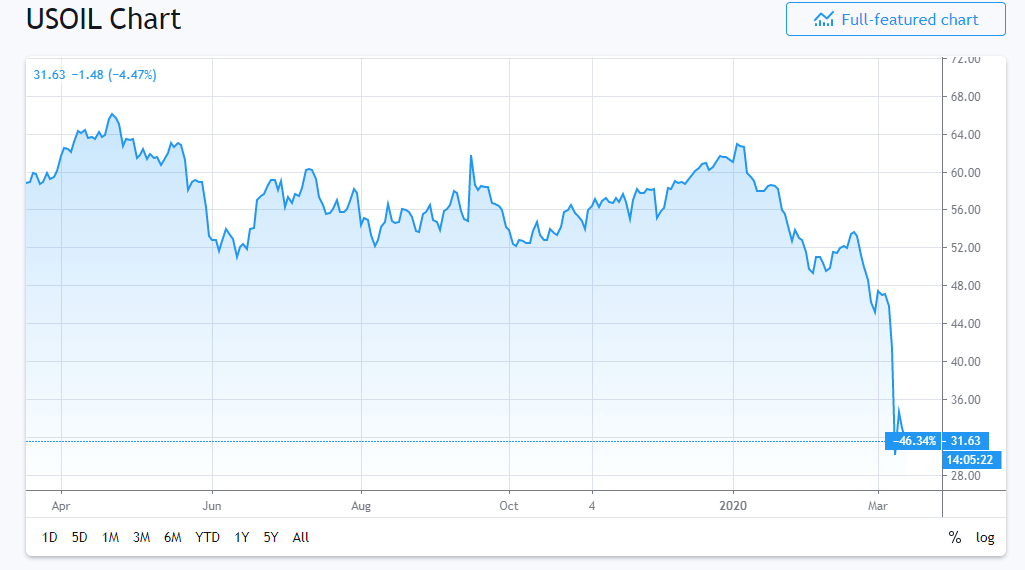

Oil price is adding to its previous losses as travel restrictions and suspension of business activities are likely to slash oil demand. The US has already issued travel advisory related to the Asia Pacific.

“The European [30-day] travel restriction is likely to further hammer the earnings of battered airlines and hotel companies and hurt consumer spending, which makes up 70 per cent of the economy,” says Ryan Dietrich, senior market strategist at LPL Financial.

President Trump directed Small Business Administration to provide capital liquidity to businesses; Trump is also planning to increase funding to the SBA by $50bn. The president instructed Treasury to provide $200bn in additional liquidity for some businesses by deferring taxes.

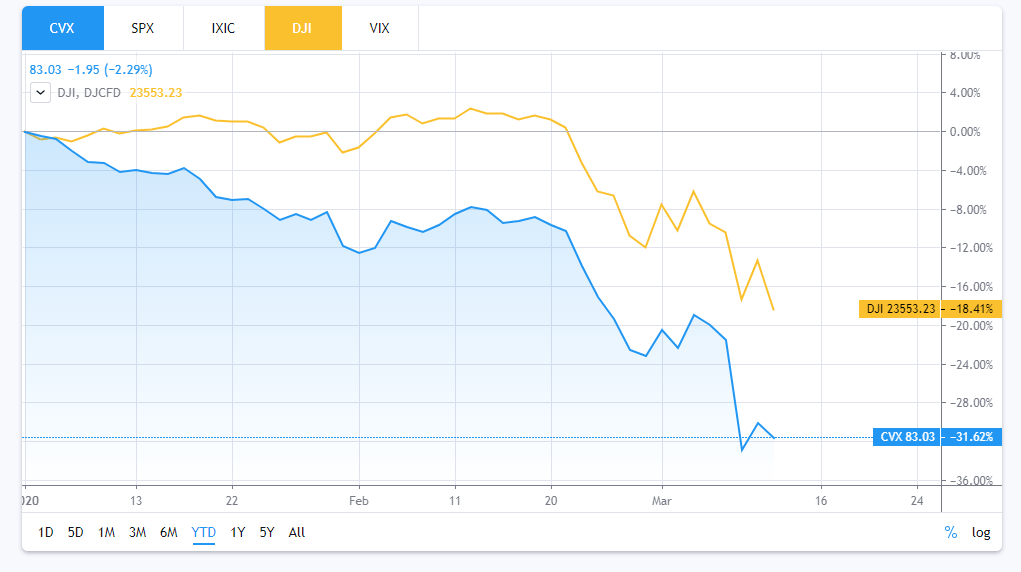

Chevron stock is among the biggest losers of Dow Jones Industrial Average; Chevron stock price slid 31% since the beginning of this year – up from Dow Jones Industrial Average drop of 18.41%. The market pundits are seeing more volatility in stock markets amid slowing European and US business activities following a massive slowdown in Asian markets.

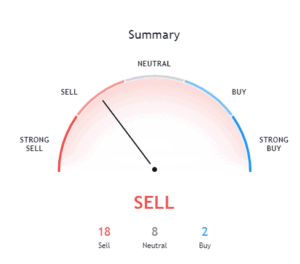

Tradingsview analysts are predicting more selling pressure on Chevron shares based on moving averages.

The World Health Organization (WHO) declared Covid-19 a global pandemic on Wednesday. “We’re deeply concerned both by the alarming levels of spread and severity, and by the alarming levels of inaction,” said WHO Director-General Tedros Adhanom Ghebreyesus. “We have rung the alarm bell loud and clear.”

Japan Nikkei 225 declined 3.3% and South Korea’s Kospi also dropped 3.04%. The Australia S&P/ASX 200 plunged 5.51% while Hong Kong’s Hang Seng index dropped 3.81%.

Find more information about how to buy and trade stocks in our stock trading guide here.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account